Well, it looks like someone is going to have a Happy Thanksgiving! LVMH Moët Hennessy Louis Vuitton SE (“LVMH”), the world’s leading luxury group and Tiffany & Co. (NYSE: TIF) (“Tiffany”), the global luxury jeweler, today announced that the companies have entered into a definitive agreement whereby LVMH will acquire Tiffany for $135 per share in cash, in a transaction with an equity value of approximately €14.7 billion or $US16.2 billion.

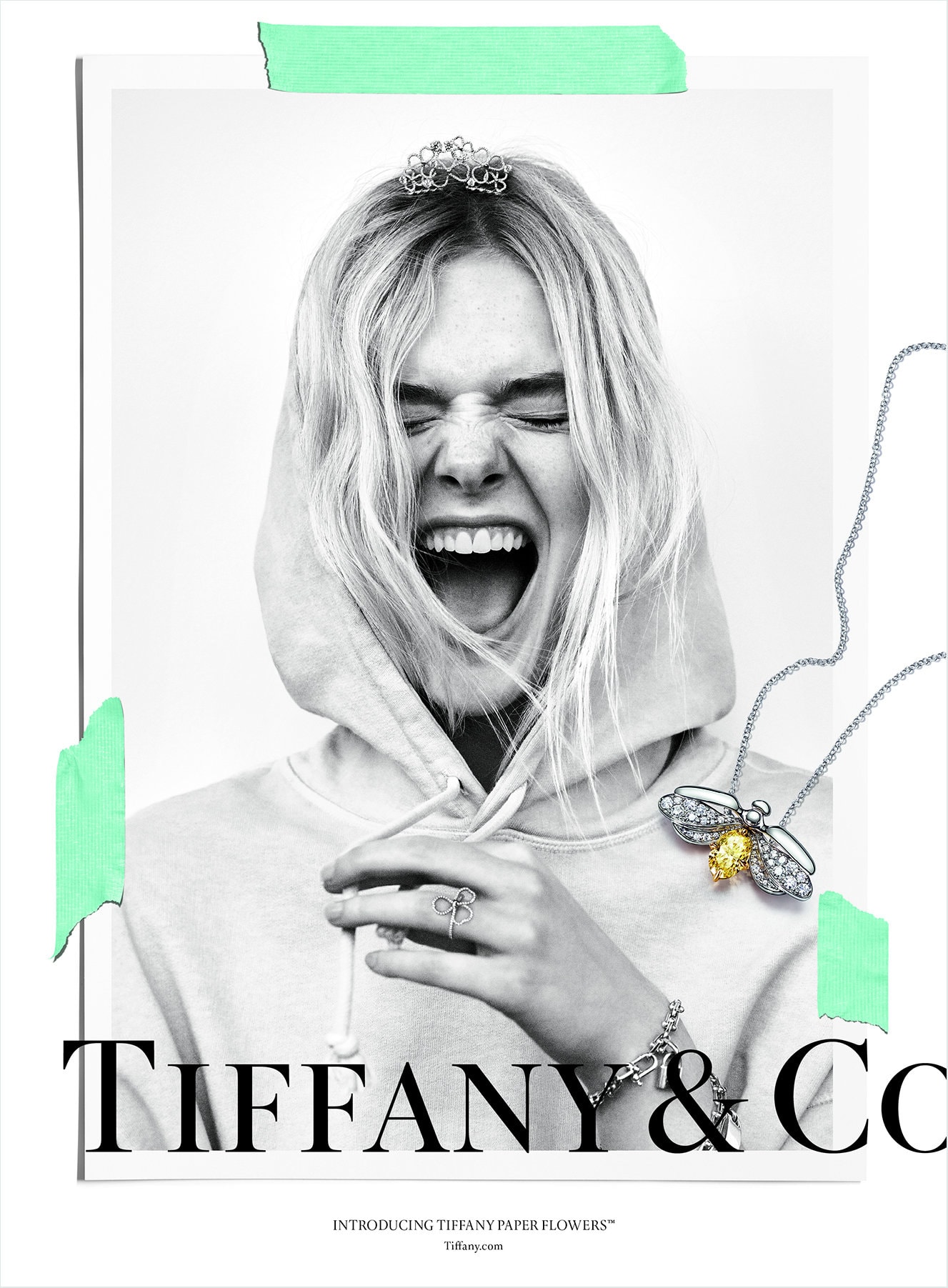

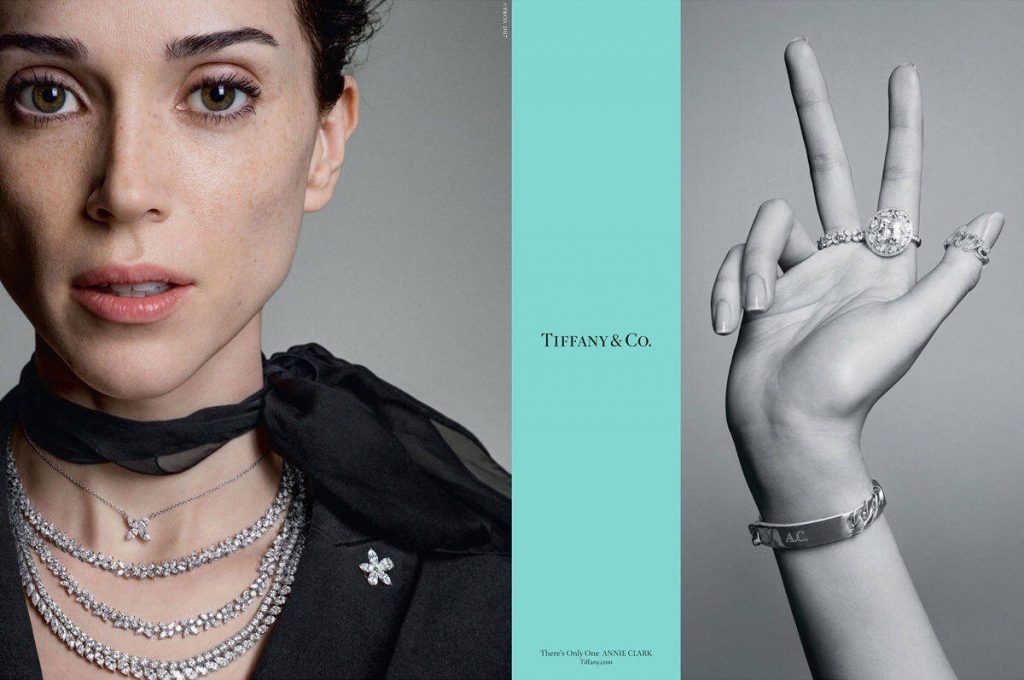

The acquisition of Tiffany will strengthen LVMH’s position in jewelry and further increase its presence in the United States. Today, with more than 14,000 employees, Tiffany and its subsidiaries design, manufacture and market jewelry, watches and luxury accessories – including more than 5,000 skilled artisans who cut diamonds and craft jewelry in the company’s workshops. The company operates more than 300 Tiffany & Co. retail stores worldwide. The addition of Tiffany will transform LVMH’s Watches & Jewelry division and complement LVMH’s 75 distinguished Houses.

We are delighted to have the opportunity to welcome Tiffany, a company with an unparalleled heritage and unique position in the global jewelry world, to the LVMH family. We have an immense respect and admiration for Tiffany and intend to develop this jewel with the same dedication and commitment that we have applied to each and every one of our Maisons. We will be proud to have Tiffany sit alongside our iconic brands and look forward to ensuring that Tiffany continues to thrive for centuries to come.

– Bernard Arnault, Chairman and Chief Executive Officer of LVMH

LVMH’s acquisition of Tiffany has been approved by the boards of directors of both companies. The transaction is expected to close in the middle of 2020 and is subject to customary closing conditions, including approval from Tiffany’s shareholders and the receipt of regulatory approvals.