Second consecutive quarterly revenue drop for luxury conglomerate signals challenges in key markets

LVMH Moët Hennessy Louis Vuitton posted a decline in net profits in the first half of the year largely due to the slump in luxury expenditure in China, impacting group sales.

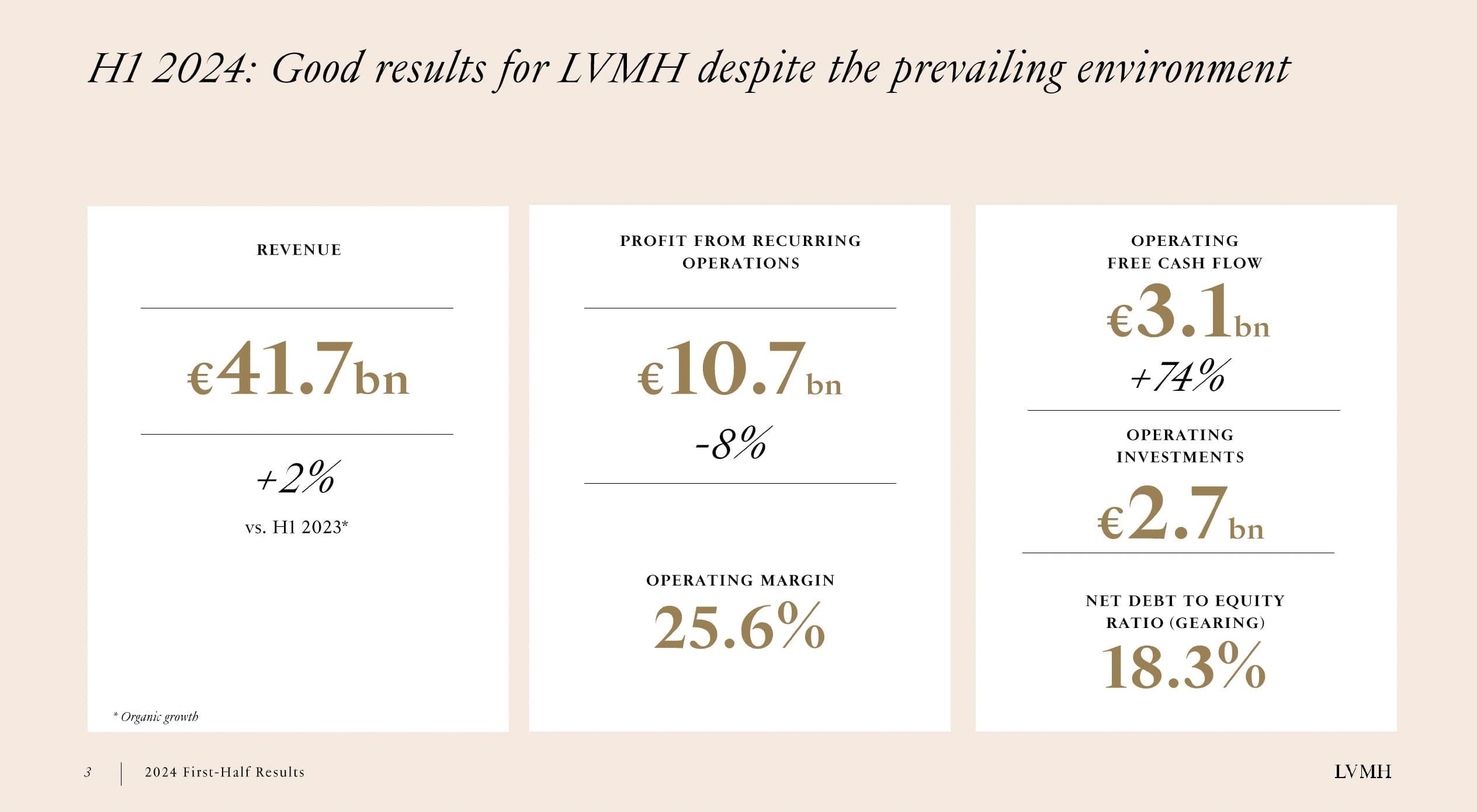

The parent company of luxury brands such as Louis Vuitton and Dior, reported a 1 percent decline in second-quarter revenues, marking its second consecutive quarterly dip. Despite this, the company managed a 2 percent increase in organic sales, adjusted for currency fluctuations, including a significant decline in the Japanese yen. These results fell short of analysts’ expectations of 3 to 4 percent organic growth.

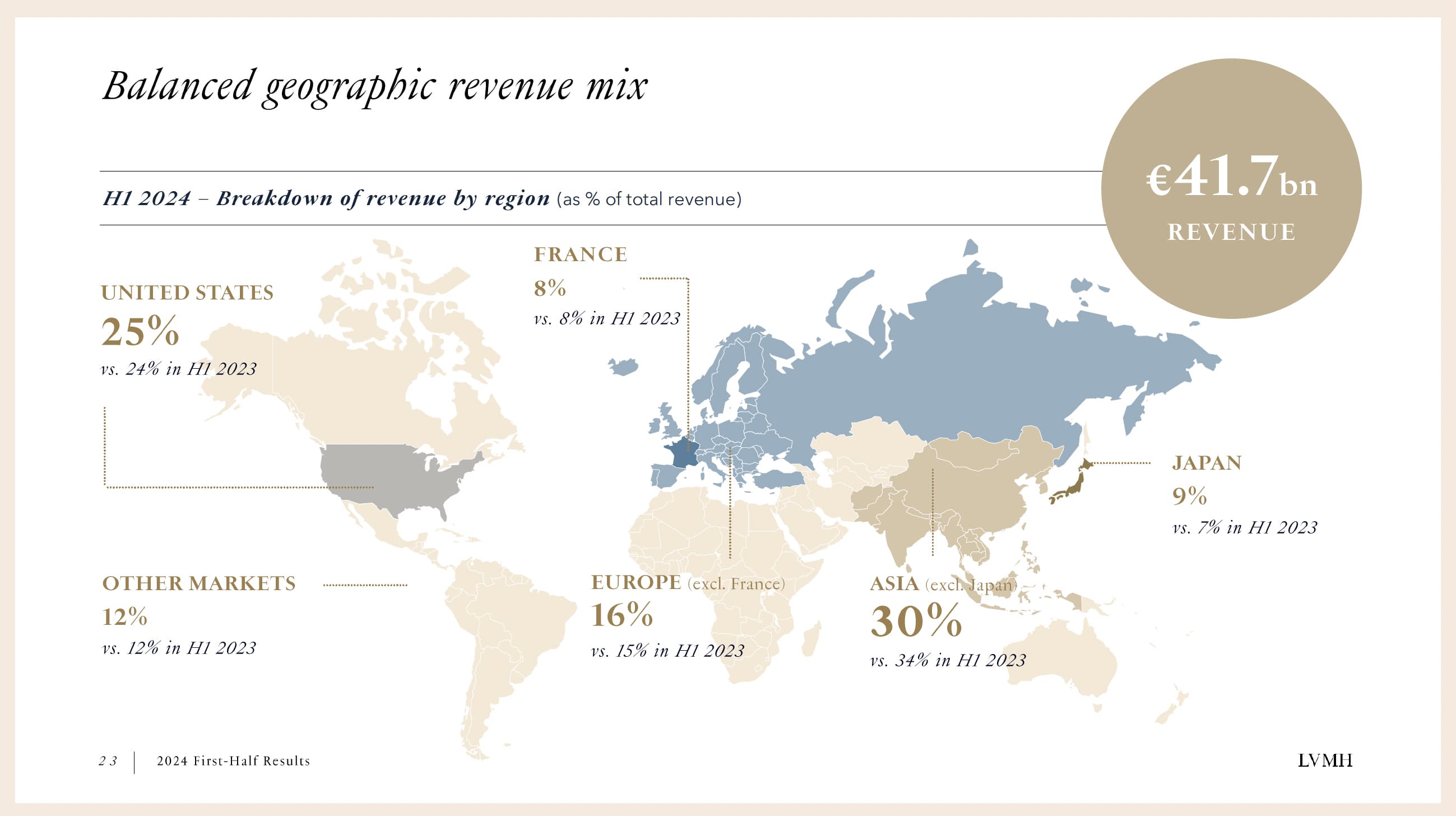

The downturn in revenue underscores the challenges faced by even the most robust players in the luxury sector amidst a global slowdown. A 14 percent drop in sales in Asia, excluding Japan, highlighted the struggles within the key Chinese market, where macroeconomic issues and changing consumer priorities are impacting demand. China’s central bank recently cut interest rates to stimulate the economy, while government policies aim to regulate excessive incomes, further dampening luxury consumption.

The company saw a mixed performance across regions. While sales in the US grew by a modest 2 percent, economic slowdown and waning enthusiasm for luxury brands tempered growth. Conversely, LVMH experienced a 57 percent surge in Japan, driven by an influx of foreign shoppers taking advantage of a weaker yen, despite price hikes affecting local consumers.

LVMH’s results were consistent with recent reports from other luxury brands. Richemont, for instance, saw a 1 percent revenue decline last week, while Burberry’s comparable retail sales plunged 22 percent. Gucci owner Kering is anticipated to report a 10 percent sales drop, further illustrating the sector-wide challenges.

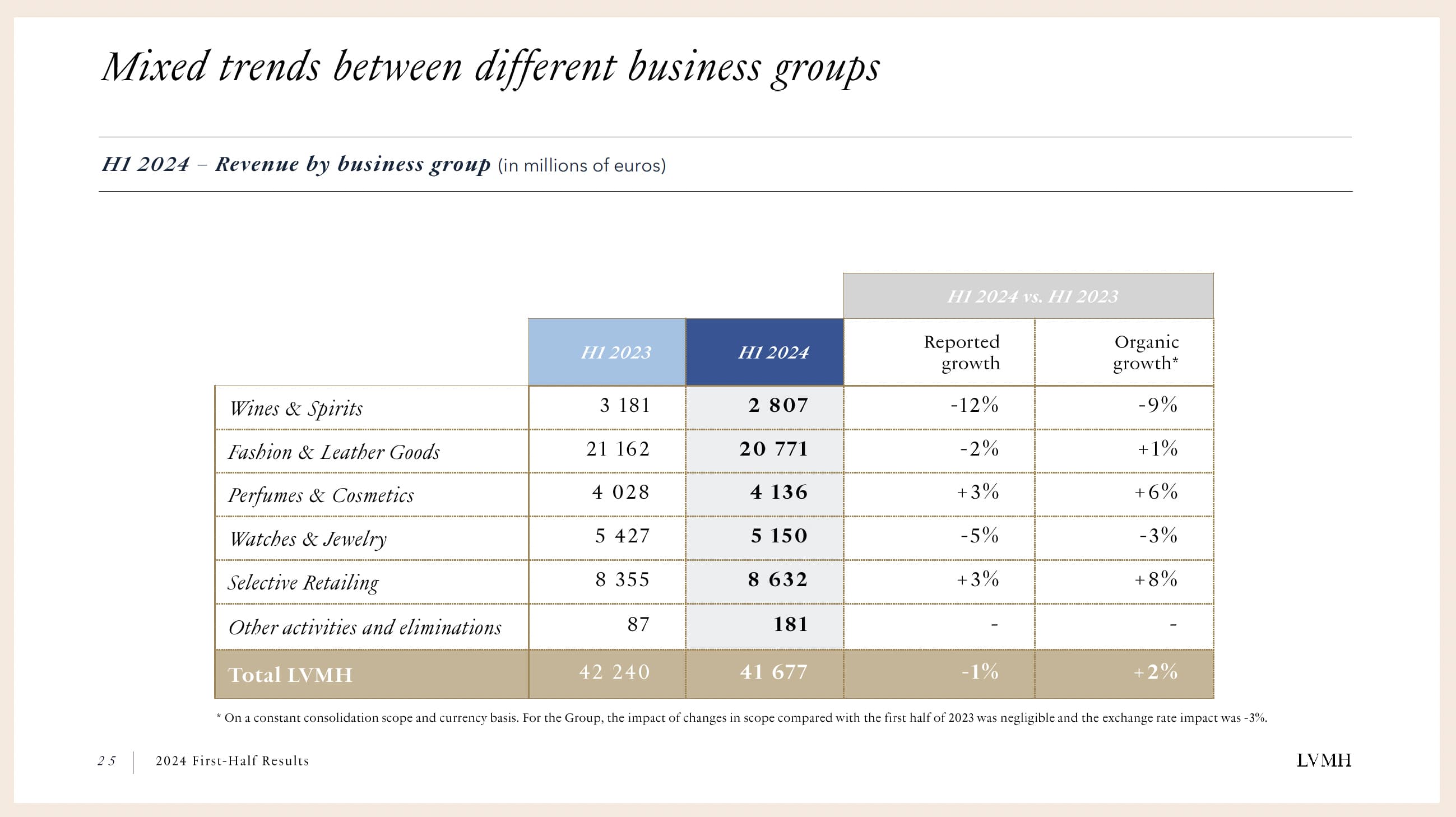

The company’s fashion and leather goods division, which includes Louis Vuitton and Dior, posted a 1 percent organic sales increase. However, other segments faced more significant declines, with watches and jewelry, including Tiffany & Co., and wine and spirits experiencing sales drops of 4 and 5 percent, respectively. In contrast, the selective retailing division, led by Sephora, grew by 5 percent, and the perfume and cosmetics segment saw a 4 percent increase.

The results for the first half of the year reflect LVMH’s remarkable resilience, backed by the strength of its maisons and the responsiveness of its teams in a climate of economic and geopolitical uncertainty. While remaining vigilant in the current context, the group approaches the second half of the year with confidence, and will count on the agility and talent of its teams to further strengthen its global leadership position in luxury goods in 2024.

– Bernard Arnault, chairman and CEO of LVMH

LVMH’s first-half operating profits decreased by 8 percent year-on-year, reflecting the broader market challenges. Despite this, the company continued to invest in store renovations, particularly for Tiffany & Co. “Consistency and long-term thinking are of the essence in this business, and we are walking the talk,” said chief financial officer Jean-Jacques Guiony.

The outlook remains uncertain, with Guiony expressing caution about the second half of the year. The impact of China’s policy changes and the spending behavior of less wealthy US consumers remain unpredictable. Despite recent price hikes, LVMH maintains that upgrading products and prices is crucial for growth. “What we are doing since 30 years is not coming to an end just because the aspirational customers are a little under pressure,” Guiony stated.

LVMH’s net profit fell 14 percent in the first half of 2024, totaling 7.27 billion euros, missing analysts’ forecasts. Profit from recurring operations dropped 8 percent to 10.65 billion euros, with an operating margin of 25.6 percent. Wines and spirits, along with watches and jewelry, were the hardest-hit segments, with operating profits down 26 percent and 19 percent, respectively.

Amidst a generational shift in management, LVMH recently appointed new CEOs for Hublot and Tag Heuer. Bernard Arnault, chairman and CEO of LVMH, emphasized the group’s resilience and strategic agility, stating, “While remaining vigilant in the current context, the group approaches the second half of the year with confidence, and will count on the agility and talent of its teams to further strengthen its global leadership position in luxury goods in 2024.”

Overall, LVMH’s share price has declined by more than 20 percent from its peak earlier this year, reflecting the broader challenges in the luxury market. As other luxury brands prepare to report their results, the industry remains vigilant amidst ongoing economic and geopolitical uncertainties.