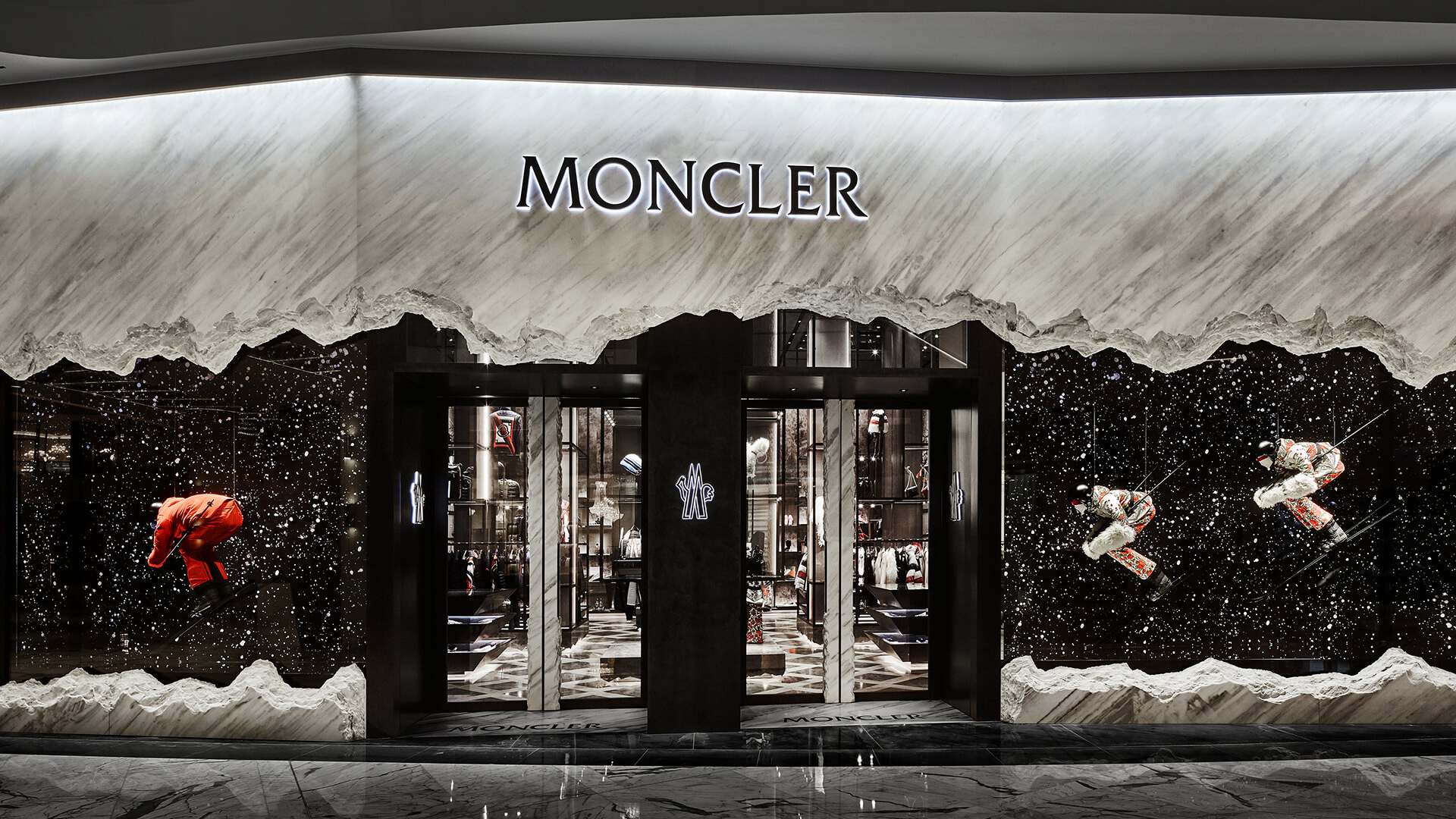

LVMH Is Set to Acquire a 10% Stake of Ruffini’s Investment Vehicle Double R, which Controls His Stake in Moncler

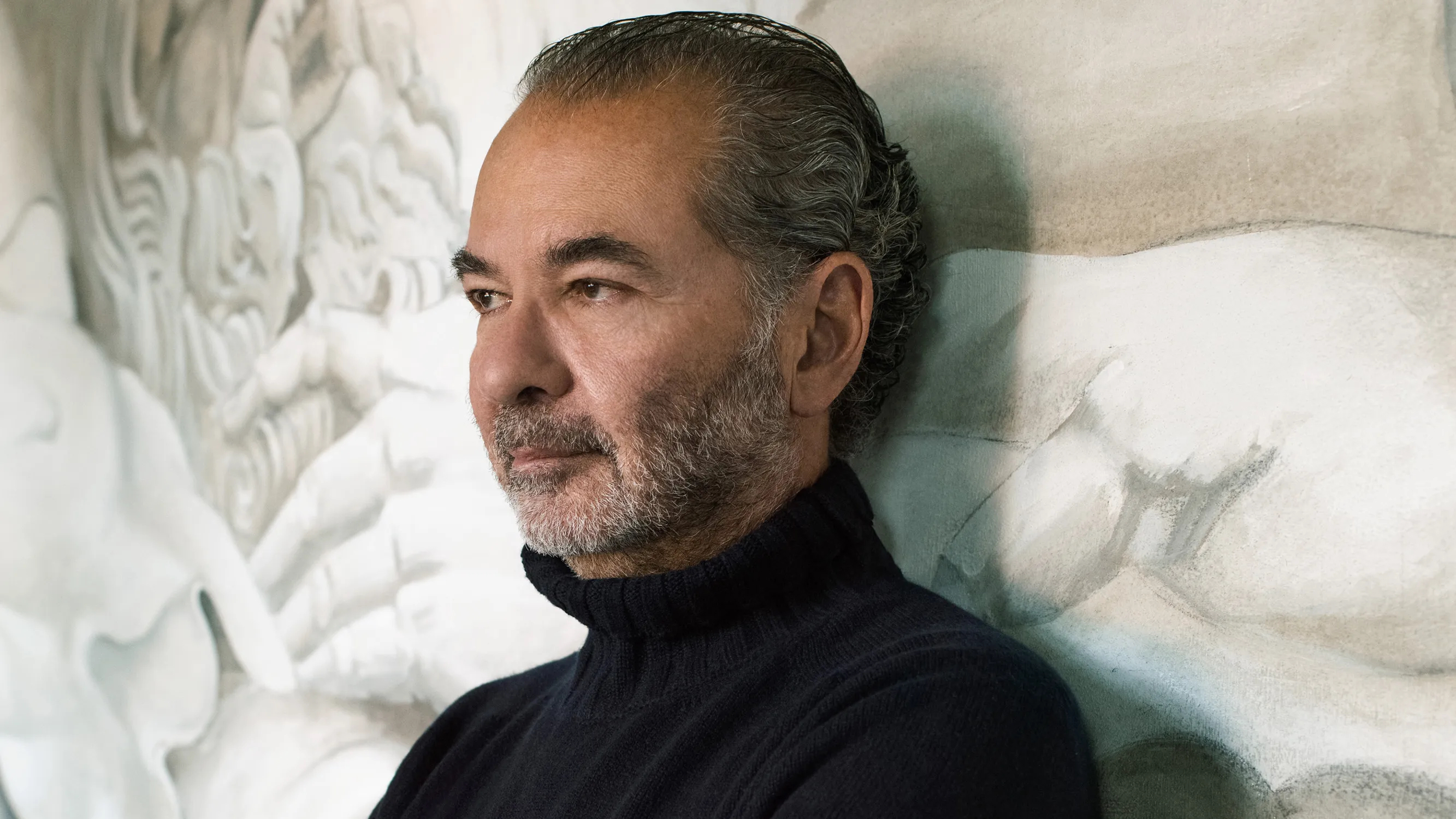

Moncler CEO Remo Ruffini has partnered with LVMH in a strategic move aimed at reinforcing Ruffini’s position as Moncler’s leading shareholder.

The partnership, announced Thursday, sees LVMH acquiring a 10 percent stake in Double R, Ruffini’s investment vehicle, which controls his 15.8 percent share in Moncler. This collaboration is set to strengthen both Ruffini’s influence in the company and LVMH’s role in the growing luxury outerwear brand.

Moncler, known for its premium outerwear, went public in 2013 and currently boasts a market capitalization of 14.2 billion euros. Ruffini’s current stake is valued at approximately 2.2 billion euros, and that number is set to rise under the terms of this new deal.

As part of the agreement, Double R will gradually purchase additional shares in Moncler over the next 18 months, potentially raising its stake to 18.5 percent. LVMH will provide financial backing for these acquisitions, increasing its own investment in Double R to a potential maximum of 22 percent.

According to LVMH, Ruffini will continue to lead Moncler as chairman and CEO, stating he remains “fully committed to Moncler Group’s success.” The luxury conglomerate also affirmed it would serve as a “stable long-term minority shareholder of Double R.”

In addition to the financial investment, LVMH will have the right to appoint two members to the board of Double R and one to Moncler’s board.

Ruffini expressed his enthusiasm for the partnership, saying, “This partnership reinforces Double R’s position in Moncler and provides the stability needed to execute my vision for the future. I have long admired Bernard Arnault’s entrepreneurial spirit and unique understanding of the luxury sector, and I am delighted he so clearly supports my long-term ambitions for our Group’s extraordinary brands.”

Arnault, LVMH’s chairman and CEO, shared his support for the collaboration, noting, “Moncler has been one of the most significant entrepreneurial success stories in the industry over the past 20 years. Remo Ruffini’s vision and leadership are remarkable, and I am delighted to invest in his holding company to reinforce his position as leading shareholder of Moncler and support the independence of the Moncler Group.”

LVMH, a global leader in luxury goods, has a market capitalization exceeding 338 billion euros and a portfolio that spans more than 75 brands, including Louis Vuitton, Dior, Sephora, and Hublot. Known for its deal-making prowess, the company has been active in expanding its influence across the fashion industry, including the 2021 acquisitions of Tiffany & Co., Off-White, and Emilio Pucci.

However, LVMH faces challenges in the current luxury market. The company recently reported a 14 percent decline in net profits to 7.27 billion euros for the first half of 2024, with revenues dipping by 1 percent. This slowdown has been attributed to shifts in consumer spending, particularly among Chinese shoppers, who have been favoring Japan for luxury purchases. Despite these headwinds, LVMH remains committed to long-term investments in its brands and portfolio.