Ongoing Challenges Hit Kering’s Key Brands, Gucci’s Sales Plunge 25 Percent in Q3

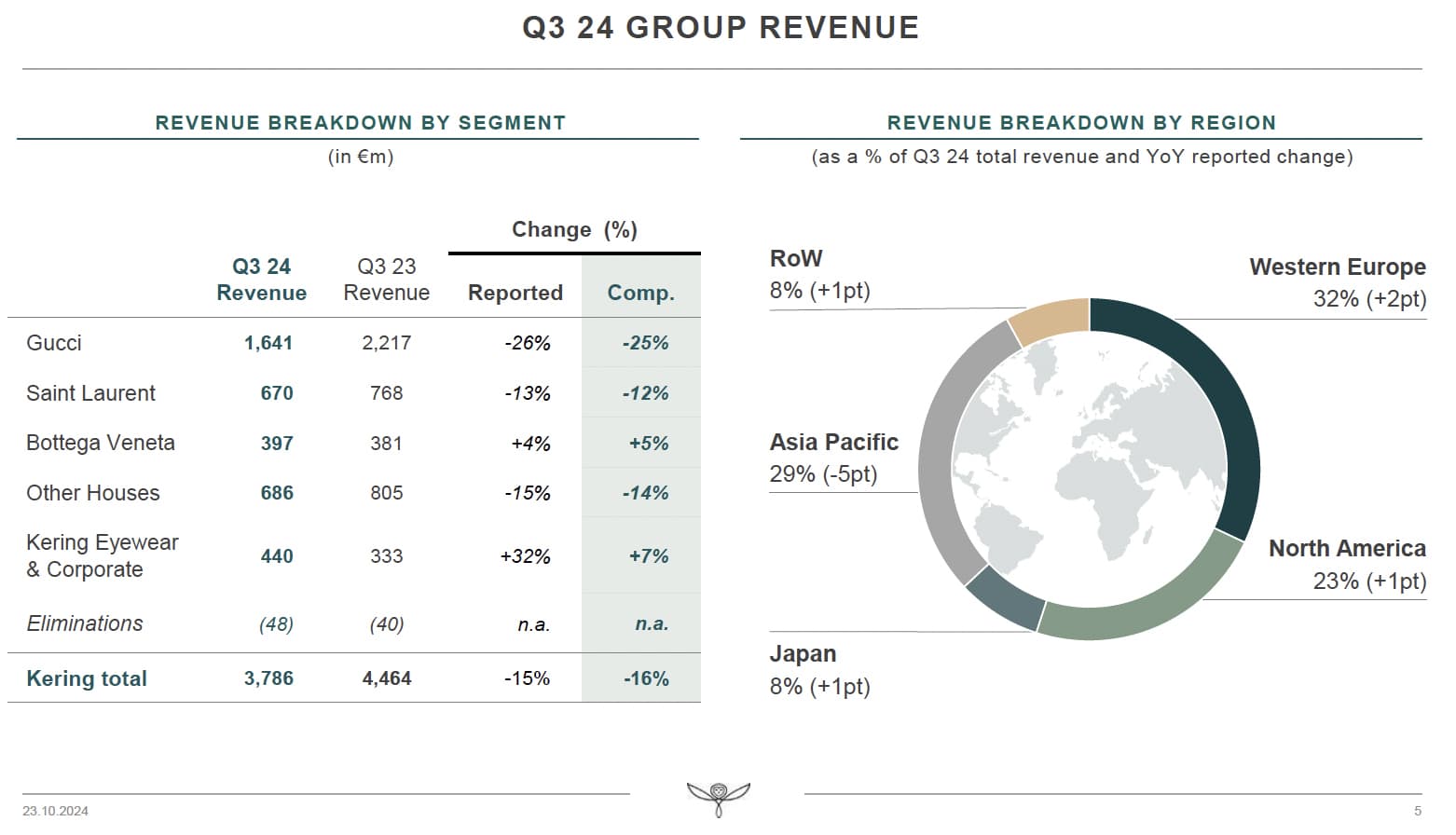

Kering reported a 16 percent drop in third-quarter sales, with its flagship brand Gucci facing the brunt of the decline. Total group revenues for the quarter amounted to €3.78 billion ($4.08 billion), as the French luxury group grappled with weak demand across key markets, particularly in Greater China.

Gucci, Kering’s largest and most profitable brand, saw a 25 percent decline in comparable sales during the quarter, following a 20 percent drop in the year’s first half. This marks a continued struggle for the brand as it revamps under new creative leadership. Gucci’s revenue fell short of analysts’ expectations, with reported revenues down 26 percent to €1.64 billion. Efforts to stabilize Gucci, including the appointment of creative director Sabato De Sarno and incoming CEO Stefano Cantino, are still underway.

Kering’s chairman and CEO, François-Henri Pinault, acknowledged the difficult period for the brand but expressed confidence in the long-term strategy. “With discipline and determination, we are executing a far-reaching transformation of the group, and at Gucci in particular, at a time when the whole luxury sector faces unfavorable market conditions. This severely impacts our performances in the short term,” Pinault said. He emphasized that building conditions for sustainable growth remains a top priority for Kering.

The broader market slowdown also impacted Kering’s other key brands. Saint Laurent saw a 12 percent decline in sales, while Bottega Veneta posted a modest 5 percent growth. The “Other Houses” division, which includes Balenciaga, Alexander McQueen, and Boucheron, reported a 14 percent drop in sales.

Kering’s struggles come amid a broader luxury market downturn, with companies across the sector facing similar challenges. The decline in demand across China and political instability globally have contributed to weakened sales for many luxury brands. Even sector leader LVMH Moët Hennessy Louis Vuitton reported a 5 percent drop in its fashion and leather goods division in the same period.

In response to the challenges, Kering issued its third profit warning of the year, forecasting a 47 percent drop in recurring operating income to around €2.5 billion for 2024, down from €4.75 billion the previous year. The company cited “major uncertainties” weighing on luxury consumer demand in the coming months.

Saint Laurent, traditionally Kering’s second-largest business, also saw a slowdown, with comparable sales down 12 percent. The decline at Kering’s “Other Houses” segment, which includes brands like McQueen and Balenciaga, was steeper than expected, falling by 14 percent, compared to analysts’ projections of a 5 percent decline.

Despite the overall negative performance, Kering is continuing its efforts to stabilize its brands and refocus its business. “Our absolute priority is to build the conditions for a return to sound, sustainable growth while further tightening control over our costs and the selectivity of our investments,” Pinault said.

Kering’s share price has dropped significantly, falling 46 percent from its peak in February. With the luxury sector facing what analysts predict could be a prolonged cyclical slump, the pressure is on Kering’s turnaround efforts, particularly at Gucci, to deliver results in a challenging environment.