The Birkin Bag Maker Reports Resilient Performance in Q3 Despite Global Economic Pressures

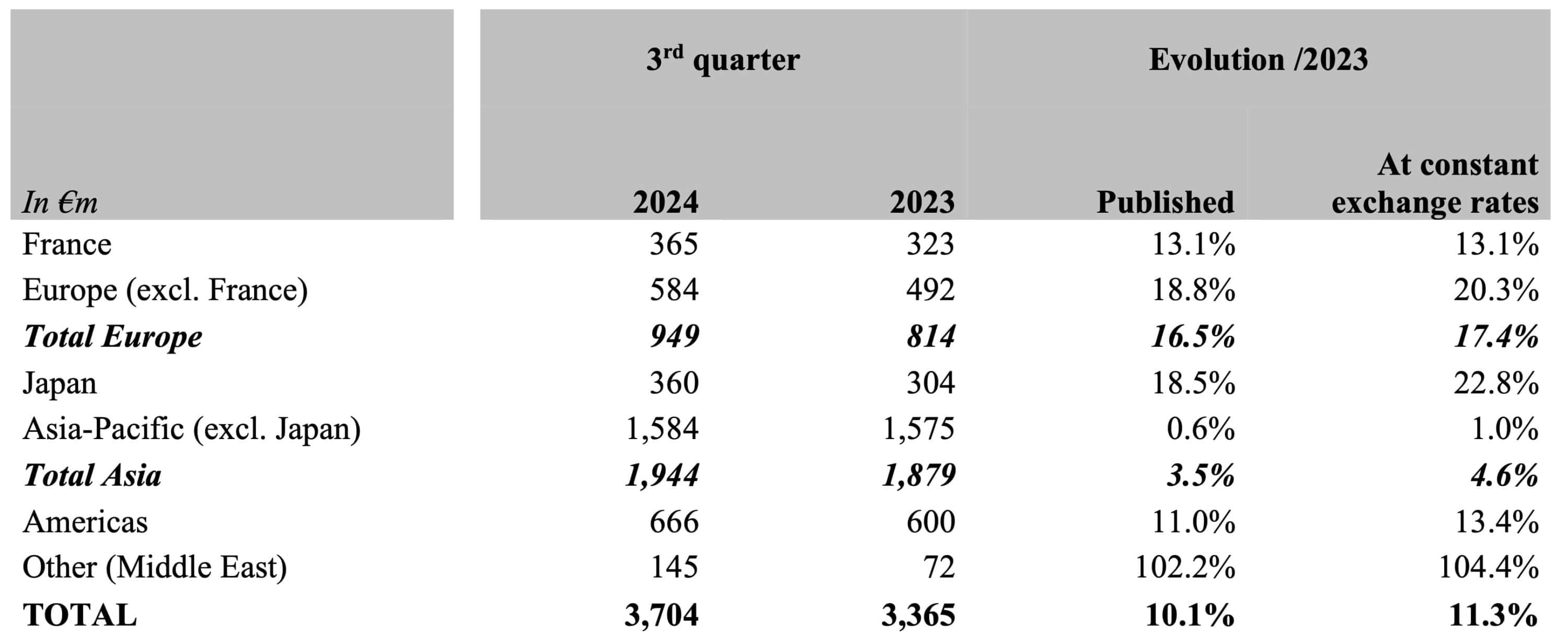

Hermès continues to defy the luxury market slowdown, reporting an 11.3 percent increase in third-quarter sales at constant exchange rates. The French luxury house, known for its Birkin bags, generated €3.7 billion ($3.99 billion) in revenue for the three months ending in September, outperforming rivals like Kering and LVMH.

Despite a broader downturn in the luxury sector, Hermès has maintained steady growth by capitalizing on its ultra-wealthy client base, particularly in Asia and the U.S. “It’s important to say that in China our clients are loyal, and this allows us to continue to sell our products there,” said Eric du Halgouët, executive vice president of finance at Hermès. While retail traffic in China has slowed since the Chinese New Year, the impact has been mitigated by an increase in average spending.

What surprised us the most over the last three quarters is probably the resilience of the group compared to other brands [and] the contrast, the resilience of Hermès, especially in Greater China compared to other players in the industry.

Eric du Halgouët, Executive VP of Finance, Hermès

Hermès’ resilience in China stands in contrast to competitors, with Kering reporting a 16 percent drop in third-quarter sales and LVMH experiencing a 4.4 percent decline. Hermès’ continued strength was reflected in shares rising 2 percent in midday trading, while other luxury stocks have struggled. The group’s shares have outperformed its peers, with Hermès up 9 percent this year, compared to LVMH’s 15 percent drop and Kering’s 40 percent decline.

In Asia, outside of Japan, sales rose 7 percent year-over-year, with solid performances in South Korea, Singapore, Thailand, and Australia. In Japan, sales jumped 23 percent, driven primarily by local clients rather than tourists. Hermès opened its second new store in Tokyo this year and a revamped location in Shenzhen, China.

Growth was also strong in Europe, with sales up 18 percent, fueled by summer tourist flows. France posted a 14 percent sales increase, although a temporary slowdown in Paris during the Olympic Games was offset by higher sales in the South of France. Business in the Americas remained steady, with revenues climbing 13 percent in the quarter.

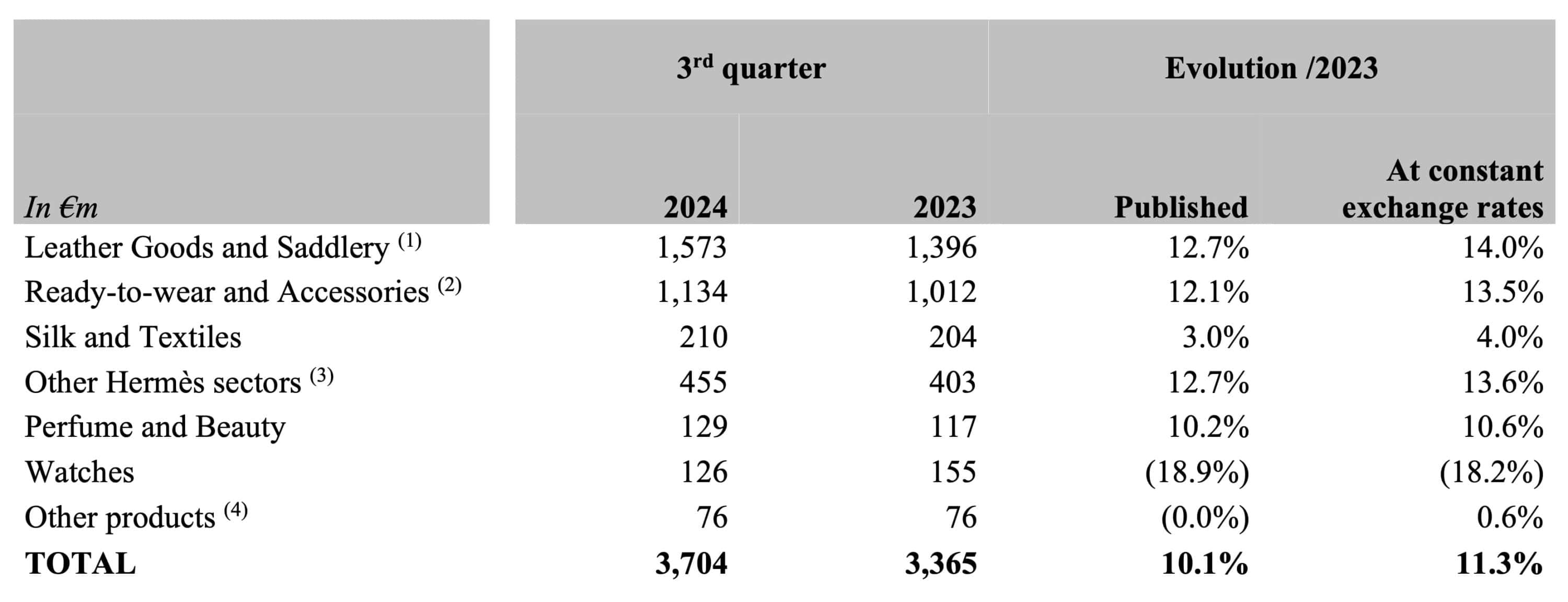

Hermès continues to invest in expanding its production capacity. The company opened its 23rd leather goods factory in Riom, France, in September, increasing leather production by 7 percent. Leather goods, including the iconic Birkin bag, saw a 14 percent rise in sales during the third quarter. The brand also introduced new handbag models to further drive growth.

The company’s ready-to-wear and jewelry divisions also performed well, with sales growing 13.5 percent and 13.6 percent, respectively. Hermès’ fine jewelry, particularly its gold pieces, continued to perform strongly. However, its watch division was the only category to experience a decline, with sales down 18.2 percent. Du Halgouët attributed this to the absence of the “Crafting Time” sales event, which has been rescheduled to November, and noted that the company is reexamining its watch designs.

The beauty division also saw growth, up 10.6 percent, while the silk division grew 4 percent, despite challenges in China. Hermès opened a new silk production facility in Lyon in June to meet growing demand.

Looking ahead, Hermès anticipates a smaller price increase in 2025, following a 9 percent hike earlier this year to offset inflation and currency fluctuations. While the company expects to face additional headwinds from currency fluctuations in the fourth quarter, its guidance for medium-term revenue growth remains unchanged.

Analysts remain optimistic about Hermès’ future. “We see Hermès as the best current opportunity to protect the portfolio from a difficult [fourth quarter],” said Bernstein analyst Luca Solca. With consolidated revenue up 14 percent year-over-year to €11.2 billion for the first nine months of the year, Hermès continues to demonstrate its ability to weather market challenges while maintaining its exclusivity.