LVMH Projects Confidence for 2025 Despite Q4 Revenues Remaining Largely Unchanged

LVMH Moët Hennessy Louis Vuitton (LVMH), the French luxury conglomerate known for brands such as Louis Vuitton, Dior, Sephora, and Tiffany & Co., revealed a largely flat revenue for the fourth quarter. Regardless, the company remains optimistic for 2025. LVMH’s primary fashion and leather goods division lessened its decline during this period.

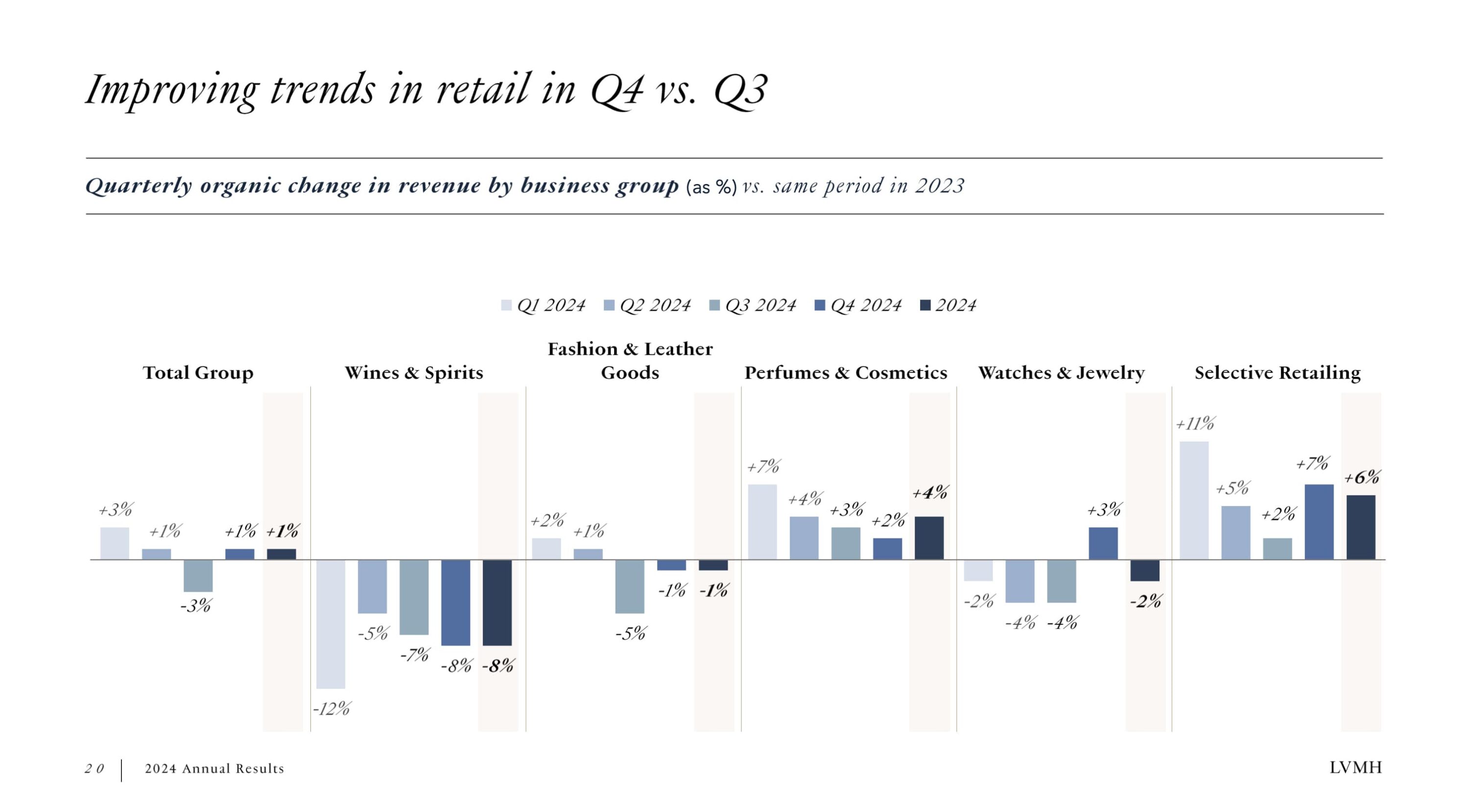

The firm reported revenues of 23.9 billion euros for the fourth quarter, mirroring the same time the previous year. The company also experienced a 1 percent organic revenue growth, which is an improvement over the 3 percent drop witnessed in the third quarter. In contrast, financial services company Compagnie Finanicère Richemont reported an unexpected 10 percent revenue increase for the same quarter, leading to a surge in luxury stock values.

While remaining highly vigilant with regard to cost management and our single-minded focus on the desirability of our designs, we enter 2025 with confidence. In 2024, amid an uncertain environment, LVMH showed strong resilience. This capacity to weather the storm in highly turbulent times – already illustrated on many occasions throughout our group’s history – is yet another testament to the strength and relevance of our strategy.

– Bernard Arnault, chairman and CEO of LVMH

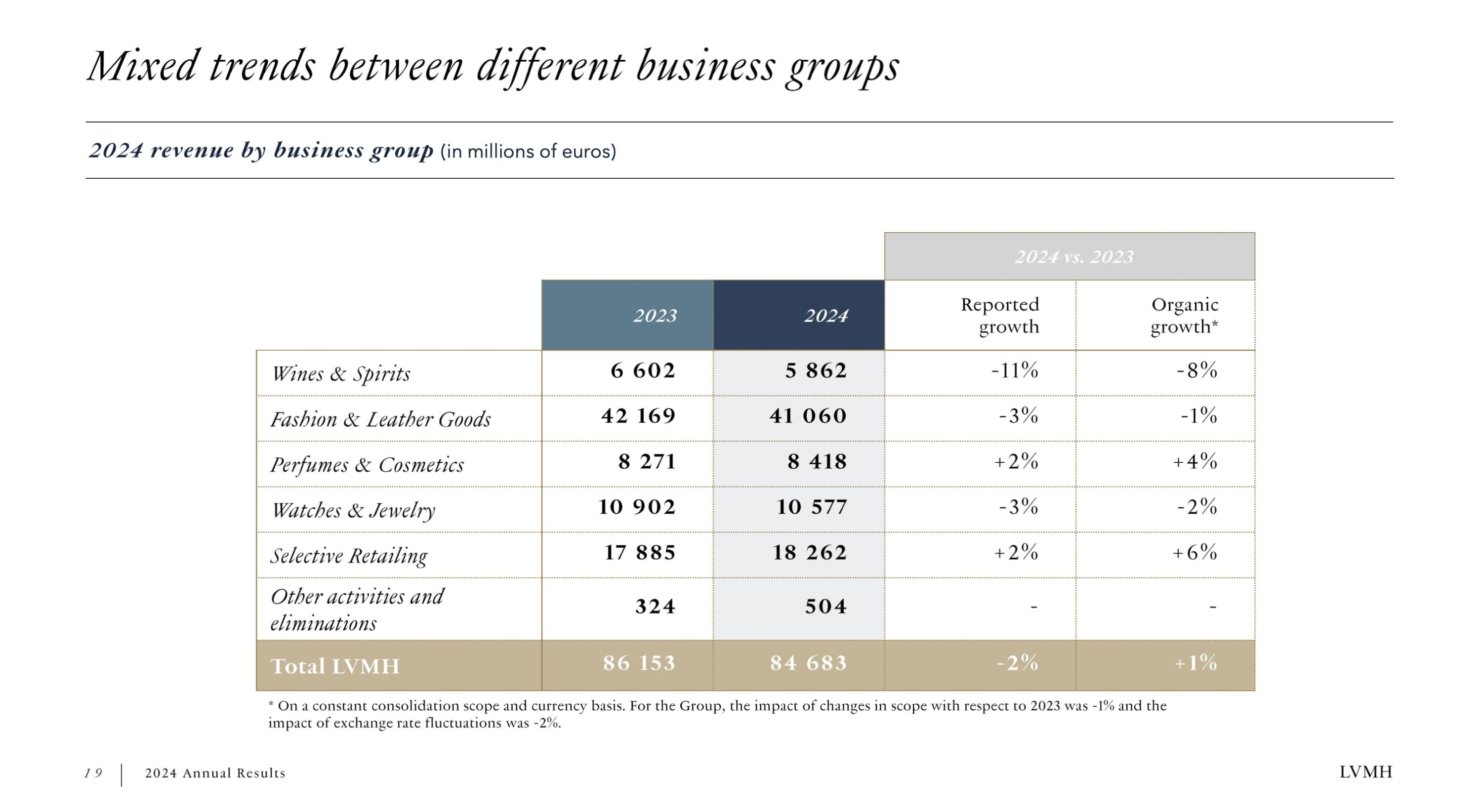

In Q4, the fashion and leather goods department experienced a 1 percent dip in organic revenue but outperformed the expected 3 percent fall. The wines and spirits division witnessed an 8 percent decrease, while areas like watches and jewelry and selective retailing saw increases of 3 percent and 7 percent, respectively. Sales of perfumes and cosmetics grew by 2 percent, a decline from the 3 percent growth in Q3.

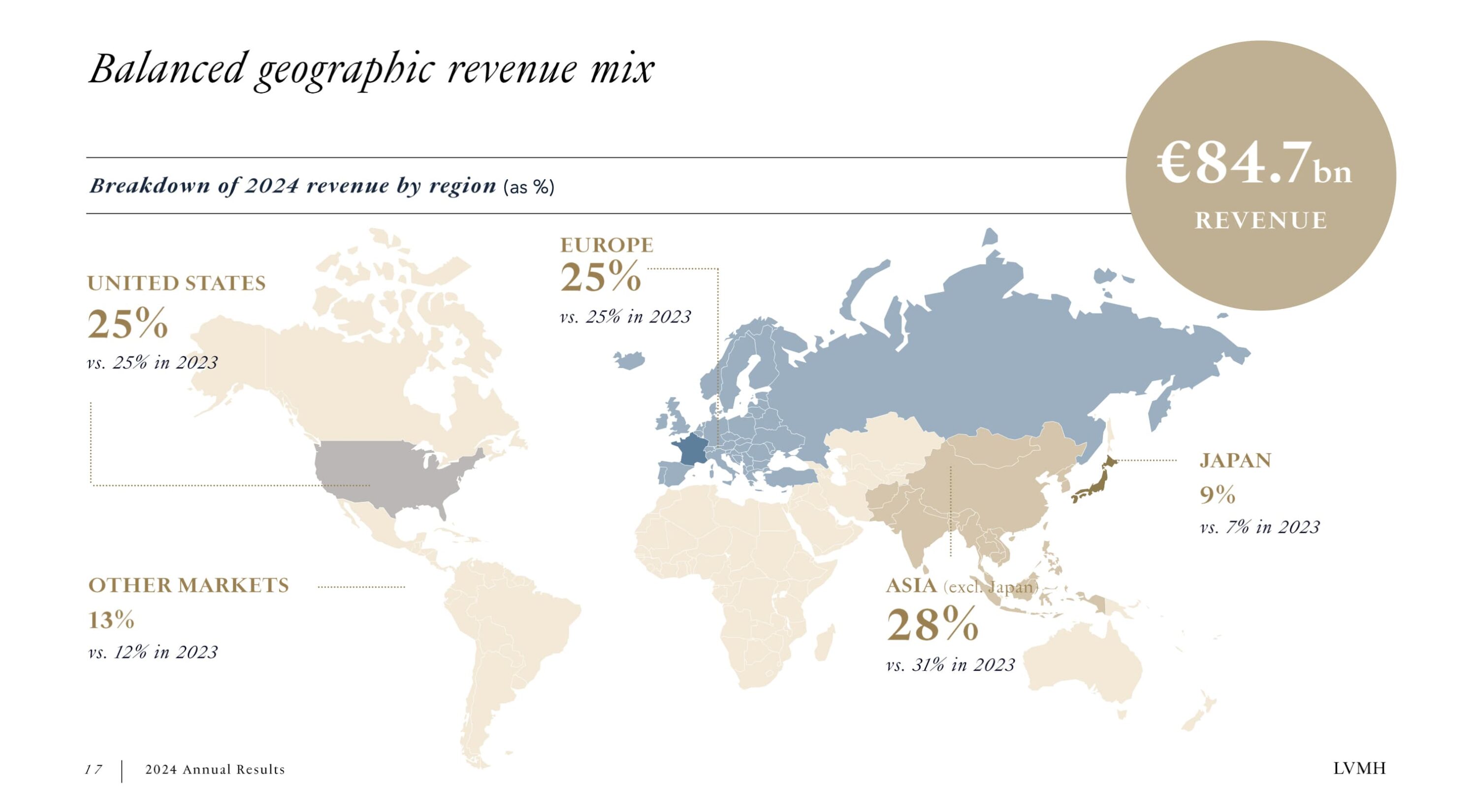

In 2024, LVMH reported overall revenues of 84.7 billion euros, marking a 1.7 percent fall year-over-year. This is due to the challenging economic and geopolitical conditions, and a high comparison base following a period of exceptional growth in the wake of the coronavirus pandemic. Net profit declined by 17 percent to 12.5 billion euros, and recurring operational profit fell by 14 percent to 19.6 billion euros. Collectively, the group invested 5.5 billion primarily into expanding their store network and creating new workshops.