VF Corp. Reports Encouraging Q3 Results; Further Progress Expected in Transformation Efforts

VF Corp.’s third fiscal quarter saw improved performance, demonstrating progress in its turnaround bid. The company reported net earnings of $167.1 million, or 43 cents per share, for the quarter, in stark contrast to losses of $42.5 million, or 11 cents per share, during this period last year.

Adjusted earnings increased to 62 cents, up from 45 cents from the previous year, exceeding Wall Street predictions by 28 cents. The news was well received by investors, leading to an increase of 6.3 percent in the company’s shares, reaching $28.26 in premarket trading on Wednesday.

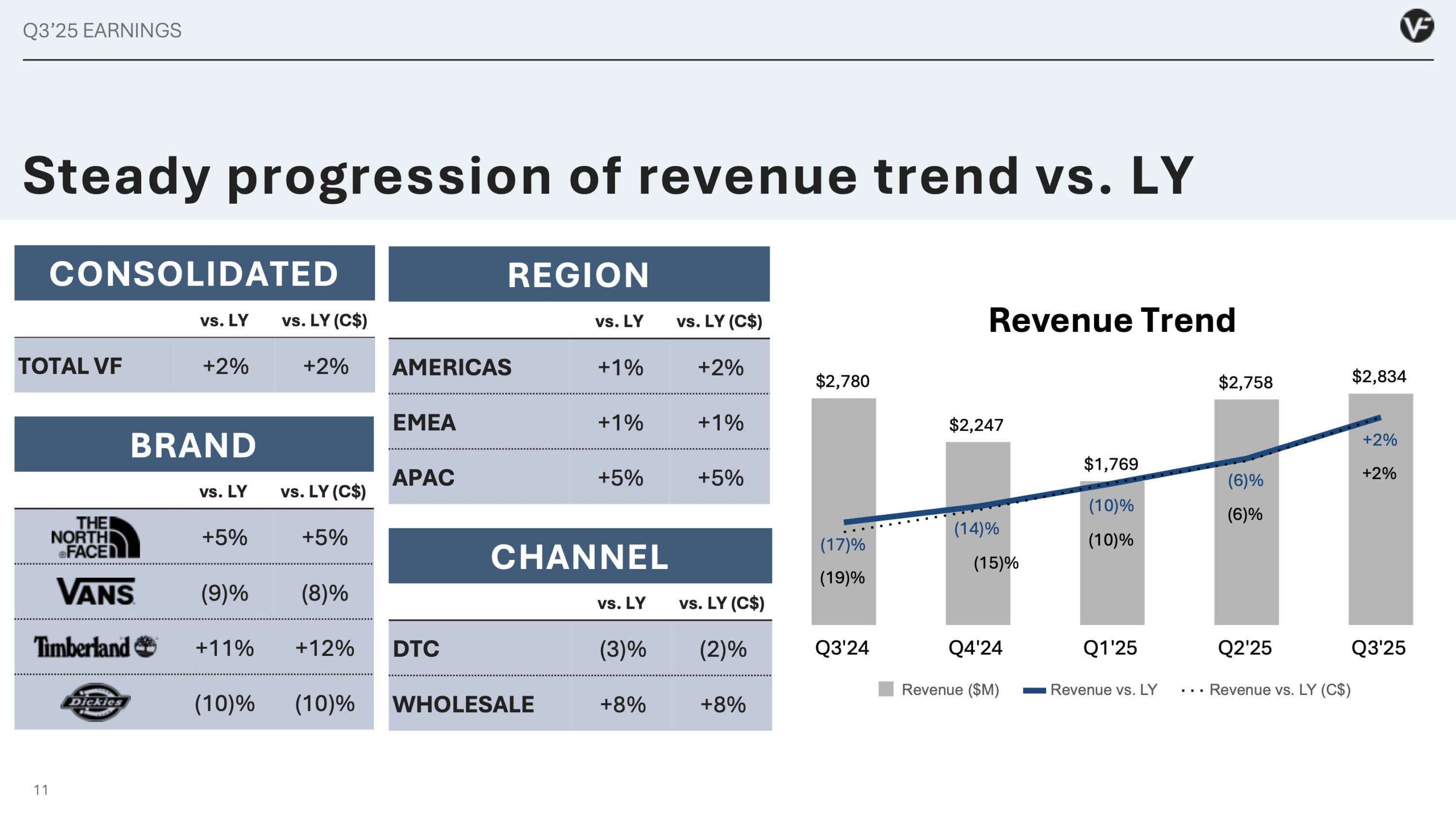

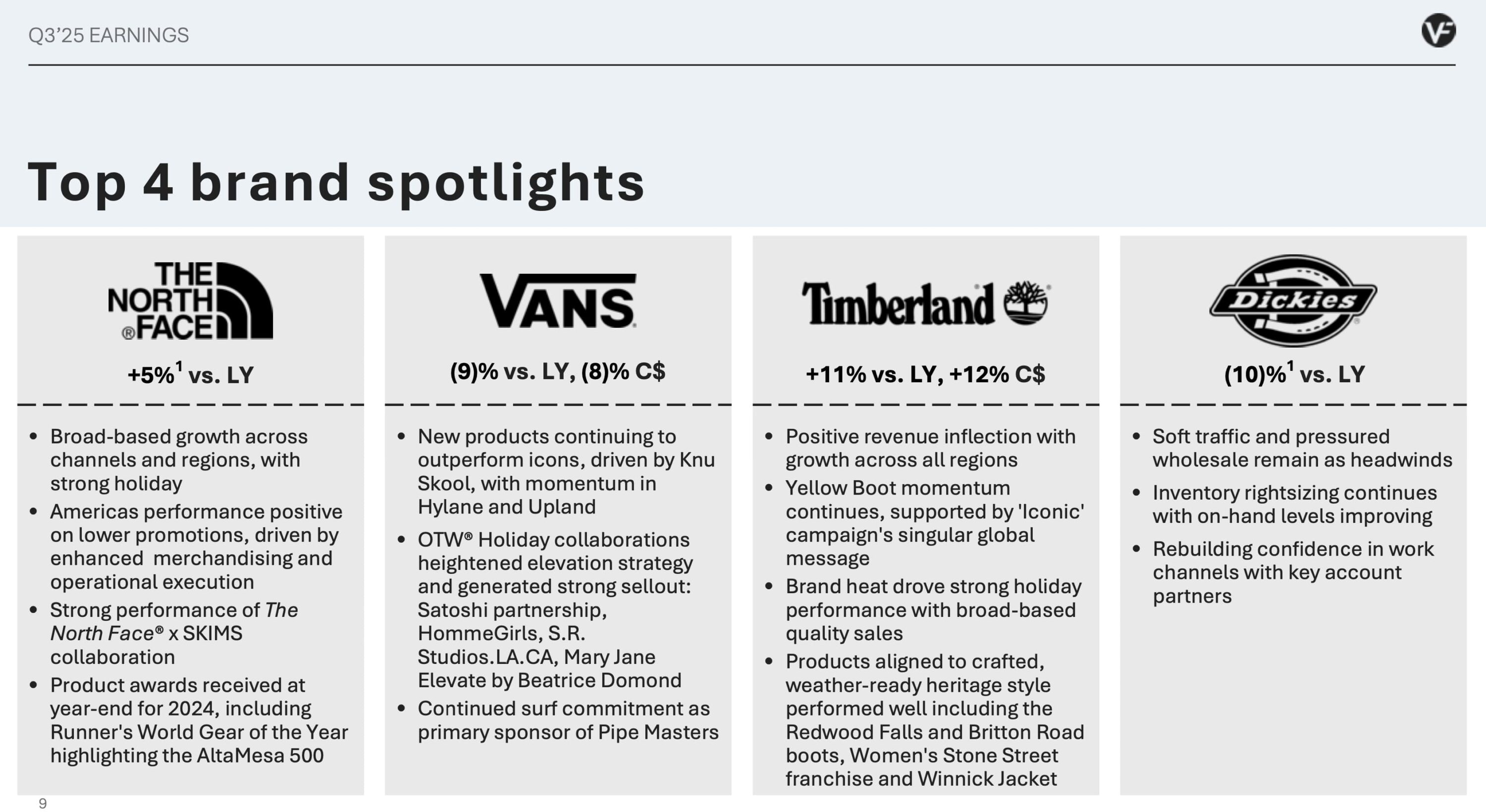

Quarterly revenues increased by 2 percent, reaching $2.8 billion by the quarter’s end on December 28. The North Face, the corporation’s top brand, contributed positively with a 5 percent sales increase, up to $1.3 billion. Timberland also performed well, with an 11 percent increase, reaching $527 million.

Despite the positive results, VF Corp. experienced a decline in sales with the Vans and Dickies brands. Vans sales dipped by 9 percent, standing at $607.6 million. Dickies, although relatively smaller, suffered a 10 percent decrease, ending at $133.6 billion.

The company succeeded in reducing its net debt by $1.9 billion over the past year, now totaling $4.7 billion. This followed the sale of Supreme to EssilorLuxottica in October. Moreover, the company has managed its inventory more effectively, reporting a 14 percent reduction at the quarter’s end.

The company’s CEO, Bracken Darrell, expressed satisfaction with the quarter’s results. He stated, “We made strong progress in Q3’25, improving profitability and strengthening the balance sheet. The pace of VF’s transformation is on track as we deliver against our Reinvent priorities.” Darrell admitted that consistent double-digit operating margins and sustainable top-line growth are yet to achieve, but also confirmed that VF is making significant advancement towards its conversion into a distinct multi-brand operator.

The firm is looking to deliver $300 million in initial savings per its Reinvent strategy, having already saved $55 million in the quarter. VF Corp. declares that it is moving into the next chapter of its Reinvent initiatives, aiming for an additional $250 million to $300 million in selling, general, and administrative expense savings, as disclosed in its investor day last year.