Gucci Misses Expectations With 24 Percent Organic Drop

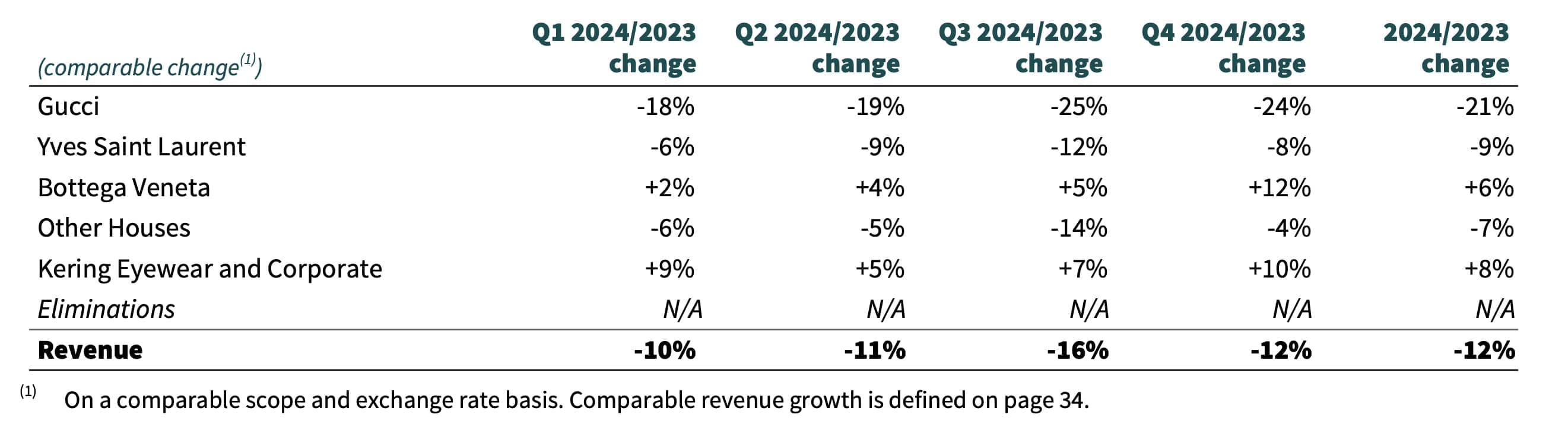

Kering ended its latest fiscal year with a 12 percent decline in fourth-quarter revenue, reporting a total of 4.39 billion euros for the three-month period ending December 31. While those results still indicate a notable drop, they exceeded analyst expectations, which had predicted a 15 percent decrease at reported exchange rates to around 4.22 billion euros. Chief executive officer François-Henri Pinault expressed cautious optimism, indicating that despite a challenging year marred by repeated profit warnings and a dramatic share price slump exceeding 40 percent, the luxury conglomerate has reached a point of “stabilization.”

Gucci, Kering’s primary growth driver, reported a 24 percent slide in organic sales, missing consensus estimates and reflecting ongoing difficulties that have plagued the iconic label. The brand now faces an extended period of uncertainty, having lost creative director Sabato de Sarno last week after less than two years in the role, with no successor named. In addition, Gucci accounted for 63 percent of the group’s operating profit in 2024, highlighting the effect of its performance on Kering’s overall financial health.

For the year, the group said its recurring operating profit decreased by 46 percent to 2.55 billion euros. This figure came in slightly above projections for a 47 percent drop but remains a substantial setback. Net profit fell 62 percent to 1.13 billion euros, underscoring the profound impact of weak consumer spending and internal challenges throughout 2024. Meanwhile, the recurring operating margin declined from 24.3 percent in the prior year to 14.9 percent for the fiscal period, further emphasizing the contraction in profitability.

Despite these hurdles, Kering’s fourth-quarter results marked an improvement over the previous quarter, which had seen a 15 percent drop at reported rates and 16 percent on an underlying basis. “In a difficult year, we accelerated the transformation of several of our houses and moved determinedly to strengthen the health and desirability of our brands for the long term,” Pinault said in a statement. “Our efforts must remain sustained and we are confident that we have driven Kering to a point of stabilization, from which we will gradually resume our growth trajectory,” he added.

Looking at other pillars of Kering’s portfolio, Saint Laurent recorded an 8 percent decline in organic sales during the final quarter, while the “other houses” category, which includes Balenciaga and Alexander McQueen, slipped by 4 percent. Yet Bottega Veneta delivered a bright spot with a 12 percent revenue jump. This favorable result may be overshadowed by an imminent creative shift: Bottega Veneta’s creative director Matthieu Blazy is stepping away, and Louise Trotter has been appointed to unveil her debut collection in Milan for the spring 2026 season.

Additionally, Kering’s eyewear and corporate division countered the broader downturn by posting a 10 percent gain in comparable sales for the fourth quarter. Even so, the group’s overall performance continues to lag behind some of its rivals. LVMH Moët Hennessy Louis Vuitton, for example, reported just a 1 percent decline in organic sales for its fashion and leather goods segment over the same period, surpassing estimates for a 3 percent drop. Richemont recorded a surprising 10 percent increase in revenue during that quarter, illustrating the uneven recovery playing out across the global luxury sector.

Attention now shifts to Gucci’s renewed strategy and the future of its leadership. With the recent exit of Sabato de Sarno, all eyes are on the brand’s next moves. Meanwhile, Stefano Cantino officially took over as Gucci’s CEO on January 1, following a deputy CEO tenure that began in May 2024. As Kering seeks to navigate an uncertain market, the emphasis on restoring momentum at Gucci is expected to play a pivotal role in the group’s renewed push for stability and future growth.