Parent Of Moncler And Stone Island Posts Growth In All Markets, Notably China

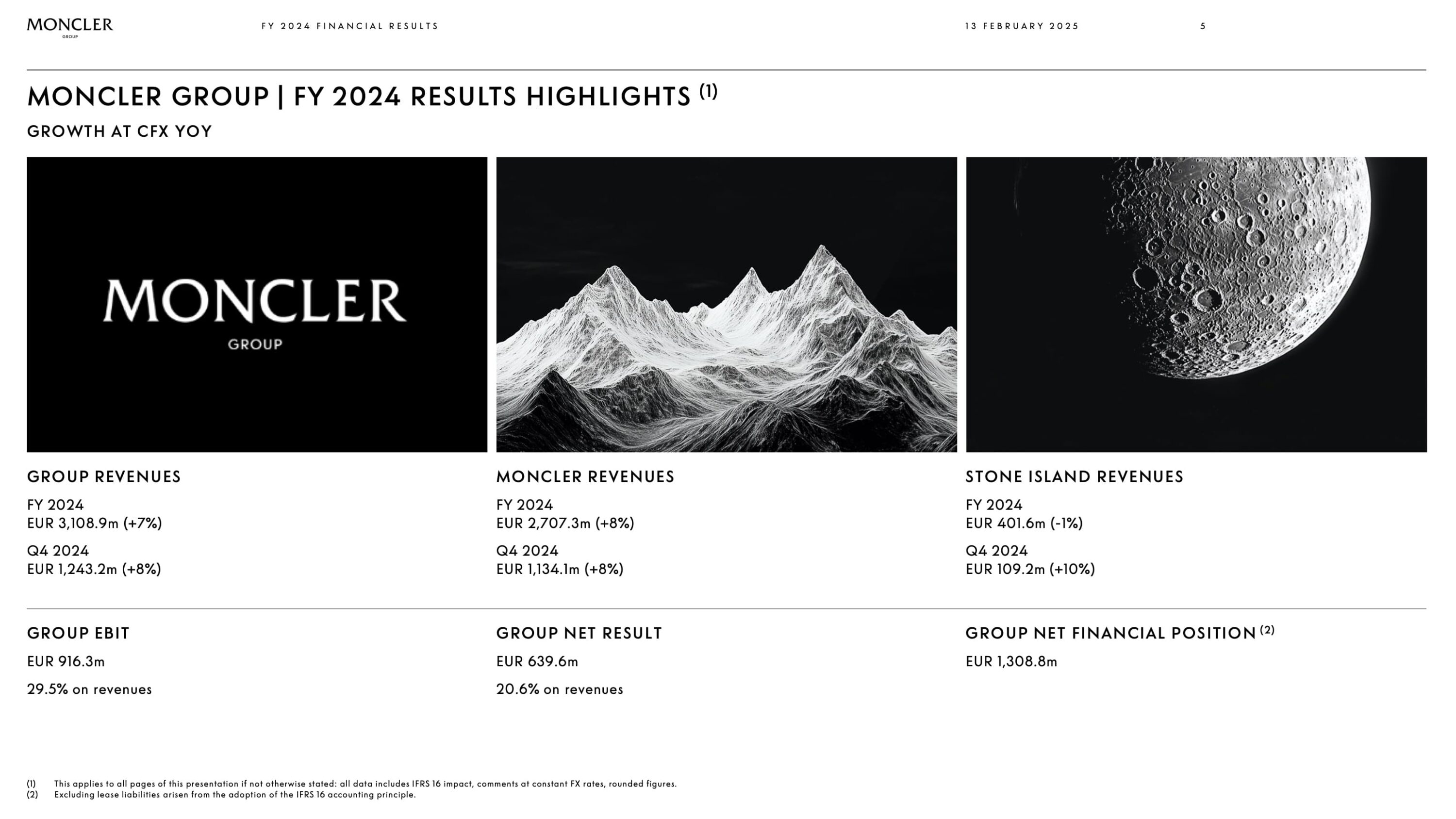

Moncler Group ended 2024 on a strong note, surpassing 3.1 billion euros in sales and posting gains across multiple markets, including a robust performance in China, where some competitors have struggled. The group also reported a cash reserve exceeding 1.3 billion euros, along with an operating profit margin just under 30 percent. Both its Moncler and Stone Island brands saw double-digit growth in direct-to-consumer sales, with an uptick toward the end of the year that exceeded analyst projections.

In a Thursday call with analysts, Remo Ruffini, chairman and chief executive officer of Moncler SpA, described the results as “remarkable,” referencing “strong resilience in a complex and volatile environment.” He highlighted the business model’s discipline and brand experiences like Moncler Grenoble in Saint Moritz and Moncler Genius in Shanghai, the latter described as “the most impactful one in the brand’s history.” Stone Island, meanwhile, further solidified its identity and broadened connections with both new and dedicated followers.

Though Ruffini noted that global economic uncertainty lingers into 2025, he expressed confidence in the group’s capacity to adapt to shifting market dynamics. “These results are more than numbers, they are about searching for creativity and uniqueness, never settling for the ordinary. We never compromise, we aim never to get bored so as not to bore others. In our ambition to push boundaries beyond conventions, we are shaping the future of our brands to drive sustainable growth and create long-term value,” Ruffini said.

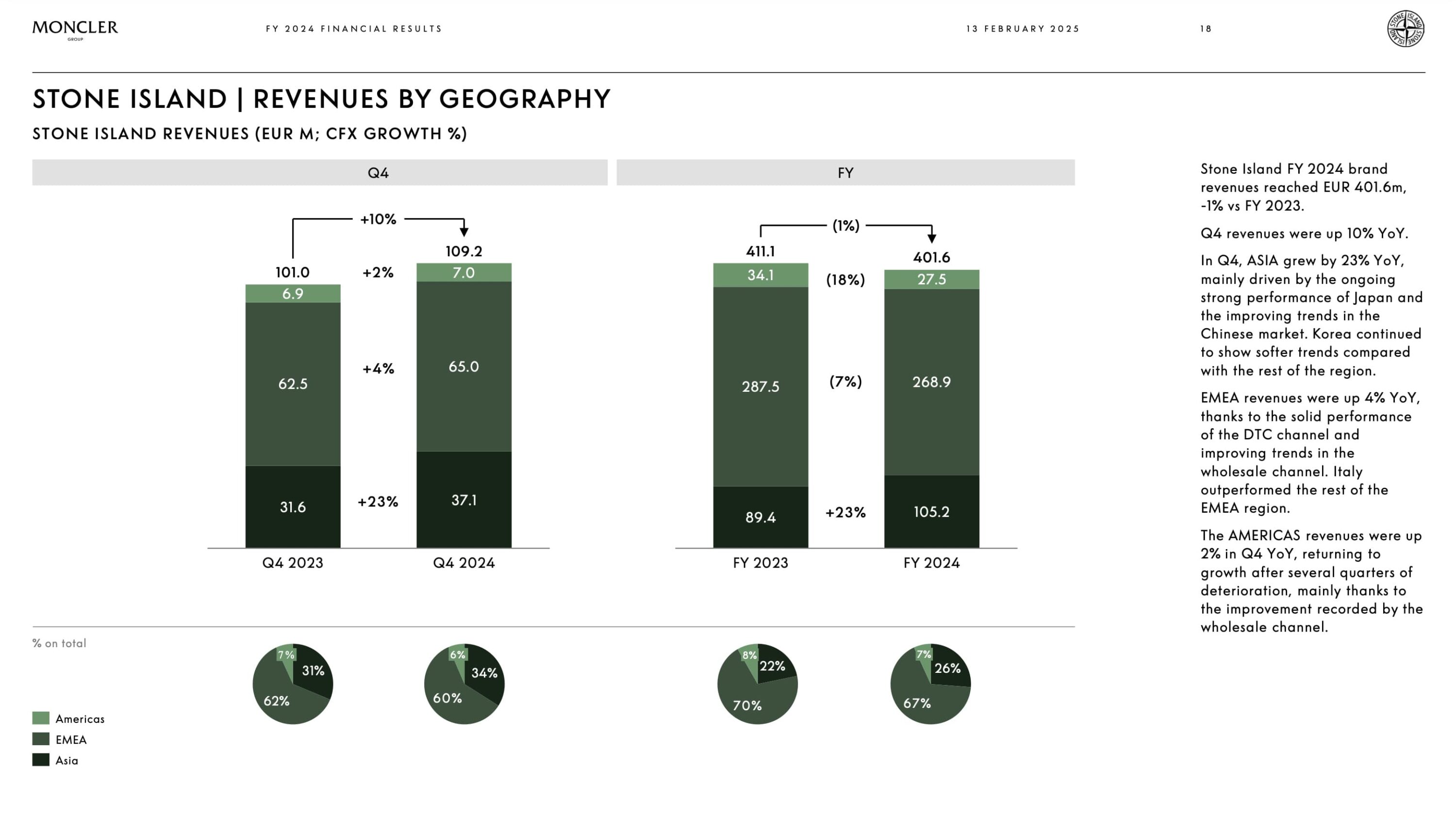

For the year, group revenues climbed 4 percent to 3.1 billion euros, a 7 percent rise at constant exchange rates. Moncler reached 2.7 billion euros in revenue, up 5 percent, while Stone Island dropped 2 percent to 401.6 million euros. However, Stone Island’s fourth-quarter revenue rose 10 percent, supported by accelerated growth across all regions.

Group net profit increased 5 percent to 639.6 million euros, compared with 611.9 million euros in 2023, and the group’s operating profit expanded to 916.3 million euros, maintaining a margin of 29.5 percent. Its net financial position totaled 1.3 billion euros as of December 31, up from 1.03 billion euros the previous year. Asked about the possibility of acquisitions, Luciano Santel, group chief corporate and supply officer, responded: “it’s a nice problem to have. We don’t have an M&A strategy and we want to remain very focused on two great brands; we see huge potential to fully develop them.”

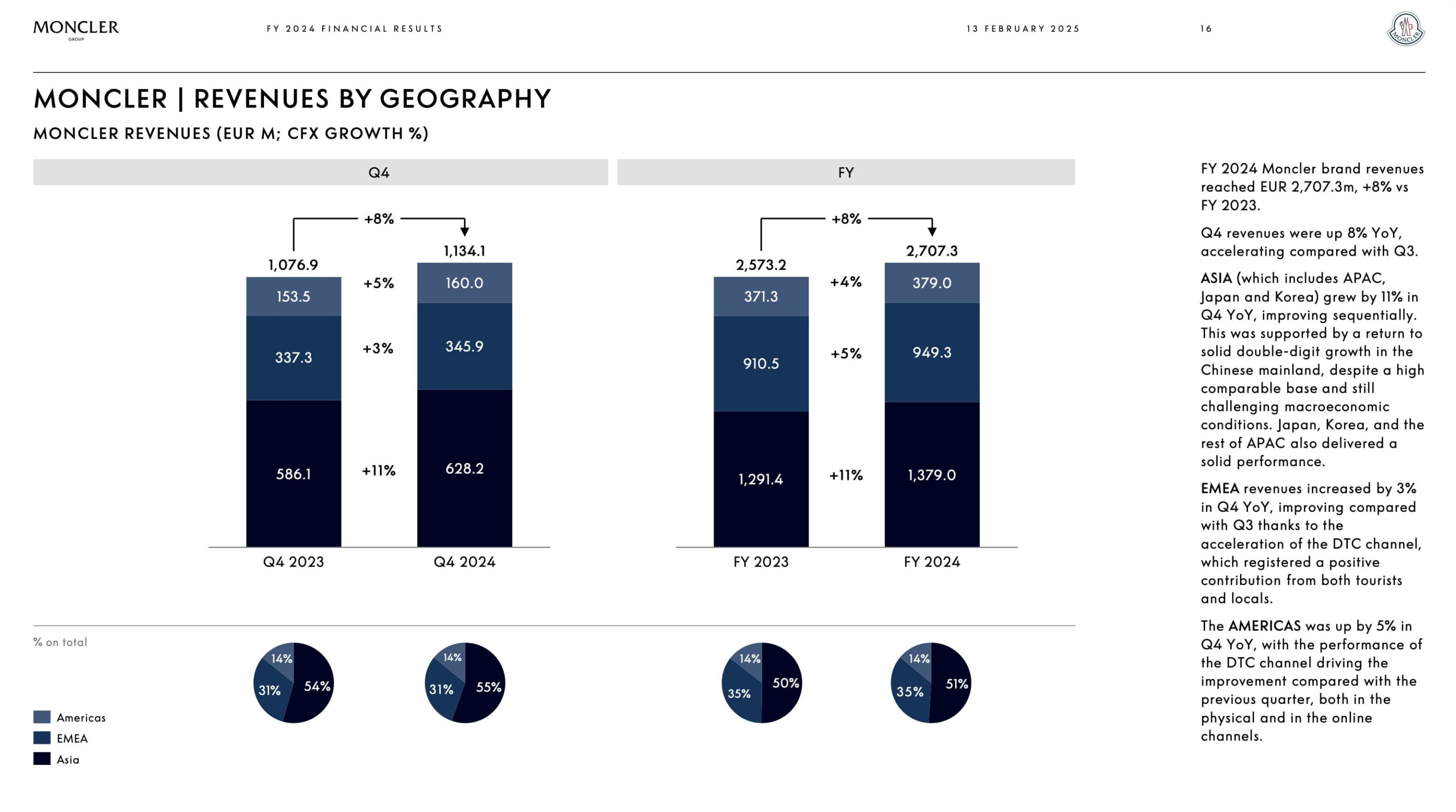

By region, Moncler’s sales in Asia jumped 7 percent to 1.38 billion euros, with fourth-quarter revenue up 11 percent at constant exchange rates. Analysts were surprised by the strong rebound in mainland China, given some peers have reported muted outcomes in the region. “We are one of the few brands for luxury outerwear, maybe the only one, and we are top of mind, there is no real competitor,” said Roberto Eggs, group chief business strategy and global market officer.

Moncler revenues in the Americas grew 2 percent to 379 million euros, with a 5 percent increase in the fourth quarter at constant rates. Eggs described a multi-year approach to expanding in the U.S. and the broader region, including upcoming flagship openings and partnerships with major retailers.

Europe, the Middle East, and Africa posted annual revenues of 949.3 million euros, a 4 percent gain on 2023. Fourth-quarter revenue in the region rose 3 percent at constant exchange rates, aided by direct-to-consumer sales and tourist traffic.

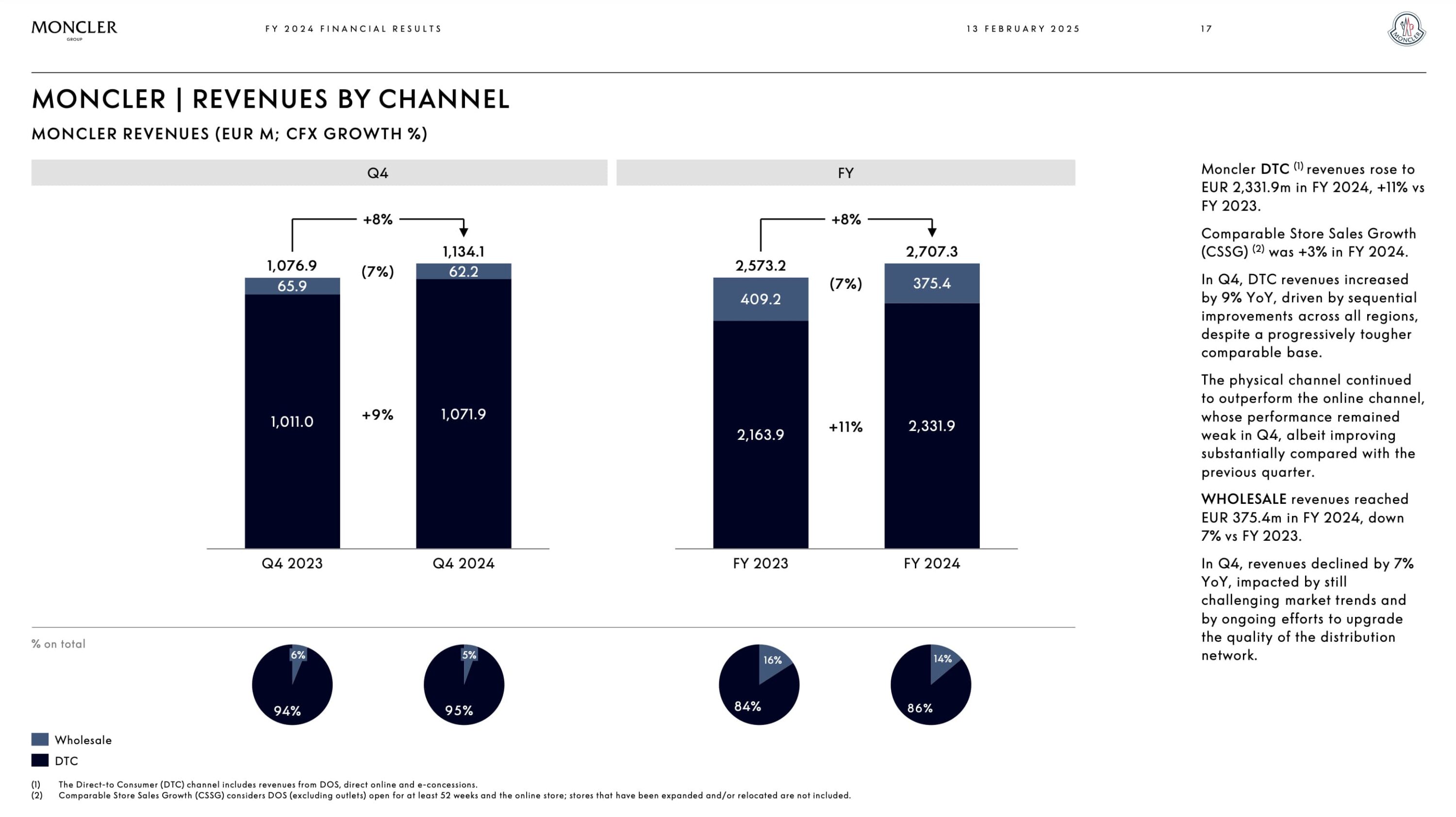

For Moncler, the direct-to-consumer channel grew 8 percent to 2.33 billion euros, while wholesale fell 8 percent, reflecting a strategic effort to enhance quality distribution. The brand counted 286 directly operated stores as of December 31. Stone Island, managed by CEO Robert Triefus since May 2023, reported revenue growth of 18 percent in Asia, with the Americas returning to positive territory in the last quarter. In total, Stone Island operated 90 directly owned stores and nine monobrand wholesale locations by year-end.

The group’s capital expenditures reached 186.7 million euros, roughly 6 percent of revenues, up from 174.1 million in 2023.