Profitability was dented due in part to tourism slowdown and macroeconomic challenges, highlighted management

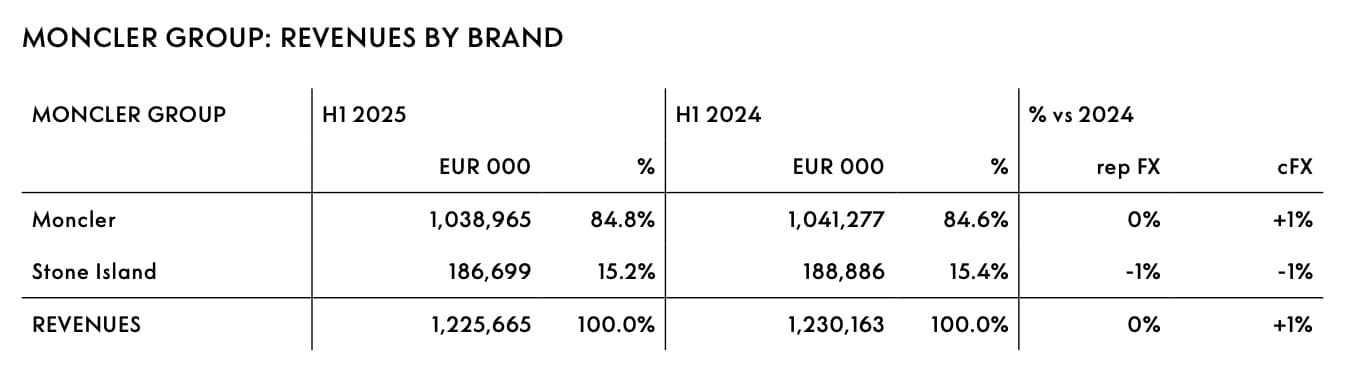

Moncler Group recently released its H1 2025 financial report. Revenues for the Italian luxury group, which owns the eponymous Moncler as well as Stone Island, remained in line with the same period last year, with sales remaining flat at €1.23 billion in the first six months ended June 30. At constant exchange, they rose 1 percent, which was in line with consensus. Overall, the group’s net financial position was €980.8 million in net cash, compared with €845.8 million at the end of June last year, after a dividend payment of €345 million.

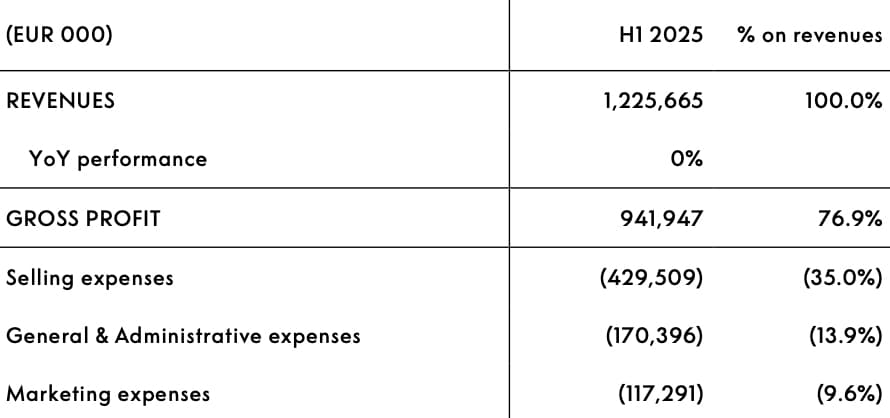

The group saw operating profit fall 13 percent, to €224.8 million from €258.7 million in the same period of 2024, with a margin of 18.3 percent compared with 21 percent. Management attributed this drop to a new strategy of phasing marketing expenses in the first half versus the second half. However, net profit was also down, amounting to €153.5 million—a decrease of 15 percent from €180.7 million during the first half of last year.

By brand, Moncler sales remained flat, resulting in a 2 percent revenue loss at constant exchange rates. Stone Island showed more positive numbers, with revenues up 6 percent at constant exchange rates. In the first six months, their direct-to-consumer sales channel grew by 7 percent to €99.1 million. The growth was championed by the Asian market, where sales rose 12 percent to €52.3 million.

Much of the group’s performance this half can be attributed to larger macroeconomic trends in consumer behavior. At the forefront was a slowdown in tourism, the impact of which was especially felt in Asia and the EMEA regions by the Moncler brand: softer tourist flows in Japan led second quarter deceleration, and revenues in Europe, the Middle East and Africa were down 8 percent at constant exchange rates in the second quarter. Also relevant were the impending tariffs soon to be set by the U.S.; management connected the 17 percent revenue decrease in the Americas to tariff anticipation.

Despite the stagnant results, management feels equipped to weather the volatile climate ahead. The company is making investments in dragging markets, specifically the Americas, where they’ve participated in a number of U.S.-oriented initiatives such as the brand’s first participation at the Met Gala in May and their first collection of apparel collaborating with Donald Glover’s Gilga Farm unveiled in June. They’re also investing €50.7 million in distribution networks and putting €31.3 million into infrastructure-related investments. Looking ahead, the group reiterated its confidence in long-term growth, led by vision, awareness, and ambition.