LVMH reported a 15% drop in profit for H1 2025, with fashion and leather goods sales falling 9% in Q2, as slowing global demand and market shifts force strategic recalibration.

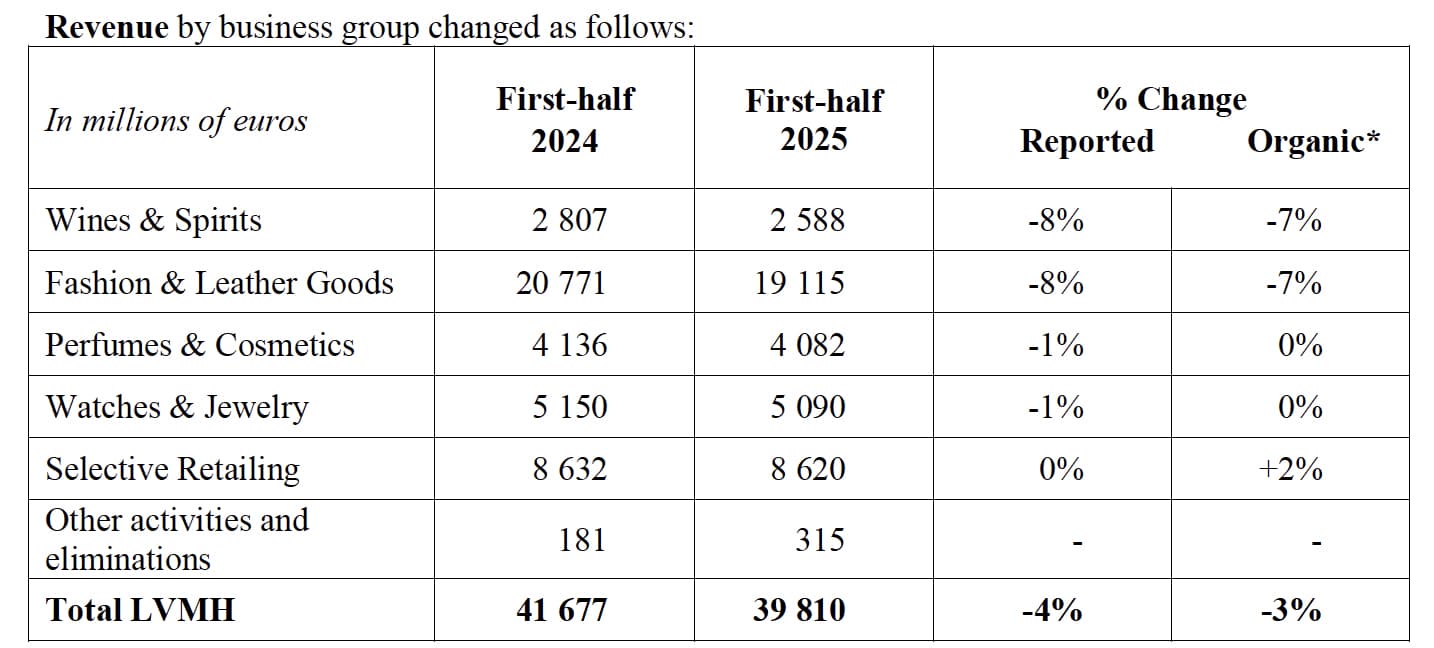

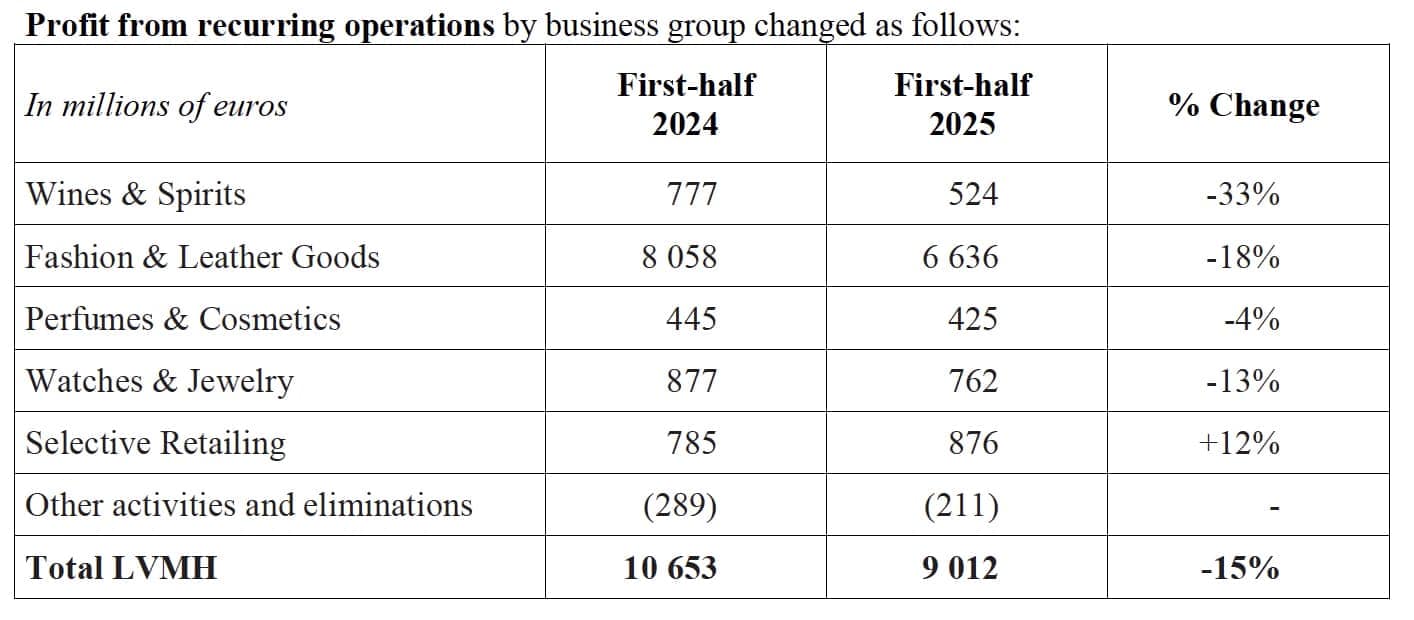

LVMH Moët Hennessy Louis Vuitton reported a 4% year-over-year drop in revenue for the first half of 2025, falling to €39.8 billion. The group’s net profit declined 22% to €5.7 billion, and recurring operating profit was down 15% to €9 billion, with key segments—fashion, leather goods, and wines and spirits—dragging on overall performance.

Division Breakdown:

- Fashion & Leather Goods: Saw organic sales drop 9%, with reported revenue down 8% year-over-year. Operating profit fell 18%, though margins remained healthy at 34.7%. Louis Vuitton continues to outperform peers, while Dior remains below average. A sharp 28% sales decline in Japan weighed heavily on results.

- Selective Retail (Sephora, DFS): Up 4%, driven by Sephora’s strength. DFS continues to lag, prompting a governance transfer of La Samaritaine to Le Bon Marché.

- Perfumes & Cosmetics: Up 1%, with new efficiencies being explored, including reduced fashion show spending.

- Watches & Jewelry: Flat sales, slightly above expectations, though the Swiss market remains under pressure.

- Wines & Spirits: Declined 4%, an improvement from the previous quarter’s 9% drop, but still challenging due to weak demand and U.S. tariff threats.

Strategic Headwinds:

Persistent macroeconomic issues—particularly in China and Japan—coupled with a return to alternative discretionary spending categories (travel, wellness), have driven down demand for big-ticket luxury. Meanwhile, price sensitivity among consumers and growing interest in niche or craftsmanship-first brands like Hermès and Miu Miu are reshaping competitive dynamics.

Compounding external pressures, LVMH also faced internal scrutiny: from data leaks at Louis Vuitton and Dior to workplace issues at Moët Hennessy and a supply chain scandal at Loro Piana. The group’s stock is down 26% YTD, allowing Hermès to surpass it in market valuation.

Leadership and Strategy:

CFO Cécile Cabanis said the group is reviewing operating costs—including fashion show budgets and marketing contracts—but remains committed to selective investment. New flagship stores for Louis Vuitton in Shanghai and Tiffany & Co. in Japan signal ongoing belief in physical retail. Dior boutiques are planned for NYC and Beverly Hills in H2.

On succession planning, Bernard Arnault reiterated his long-term confidence but did not rule out spinning off underperforming units. “We will not miss good opportunities, and we will not keep brands if they are not a good fit,” said Cabanis.

Brand Updates:

- Louis Vuitton: Staying the course with upscale product development and experiential retail, including a cruise ship-inspired Shanghai flagship. A Pat McGrath-developed cosmetics line launches this fall.

- Dior: New creative director Jonathan Anderson’s menswear debut received 1.1B views online. First womenswear collection debuts October 1.

- Celine, Givenchy: Recent debuts from Michael Rider (Celine) and Sarah Burton (Givenchy) were well received.

- Loro Piana: Working to resolve third-party labor issues; broader scrutiny expected in the Italian luxury supply chain.

- Moët Hennessy: Undergoing strategic restructuring, with expected impact to emerge in late 2026.

Outlook:

Looking ahead, LVMH is balancing margin preservation with high-value brand investment, while closely watching developments around U.S. tariffs. A potential trade deal could ease pressure, particularly on wines and spirits.

As new creative leadership takes shape and key retail debuts roll out in the second half, the group’s future depends on navigating shifting consumer behaviors while maintaining brand equity in an increasingly fragmented market.