Calvin Klein and Tommy Hilfiger Drive Renewed Confidence as Fall Season Approaches

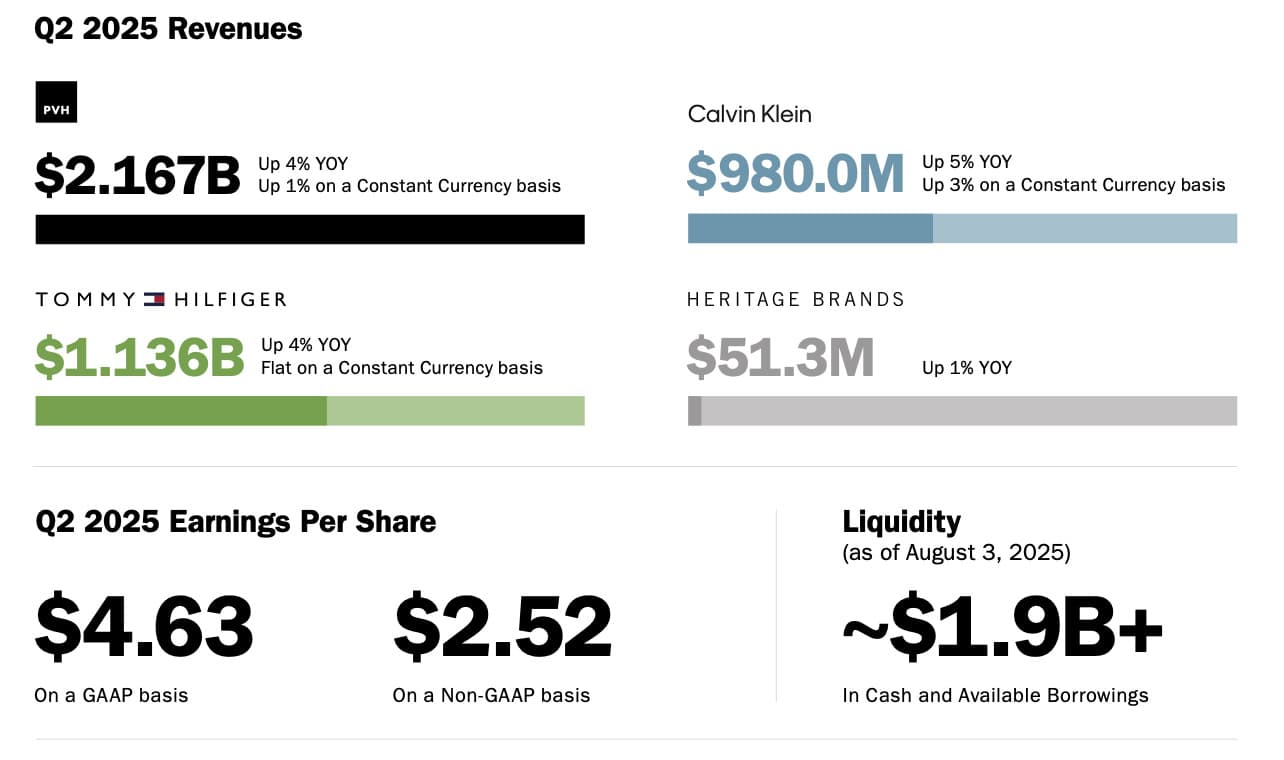

PVH Corp., parent of Calvin Klein and Tommy Hilfiger, raised its full-year revenue forecast after second-quarter results exceeded expectations, crediting a boost from high-impact talent collaborations and renewed marketing muscle.

The New York-based fashion group now anticipates revenue to increase “slightly” to the low-single digits, up from its previous forecast of flat to slightly increasing. The company also reaffirmed its full-year adjusted earnings outlook, signaling growing confidence as it prepares for the critical fall season.

Second-quarter earnings were buoyed by strong momentum across both core brands. Calvin Klein revenue rose 5 percent to $980 million, outpacing estimates, while Tommy Hilfiger climbed 4 percent to $1.1 billion. Growth was led by the Americas, where sales surged 11 percent. Europe posted a modest 3 percent gain, while Asia Pacific saw a 1 percent dip, attributed to “a challenging consumer environment,” particularly in China.

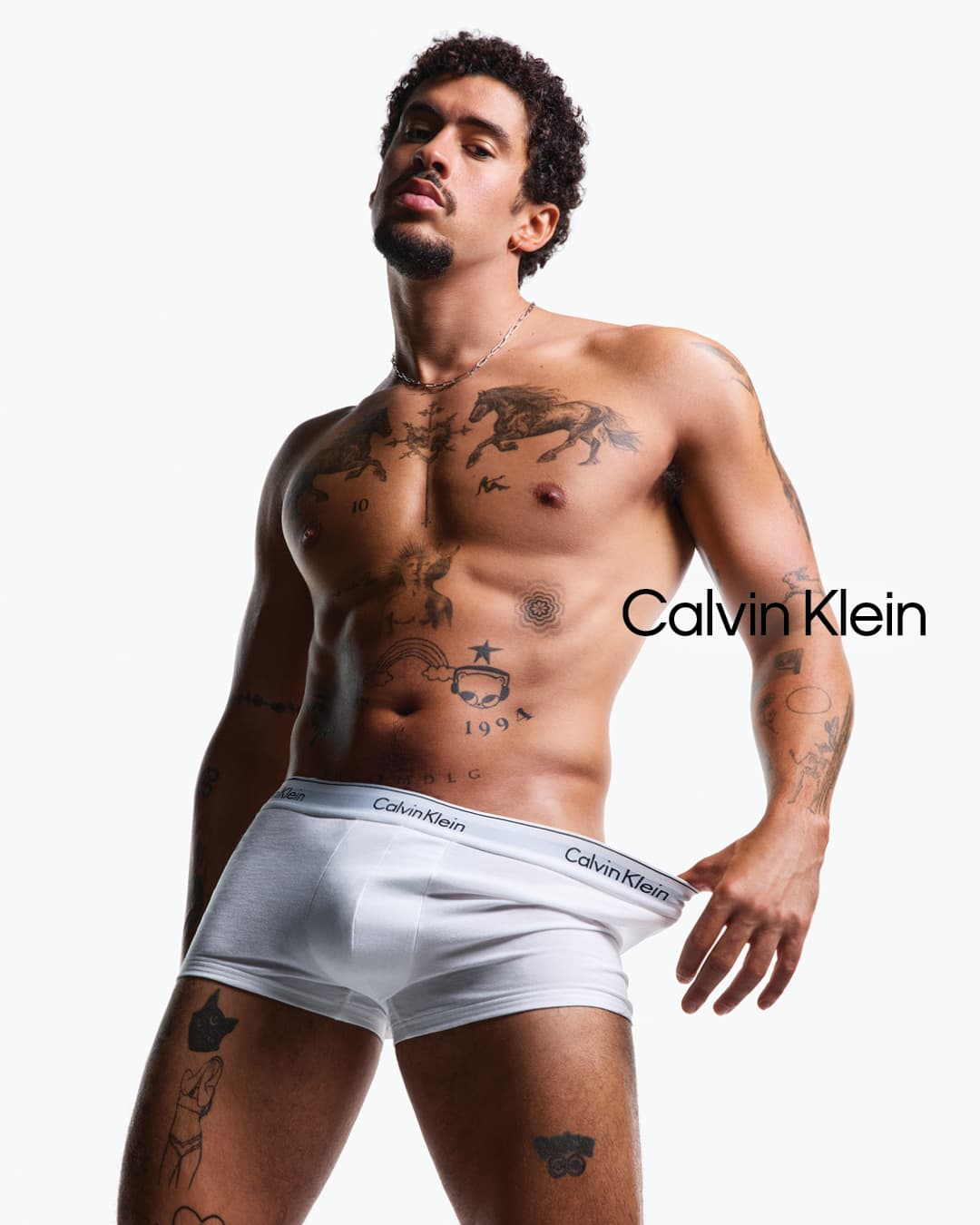

CEO Stefan Larsson emphasized PVH’s progress on its PVH+ Plan, pointing to increased brand heat driven by product innovation and strategic celebrity partnerships. “Calvin Klein showed continued growth in underwear and fashion denim, driven by the biggest product innovation so far, amplified by mega talent like Bad Bunny,” Larsson said. “Tommy Hilfiger’s summer season was successfully amplified by the campaign around the summer’s biggest blockbuster, F1® The Movie, and the partnership with the US SailGP racing team.”

Despite the upbeat report, PVH shares remain down more than 20 percent year-to-date following several quarters of declining revenue—a fact not lost on leadership as they intensify turnaround efforts. The stock gained 4 percent in after-hours trading following the earnings release.

The company also increased its projected tariff-related headwind to $70 million, up from $65 million, though it expects to mitigate the impact in the second half of the year through tariff relief strategies.

Looking ahead, Larsson remained bullish. “Coming into the important fall season, both brands are geared up with a strong category focus, more innovation in key product franchises, and cut-through campaigns with a strong lineup of globally relevant talent,” he said. “We continue to expect 2025 to mark our return to growth.”

With momentum building, PVH is betting big that sharper product storytelling and cultural resonance will reestablish Calvin Klein and Tommy Hilfiger as two of the world’s most desirable fashion brands.