Group Partners With Samsung For South Korea As U.S. And EMEA Lead Growth; China Still Under Pressure Amid Repositioning

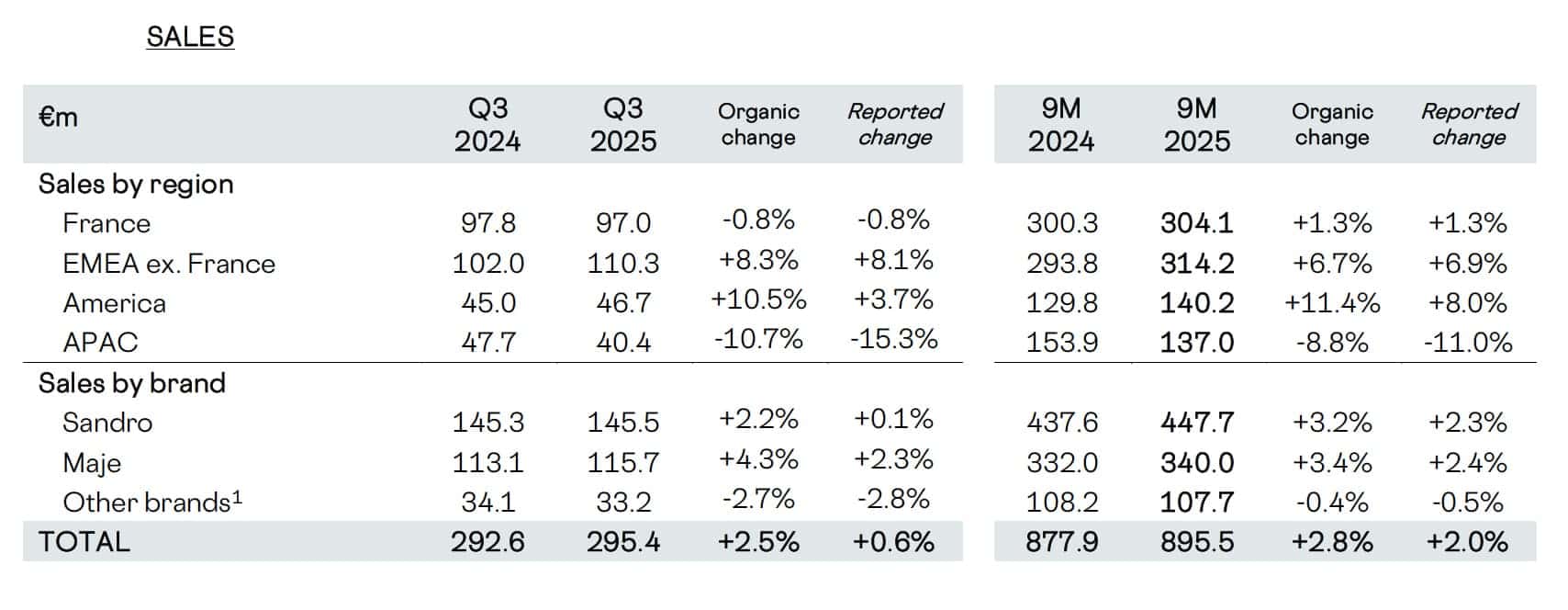

French fashion group SMCP posted a 2.5 percent increase in organic revenue for the third quarter, reaching 294 million euros. The French fashion group, which owns Sandro, Maje, Claudie Pierlot, and Fursac, credited the gain to continued efforts around brand elevation, regional rebalancing, and a sharpened focus on full-price sales.

The U.S. remained a key growth driver, with sales rising 10.5 percent in the region. “The positive momentum observed in the first semester was confirmed in the third quarter. I am particularly proud of our performance in America and EMEA, where growth remains very strong. In France, we continue to demonstrate solid resilience and outperform the rest of the market in a highly complex politico-economic environment,” said SMCP CEO Isabelle Guichot.

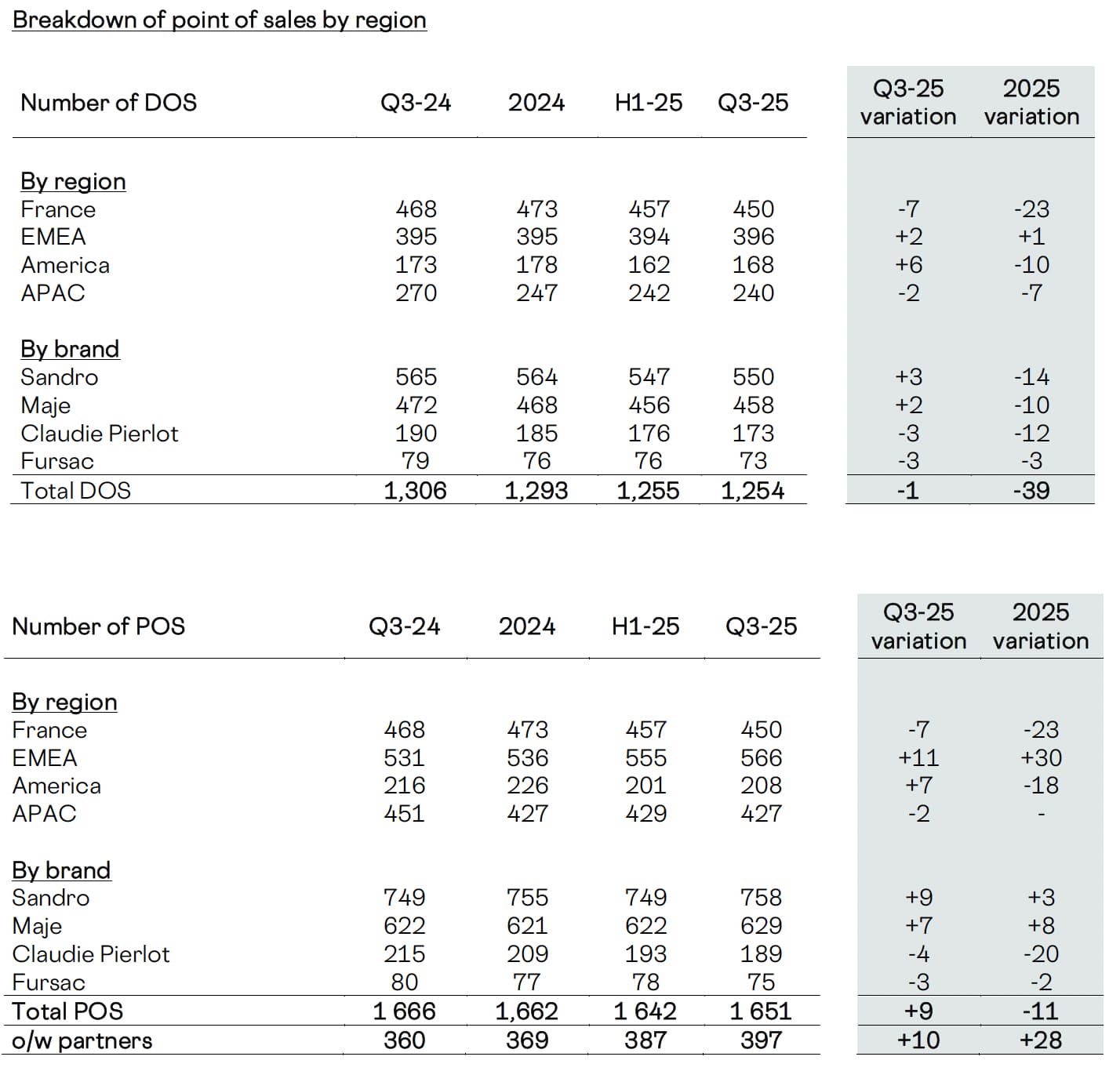

Asia continued to weigh on results, with organic sales down 10.7 percent as the company pressed ahead with store closures in China. SMCP shuttered 65 stores there last year and closed two more this quarter. “In Asia, while the network optimization in China continues to impact sales, our efforts are beginning to bear fruit, with a return to like-for-like growth in our physical network,” Guichot said. The company reported mid-single-digit growth in store performance in China on a like-for-like basis.

Other Asian markets showed stability, with Malaysia and Thailand noted for positive trends and new market entries in India and Indonesia described as promising. In South Korea, SMCP finalized a new distribution agreement with Samsung, whose portfolio includes Balmain, Ganni, Jacquemus, Lemaire, and Thom Browne. Samsung will begin distributing SMCP’s brands with the Spring 2026 collections.

Like-for-like sales across all regions rose 3.2 percent, driven by physical store traffic. The company opened new locations in Georgia, Egypt, and several Balkan countries, while executing seven net store closures in Europe. In France, sales fell just under one percent year-over-year, which SMCP attributed to political gridlock and delayed national budget approvals in September. However, it noted a rebound in store traffic after the Paris 2024 Olympics, while digital sales were dampened by the group’s reduced promotional activity.

“In line with our strategic plan, we have continued across all regions to strengthen the desirability of our brands, enabling us to maintain our full-price strategy. Building on this progress, we approach the end of the year with confidence in our ability to sustain this trajectory, in a market that nevertheless remains uncertain,” Guichot added. The company reduced its average global discount rate by three points compared to 2024.

In EMEA, sales grew 8.3 percent, with performance strong across most markets despite the drag from France. Sandro and Maje led brand-level results, with sales up 9 percent and 7 percent, respectively. SMCP has focused on upscaling both brands through material upgrades, targeted marketing, and more focused creative direction. Sandro leaned into art world collaborations—including recent projects with Louise Bourgeois and runway shows at the Bibliothèque nationale and Musée Bourdelle in Paris—while supporting Marseille’s fashion incubator Maison Mode Méditerranée.

Maje continued to emphasize celebrity placements, including recent appearances by Kerry Washington and Lady Gaga, who wore the brand on stage in London.

Claudie Pierlot saw a 4 percent drop in sales. The brand, now under new CEO Anne Cottin since June, has begun a repositioning that includes store closures and a refreshed identity under the shortened name Claudie. Menswear label Fursac posted a 3 percent sales decline for the quarter.