Stronger-Than-Expected Results At Coach And Rising Gen Z Engagement Boost Confidence In The Company’s Long-Term Growth Plan

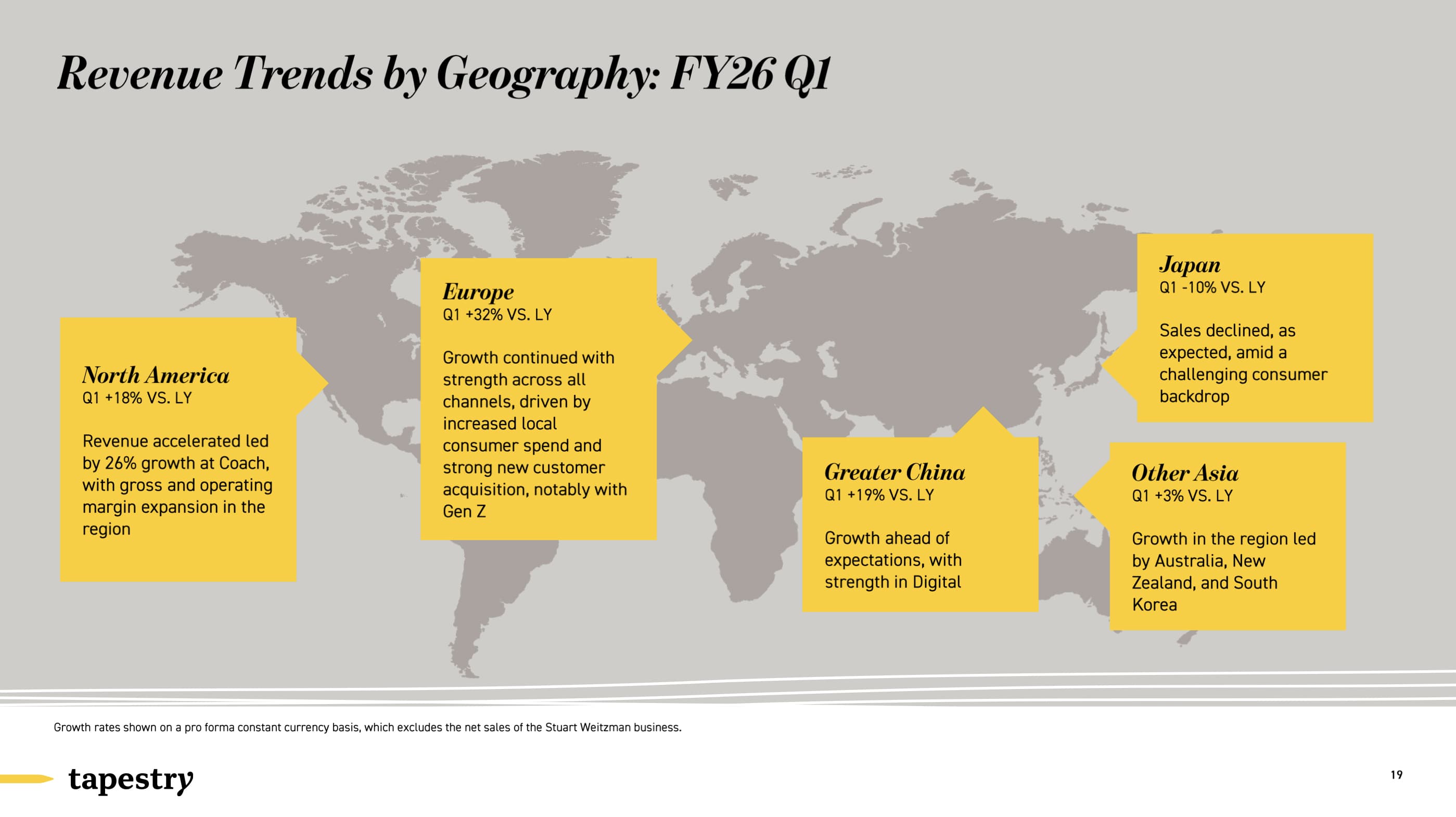

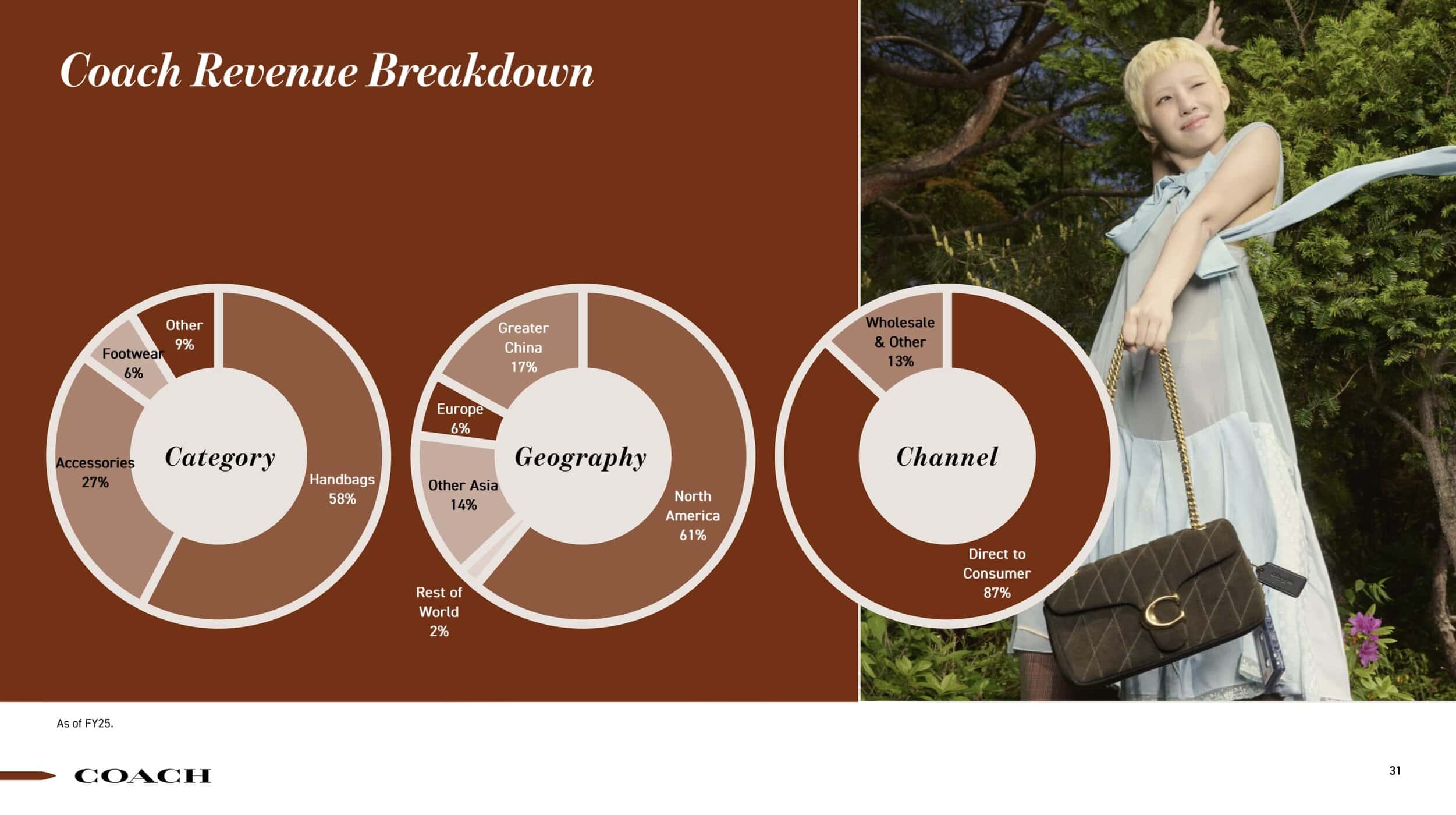

Tapestry Inc. entered fiscal 2025 with momentum, reporting a 16 percent rise in first-quarter sales to $1.7 billion, driven by a 22 percent surge at Coach. Excluding the recently sold Stuart Weitzman business, the group’s performance underscored the strength of its core brands and its renewed strategic focus under chief executive officer Joanne Crevoiserat. Kate Spade, still in the midst of a turnaround, posted an 8 percent decline to $260.2 million.

After its proposed acquisition of Capri Holdings was blocked by antitrust regulators last year, Tapestry doubled down on execution. The approach is paying off. Adjusted operating income rose 24.2 percent to $354 million, with operating margins improving to 20.9 percent from 18.9 percent a year earlier — a gain partially attributed to the Weitzman divestment. Net profits totaled $274.8 million, while adjusted earnings per share reached $1.38, surpassing analyst forecasts of $1.26, according to Yahoo Finance.

“At our investor day in September, we introduced our Amplify plan – a bold vision to bring Tapestry’s iconic brands to new generations of consumers and drive durable growth,” said Crevoiserat. “Our first quarter outperformance marked a powerful start to this next chapter. Through focused execution of our strategies, we brought creativity and craftsmanship to our customers around the world, achieving revenue and earnings increases ahead of expectations. From this position of strength, we are raising our full year outlook, reinforcing that our advantages are structural and sustainable.”

The company’s Amplify plan aims to grow Coach into a $10 billion business by broadening its audience beyond traditional handbag buyers and expanding its appeal across generations. In North America, sales grew 26 percent, with Gen Z customers representing a growing share of the brand’s base. “I don’t see many brands putting up those kinds of numbers,” said Crevoiserat. “That’s being fueled by Gen Z acquisition, fueled by the innovation that we’re delivering in the marketplace at compelling value.”

Tapestry said it added 2.2 million new shoppers in the quarter ended September 27, with Gen Z accounting for about 35 percent of those gains. With more clarity around its audience, the company has also ramped up marketing investment to 11 percent of sales, compared with 4 percent in fiscal 2019.

“We have worked a lot of years to prepare for this moment,” said Scott Roe, chief financial and operating officer. “We’re ready for this moment because we’ve remade the business model, we’ve remade the P&L, and that marketing investment getting to north of 11 percent in the quarter — and for the year — is also with taking up our full-year guidance on operating margin. That’s because of the quality of the sales that we’re driving. We’re not just chasing dollars, we’re getting the gross margins, we’re getting the efficiency. And that’s translating into not just profit, but cash flow.”

For the full fiscal year, Tapestry expects sales to rise 7 to 8 percent to approximately $7.3 billion, excluding Stuart Weitzman. Annual earnings per share are now projected between $5.45 and $5.60, up from previous guidance of $5.30 to $5.45. The company also plans to repurchase $1 billion in common stock this year, an increase from its earlier $800 million forecast.