Burberry Repositions for the Future with ‘Burberry Forward’ Strategy

This week, two significant stories shaped the luxury market, starting with Tapestry Inc. and Capri Holdings officially terminating their $8.5 billion merger. The decision came after the Federal Trade Commission (FTC) challenged the deal on antitrust grounds, arguing it would create an unfairly dominant player in the accessible luxury handbag market, potentially raising consumer prices by $365 million annually. With a federal judge granting a preliminary injunction, the merger came to an abrupt halt, and both companies agreed to part ways. Wall Street reacted sharply—Tapestry’s stock surged 10%, while Capri’s shares dropped by 5%. Both companies are now focusing on their individual strategies moving forward.

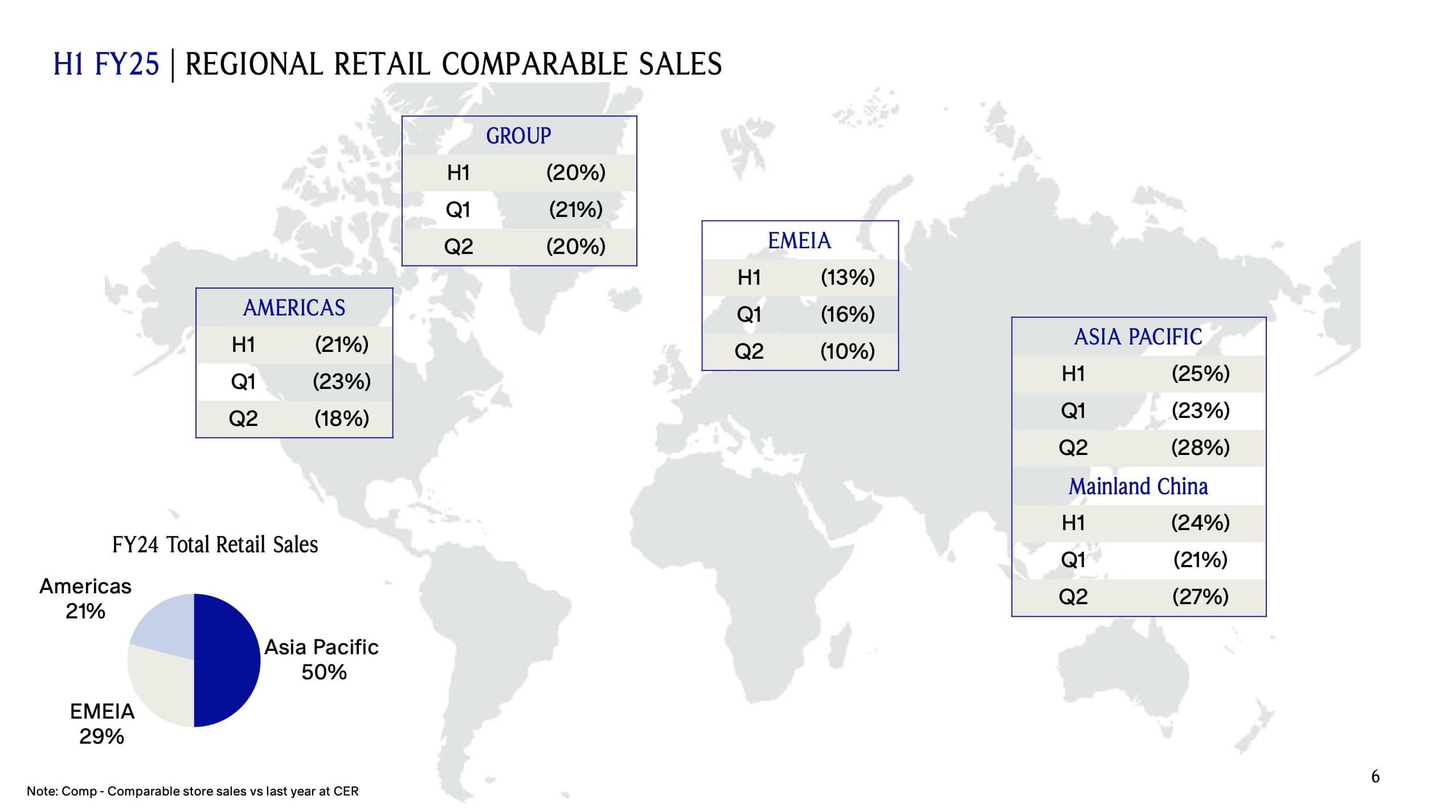

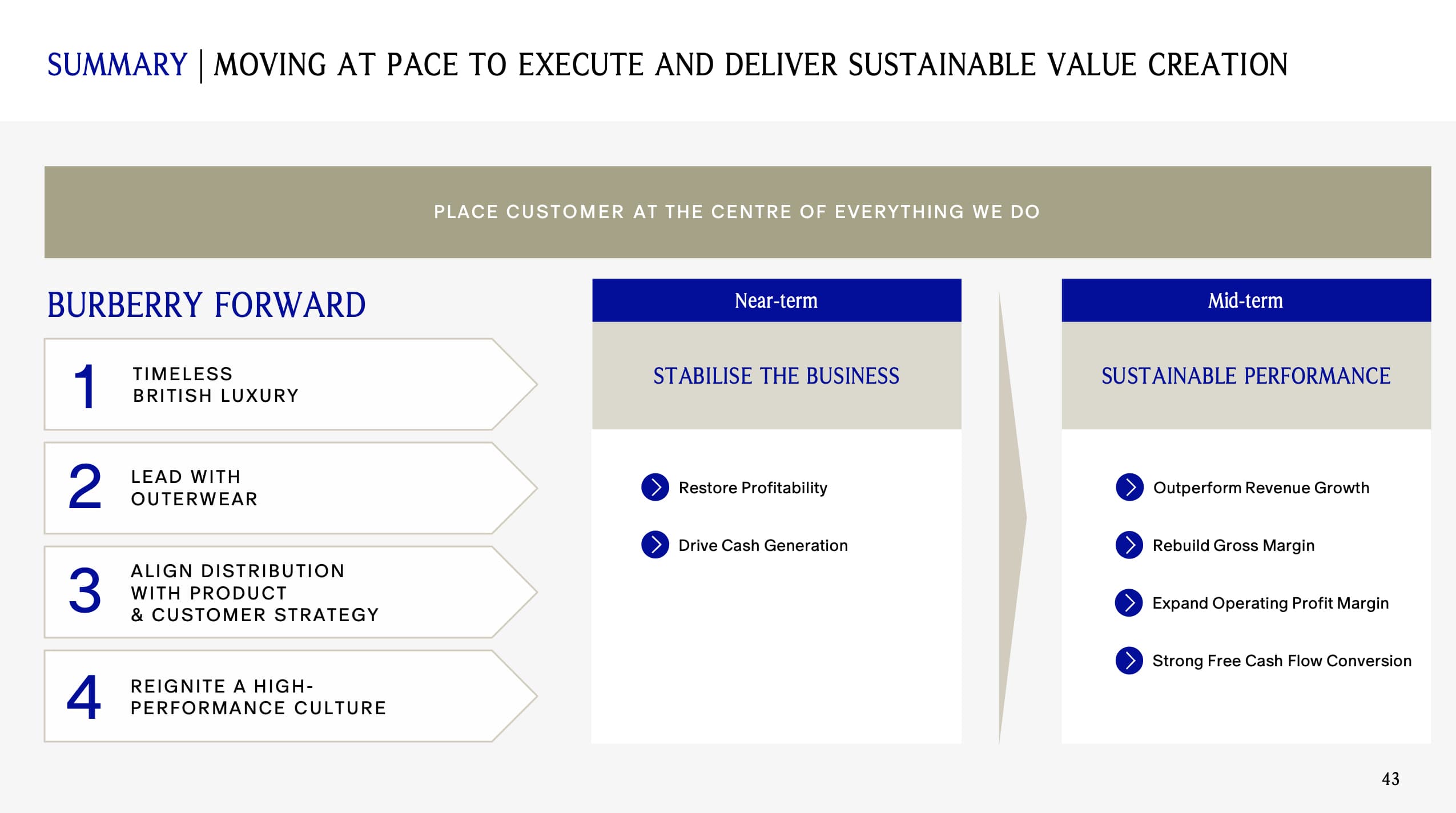

Meanwhile, Burberry revealed a drastic shift in its approach. Despite reporting a 20% decline in revenues for the first half of 2025, leading to an operating loss of £53 million, CEO Joshua Schulman, who joined in July, unveiled a new strategic plan to recalibrate the brand’s direction. His “Burberry Forward” strategy is designed to restore the brand’s luxury position and counter recent struggles. Crucially, Schulman stressed that Burberry will remain firmly within the luxury sphere, eschewing the path of “accessible luxury” and steering clear of being dubbed “the British version of Coach.”

1. Recalibrating Pricing to Reflect Luxury Core

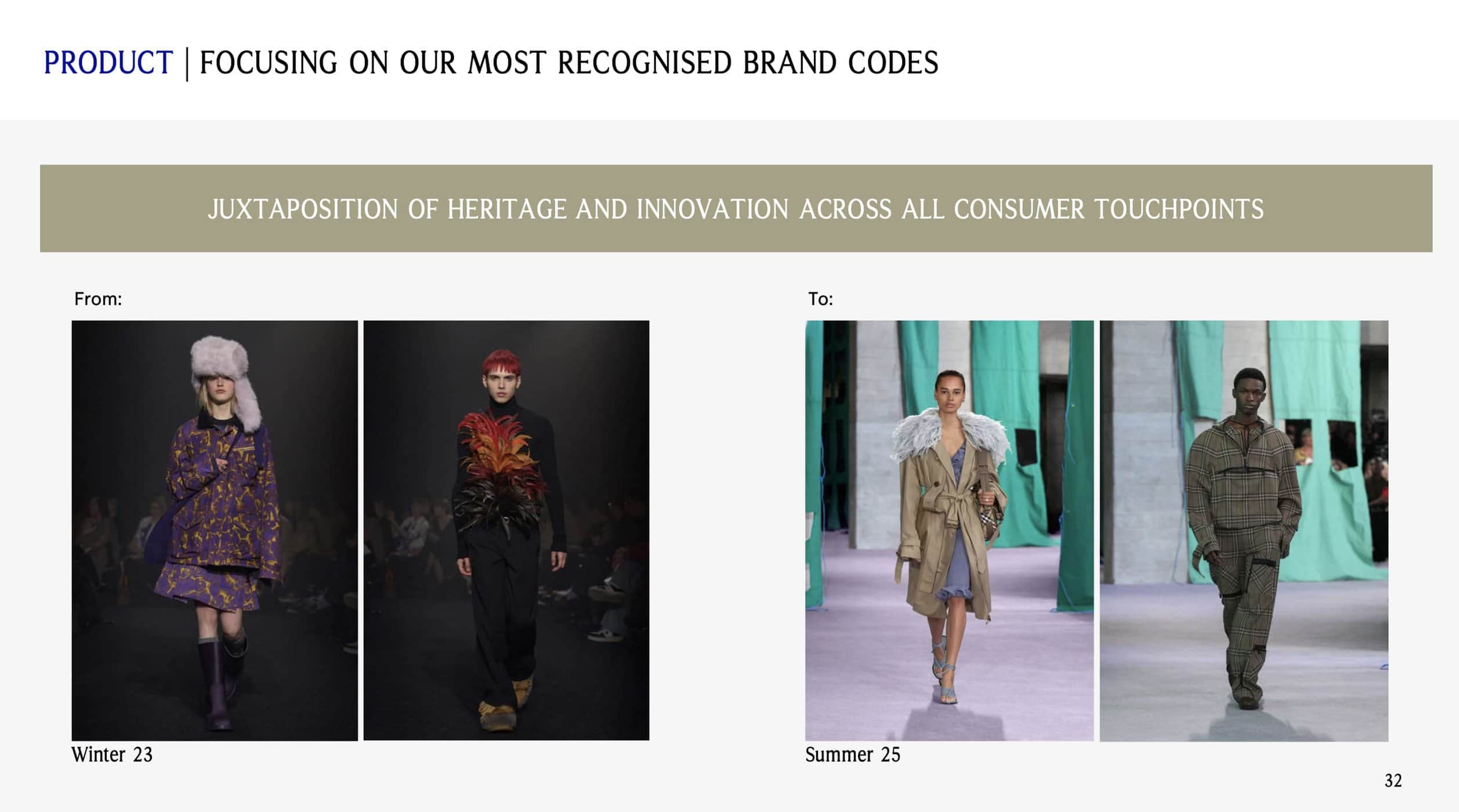

Burberry’s pricing structure is one of the central elements of its new direction. The company had previously ventured into an elevation strategy that involved pushing high-priced leather goods, but this approach didn’t resonate with customers as expected, contributing to weak sales. Schulman admits that Burberry “wandered off too far” from its heritage in its attempt to modernize. As a result, the brand took pricing too high, especially in leather goods, which led to a disconnect with its core customers.

Under the “Burberry Forward” plan, Schulman is recalibrating the pricing strategy. Handbag prices will now be positioned between £1,500 and £2,000, bringing them more in line with the historical pricing levels that made the brand a luxury icon. This move also reflects the need for a diversified pricing structure across categories. Rather than focusing on high-end goods across the board, Burberry will apply different price tiers—“good, better, best”—to meet varying consumer needs while keeping its luxury standing intact. In outerwear, for example, 20% of sales will be at the top-tier pricing, with the majority of sales coming from “better” and “good” price points.

2. A Renewed Focus on Outerwear and Scarves

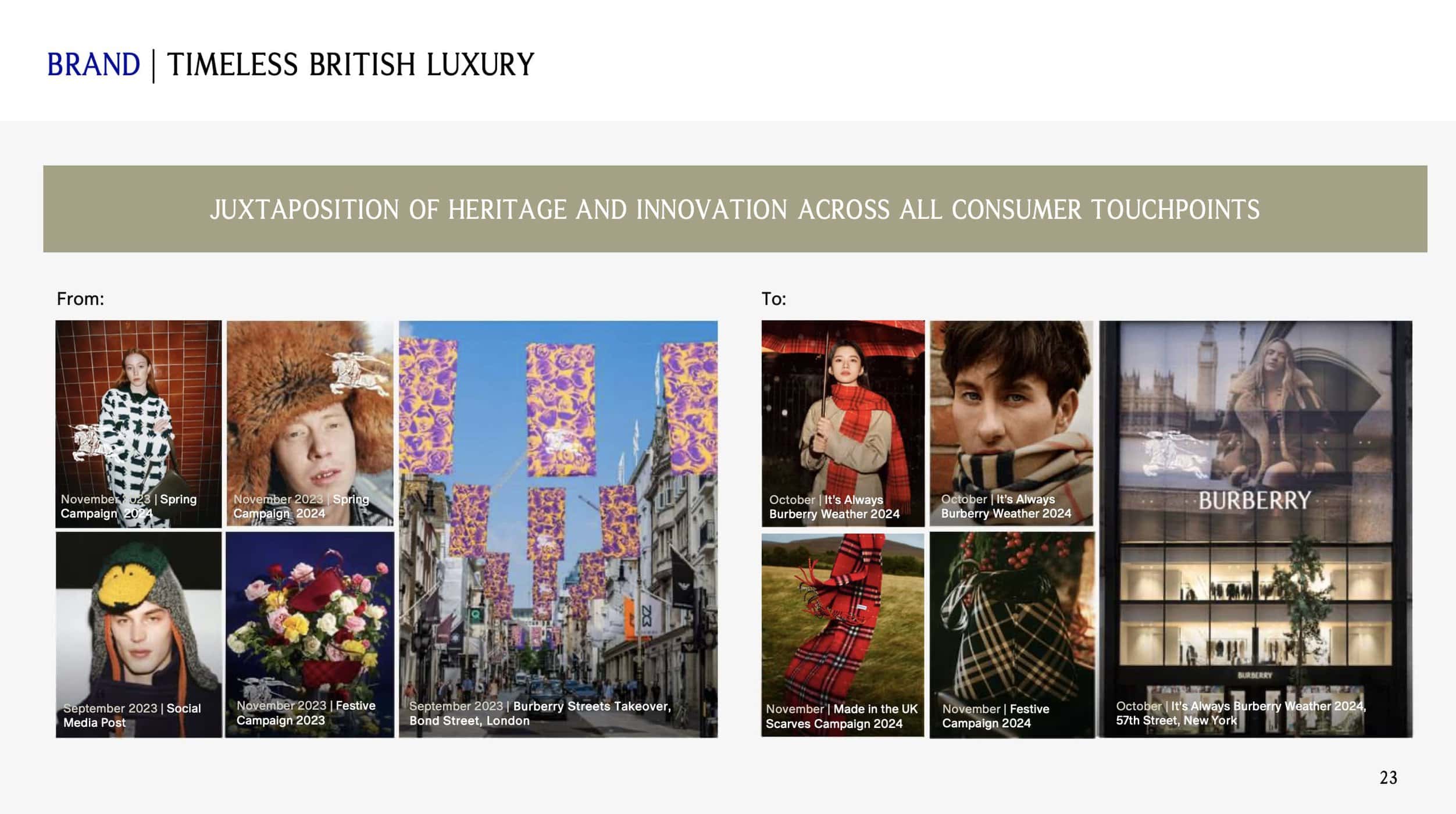

One of Burberry’s key strengths has always been its iconic outerwear and scarves. Schulman emphasized that these products, which represent the brand’s heritage and luxury authority, would now be the focal point in stores and marketing. Rather than relegating scarves to drawers and corners, Burberry has introduced the “Scarf Bar” at its New York flagship store, making scarves a central part of the brand’s retail experience. The new campaign, “It’s always Burberry weather,” reinforces this focus, showcasing the versatility and luxury of these iconic pieces.

By repositioning outerwear and scarves to the forefront of its offerings, Burberry aims to reconnect with its core customers, especially those who value the brand’s long-standing expertise in these categories. The outerwear category will be split into three pricing levels, providing customers with accessible luxury while maintaining exclusivity through higher-end items.

3. Connecting with the Core Customer Base

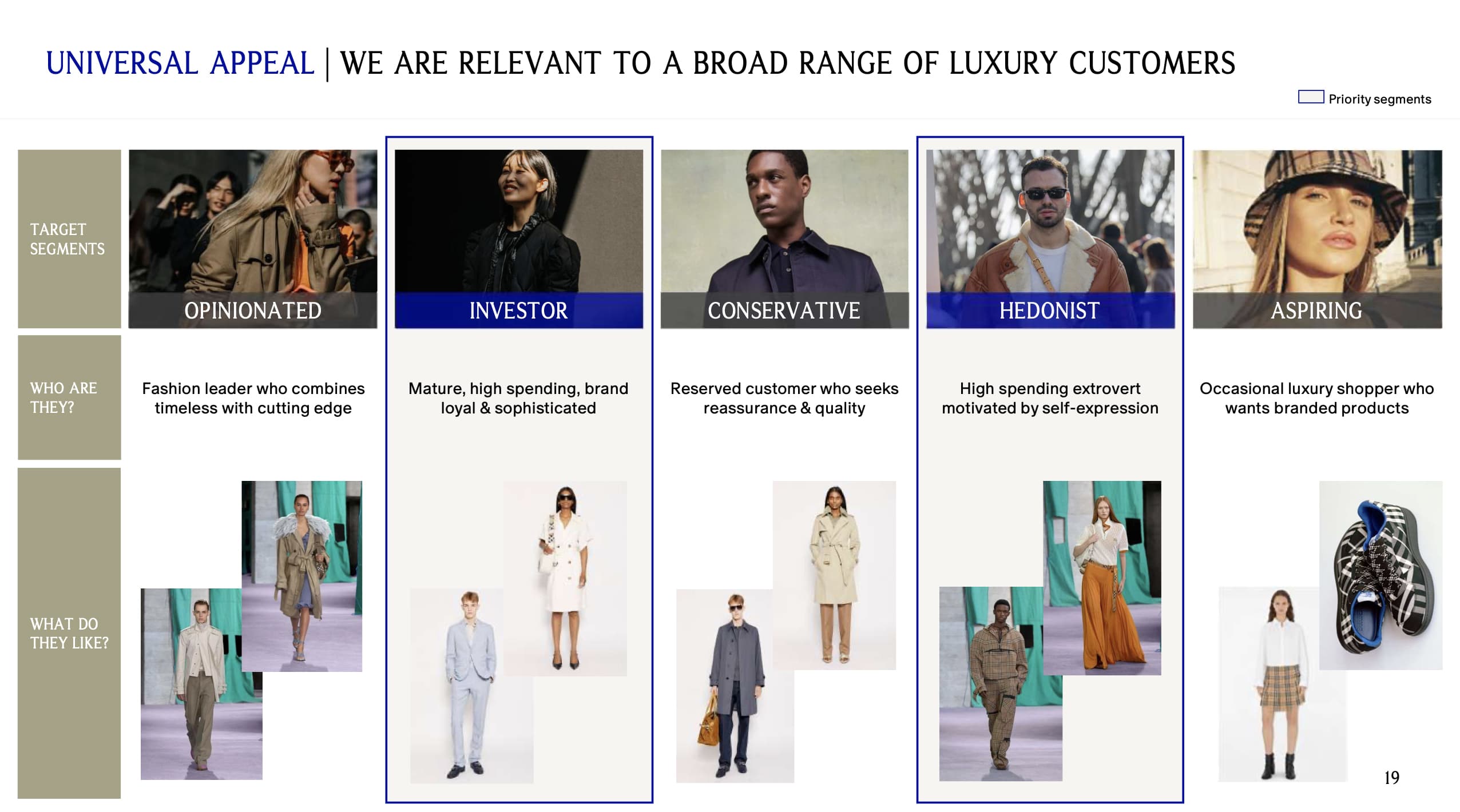

Burberry’s recent strategy has been seen as focusing too narrowly on the fashion-forward, high-spending customer. While this approach undoubtedly attracts a certain demographic, it alienates other important customer segments. Schulman acknowledges that Burberry’s efforts to cater exclusively to the opinionated, fashion-forward customer left other key archetypes—such as the “investor,” “hedonist,” and “conservative” shoppers—feeling sidelined.

The new strategy seeks to balance these groups by targeting a wider audience. Burberry’s pricing architecture now embraces a more inclusive approach: it will still appeal to high-spending fashion-forward customers, but it will also cater to the “investor” customer who values quality and is willing to spend on timeless pieces, as well as the “hedonist” customer who seeks luxury for self-expression. By focusing on these broader customer segments, Burberry hopes to re-establish its relevance and strengthen its appeal across the luxury market.

The market reacted positively to Burberry’s strategy shift, with shares rising 5.75% by the end of the week.