Zegna, Tom Ford, And Thom Browne Show Momentum In DTC As The Group Expands Salotto Concept And Navigates Leadership Changes

The Ermenegildo Zegna Group reported third-quarter earnings that reflect the acceleration of its direct-to-consumer (DTC) strategy, with strong performances from its key brands and further investment in its physical retail network. Organic revenues for the quarter ended September 30 rose 3.6 percent to 398.2 million euros. On a reported basis, which includes currency fluctuations, sales increased by 0.2 percent.

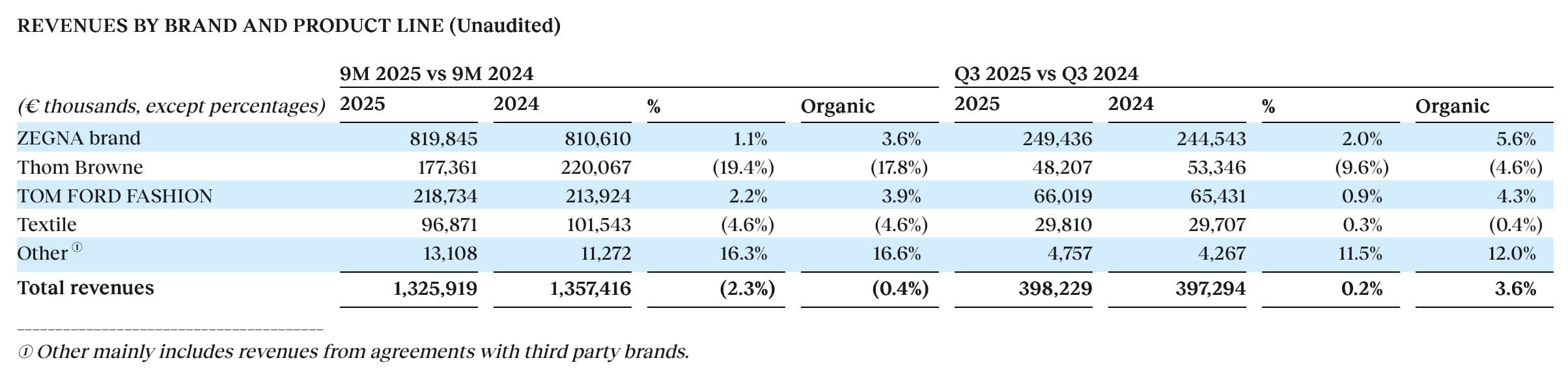

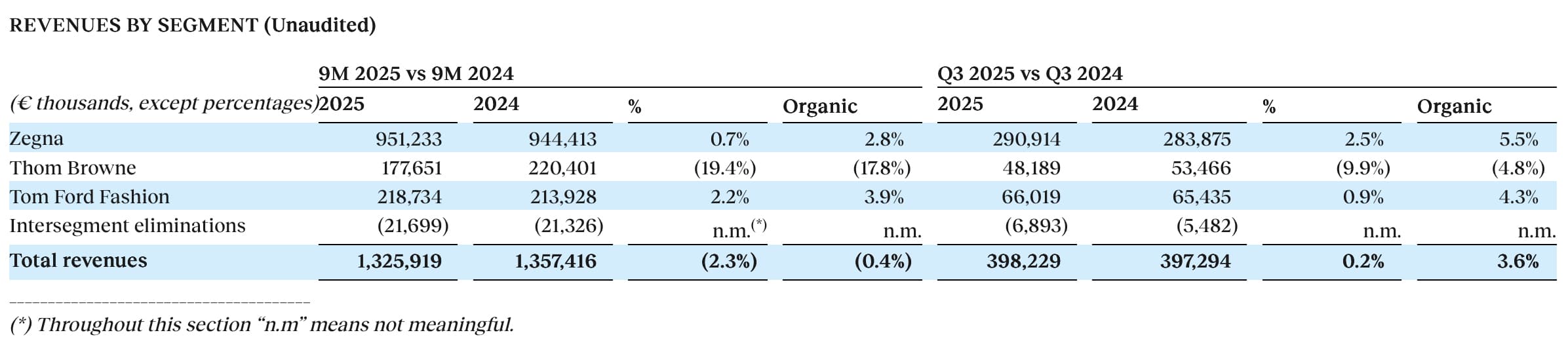

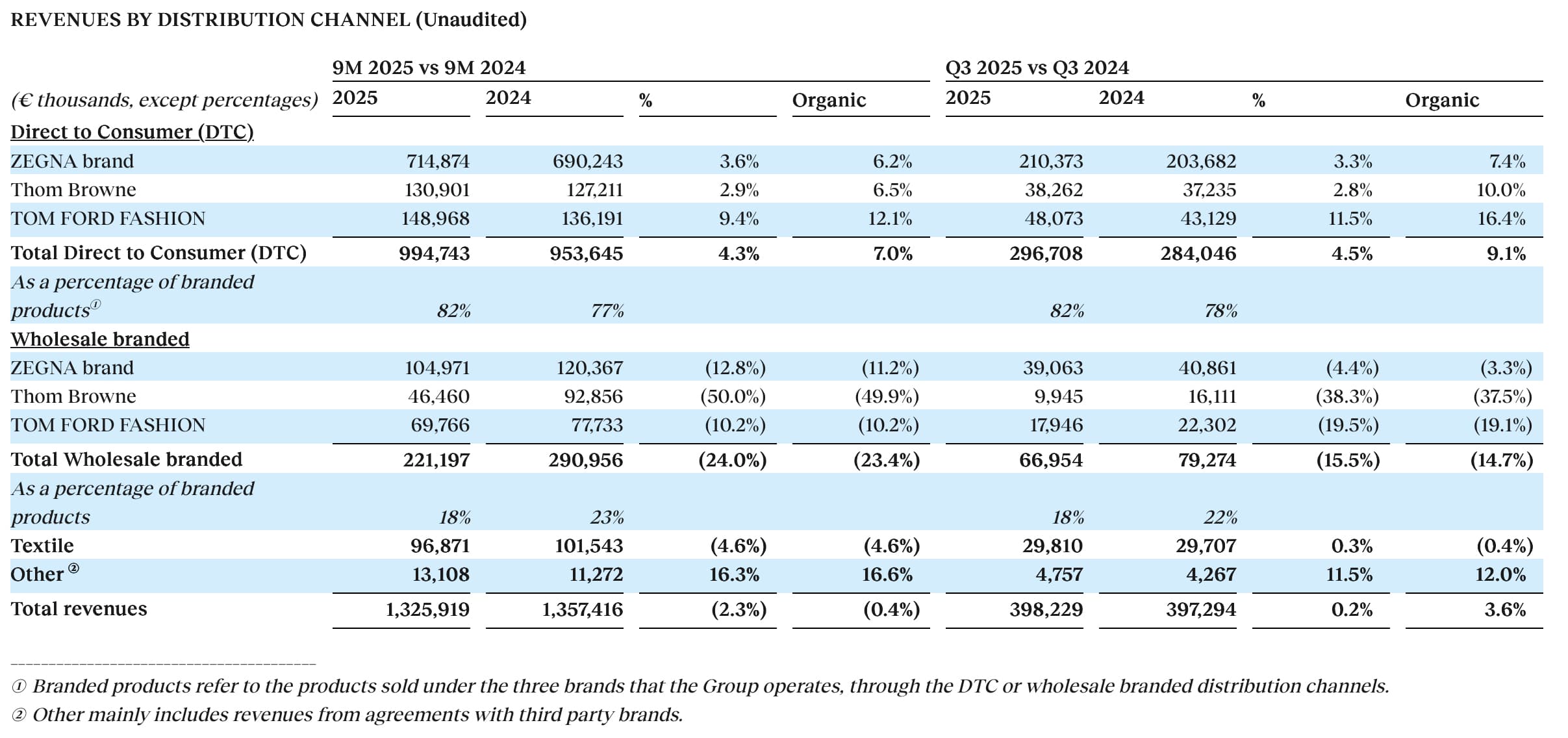

The positive momentum in DTC helped offset ongoing macroeconomic pressures and underperformance in the group’s wholesale channel. Overall, organic revenue across the nine-month period remained flat at 1.33 billion euros. Reported sales declined 2.3 percent due to currency headwinds.

DTC was the group’s clear growth engine, contributing 994.7 million euros in revenue for the first nine months of the year, up 7 percent organically compared to the same period last year. This growth gained pace in the third quarter alone, with DTC revenues climbing 9.1 percent. All three brands in the portfolio—Zegna, Tom Ford Fashion, and Thom Browne—recorded increases in their DTC performance during the quarter.

Zegna’s namesake label reported third-quarter sales of 210.3 million euros, a 7.4 percent organic increase. Tom Ford Fashion rose 16.4 percent to 48 million euros, and Thom Browne was up 10 percent to 38.2 million euros. These gains helped counterbalance the wholesale channel’s 23.4 percent organic decline to 221.2 million euros across the same nine-month period.

Gildo Zegna, Chairman and CEO of the group, emphasized the strength of the company’s strategy, stating, “I am pleased with the continued growth of the Zegna brand’s direct-to-consumer channel, led by the Americas and the EMEA region, and also delighted to see the outstanding performances of Tom Ford Fashion and Thom Browne, whose DTC channel grew by double digits on an organic basis this quarter.”

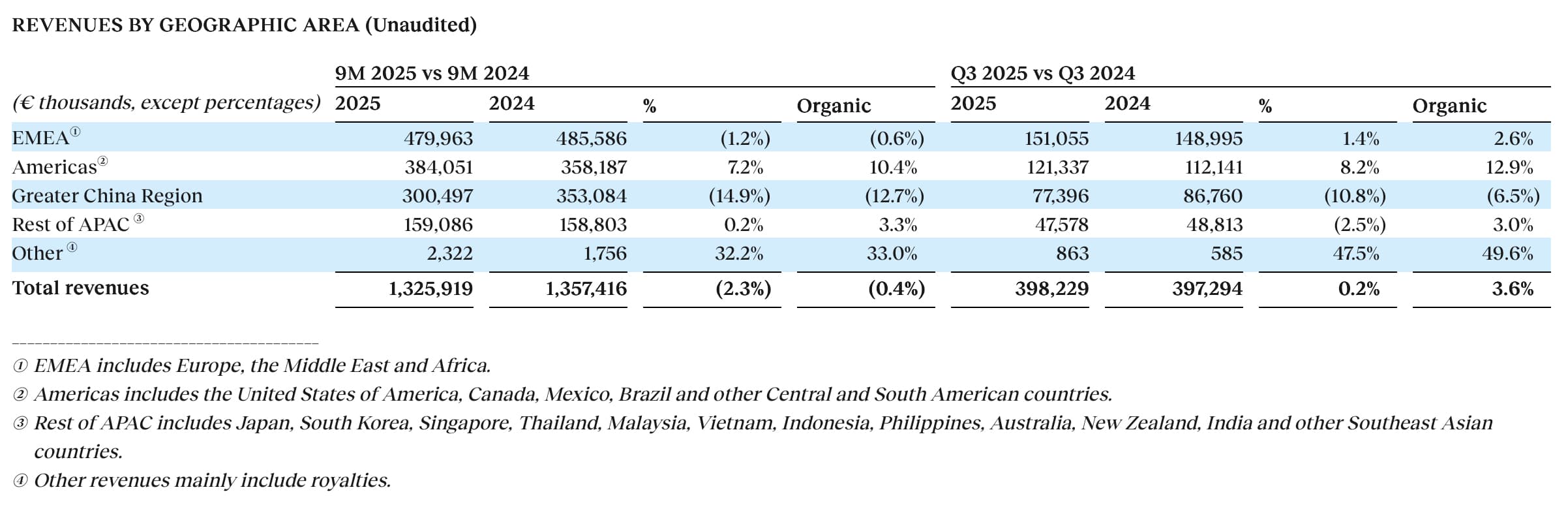

In the context of regional performance, the Americas led all markets with 13 percent organic growth in the third quarter. The Europe, Middle East, and Africa (EMEA) region posted 2.6 percent growth in the quarter, despite declining 0.6 percent year-over-year across the nine months, with reported sales of 480 million euros. Asia-Pacific was not broken out individually in the Q3 highlights, though continued store network enhancements and DTC channel development remain part of the group’s global approach.

“We’ve just reopened our completely renewed Zegna store in Dubai, now home to our fourth Salotto—following Beijing, Shanghai, and Singapore. This by-appointment-only concept marks a significant milestone. Dubai is the first store in our network, and I’m confident that this refurbishment, together with the Salotto, will further reinforce its global leadership. The Gulf region remains a key strategic area for us and for the sector—it’s one of our pillars for growth,” Zegna said.

The DTC acceleration comes at a time when the company is investing heavily in both physical retail and brand equity. The Salotto concept, a tailored, appointment-based shopping experience, reflects the group’s ambition to elevate service, exclusivity, and customer retention. The Dubai relaunch marks Zegna’s continued commitment to key international markets, especially in the Middle East, where luxury consumer demand remains strong.

Brand-by-brand, performance has varied across segments. The Zegna brand, which represents the group’s largest revenue share, recorded a 3.6 percent increase in organic sales across the nine-month period, reaching 819.8 million euros. Tom Ford Fashion posted 3.9 percent organic growth to 218.7 million euros over the same period. Thom Browne, however, declined 17.8 percent to 177.3 million euros—reflecting what Zegna characterized as a transitional moment for the brand.

Leadership shifts may partially explain the lag at Thom Browne. In late August, CEO Rodrigo Bazan stepped down after nearly eight years in the role. Bazan was instrumental in driving growth at the label, tripling sales during his tenure. He has been succeeded by Sam Lobban, previously EVP and general merchandising manager for apparel and designer at Nordstrom.

Referring to the transition, Zegna said that Lobban “has just begun his journey, focusing on elevating the retail experience and enhancing the merchandising offer. It will take time, but I know he brings a clear vision and a well-defined plan to execute.”

While Thom Browne adjusts to new leadership, Tom Ford Fashion is entering its next phase under Haider Ackermann, who was appointed creative director in September 2024 following Peter Hawkings’ departure. Zegna, which licenses Tom Ford’s fashion business as part of Estée Lauder’s $2.8 billion acquisition of the brand in 2022, continues to highlight the label’s potential.

“I’ve been pleased with the beautiful Tom Ford fashion show in Paris, the second by Haider Ackermann, and with the brand’s DTC performance this quarter, which grew by 16 percent,” said Zegna. “The fall collection was well-received, and the work we’re doing to elevate our retail and CRM capabilities—while building a stronger team—is starting to pay off. We are just at the beginning of our journey. We know it might require time, and the path may not be linear. But the vision is clear. Now, our focus must be on execution.”

The group is also focusing on strengthening internal capabilities, including team building and customer engagement systems. Zegna pointed to organizational progress as key to long-term growth, saying, “The work we’ve done over the past months—strengthening our leadership team, building on our brands’ equity, and staying focused and consistent with our strategic vision—is starting to bear fruit. I know our journey to exploit our brands’ full potentials is still at the beginning. Early positive signs are encouraging, however we still have important work to do in front of us. We are ready, the team is built, the actions are clear. We are working united as family and as a group.”

Despite the promising figures and momentum in the DTC channel, Zegna acknowledged that the broader industry outlook remains uncertain. “Looking ahead, we expect the environment to remain challenging for our industry, with ongoing uncertainties in consumer demand and currency fluctuations,” he said. “However, the success of the recent Tom Ford and Thom Browne shows, the good reception of the fall/winter drops at Zegna and the many projects in our pipeline give me confidence that we will continue to deliver on our mid-term targets.”

The group’s physical footprint remains substantial, with 670 stores globally as of the end of the quarter. Of those, 472 are directly operated, reinforcing the company’s focus on owning the customer relationship and controlling the retail experience. The move toward a greater DTC mix also reflects shifting consumer expectations for personalized service, luxury exclusivity, and brand storytelling—all pillars of Zegna Group’s strategic direction.

While macroeconomic factors, such as inflation and foreign exchange volatility, continue to impact overall performance, the group’s targeted efforts—expanding immersive retail concepts, realigning brand leadership, and focusing on full-price DTC sales—have begun to show results. The realignment of its retail model and emphasis on curated, high-end experiences places Zegna Group in a more insulated position as the industry continues to navigate cyclical challenges.

As execution becomes the key focus, the company remains confident in its long-term ambitions. “The vision is clear,” Zegna said. “Now, our focus must be on execution.”