Ermenegildo Zegna Group To Become A Publicly Traded Company Listed On New York Stock Exchange By Combining With Investindustrial Acquisition Corp

The Ermenegildo Zegna Group and Investindustrial Acquisition Corp., an investment subsidiary of Investindustrial VII L.P., have entered into a business agreement to make Zegna a public company listed on the New York Stock Exchange later this year.

Over 111 years ago, my grandfather and namesake founded Zegna with the belief that caring for both the natural environment and for people was the bedrock for creating the finest textiles and a successful brand. Since then, we have proudly followed in his footsteps to become one of Italy’s true luxury houses. Today’s announcement underscores the success of our strategy of continuously focusing on the Group’s brand equity while also continuing to build upon our heritage, our ethos of sustainability, and the unique craftsmanship that has made our name synonymous with quality and luxury around the world. The Zegna family will remain at the Company’s helm following the transaction’s completion, and we will continue to invest in creativity, innovation, talent, and technology in order to sustain Zegna’s leadership position in the global luxury market.

– Ermenegildo “Gildo” Zegna, Zegna Group CEO

Since its founding in 1910 by the company’s namesake, Ermenegildo Zegna, the group has evolved from a producer of textiles and menswear into a leading purveyor of luxury goods to clients around the globe. While the Zegna brand remains the group’s flagship label, in 2018 Zegna acquired the majority stake in American luxury fashion brand Thom Browne. The brand’s growing success under Zegna’s ownership is yet another example of the Group’s ability to grow through acquisitions by creating prospects for integration and efficiency.

Zegna’s management has capitalized on the unique strengths of Thom Browne, namely its consistency and name recognition, its younger customer base, its high digital penetration, and its iconic collections, doubling Thom Browne’s revenues since 2018 as a result.

Over the past years, Zegna has strengthened its one-of-a-kind Made in Italy luxury textile laboratory platform through the acquisition of Italian textile manufacturers. The platform is a key competitive advantage alongside the Group’s ready-to-wear and Made-to-Measure offerings. It is the provider of choice for some of the world’s most highly regarded luxury names while also supplying the finest materials to the Group’s own brands.

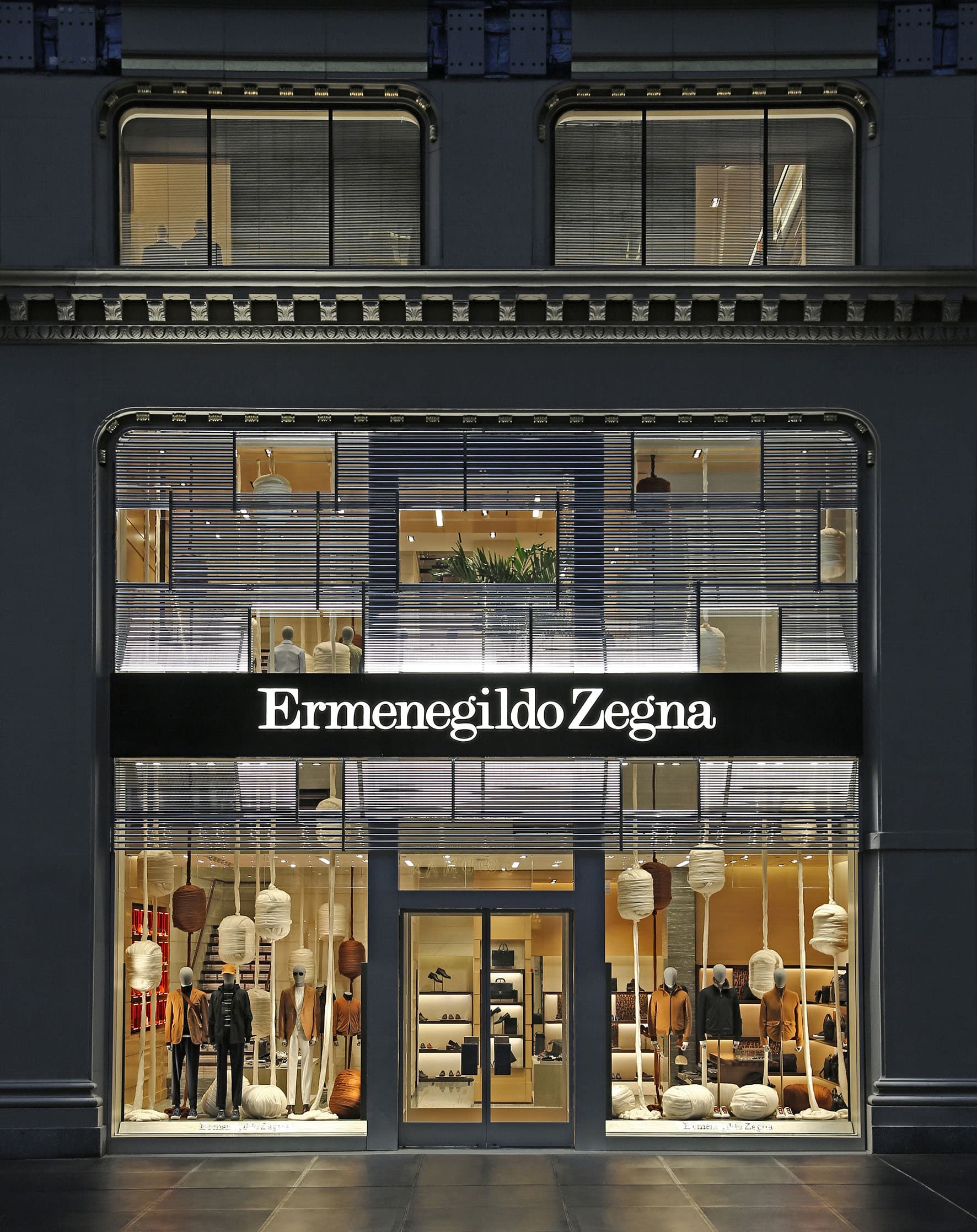

As of December 31, 2020, the Group has a presence in 80 countries through 296 directly operated stores, and this year, the Group expects annual sales to approach those of 2019. In 1991, Zegna was the first luxury menswear brand to open in China, and Greater China accounted for 35% of the Company’s apparel, accessories, and textile revenues in 2019.

Zegna has expanded its leadership in the luxury leisurewear segment, growing this category from 38% of sales in 2016 to over 50% in 2021 YTD, all while maintaining its leadership position in the heritage formalwear segment. The Company has also successfully attracted a new generation of customers through partnerships and collaborations that have further elevated the brand’s name with younger consumers.

Upon closing of the transaction, which is expected to occur in the fourth quarter of this year subject to customary approvals and conditions and to IIAC’s shareholders’ vote, the Zegna family will continue to control the Company with a stake of approximately 62%. Based on the transaction value, the merged entity will have an anticipated initial enterprise value of $3.2 billion with an expected market capitalization of $2.5 billion.

We are supporting the Zegna Group with a long-term commitment and a significant investment to back the Company’s ongoing expansion and growth, with the goal of spreading Zegna’s unparalleled heritage and luxury craftmanship more broadly to customers around the world.

– Andrea C. Bonomi, Founder of Investindustrial and Chairman of the Industrial Advisory Board