Navigating Retail’s Brave New World

By Mark Wittmer

While for a long time department stores were the primary or even the only way for customers to directly engage with and buy new luxury fashion, the current retail landscape is much more decentralized. With dozens of major digital-only department stores, resell on the rise, more and more brands commanding in-house selling and shipping capabilities, and social media piloting the “attention economy,” long-established stores must adapt or die. Retailers must maintain a balance of keeping up with technical innovation and changes in consumption habits – of which expanding into digital is just the beginning – while continuing to play to the strengths that have made them successful in the longterm to avoid getting lost in the noise.

Key Strategies

The Marketplace Model: More and more digital department stores are shifting from wholesale to concessions and hybrid models, offering exciting new opportunities and growth for both retailers and brands – if they can navigate the risks.

Retailer as Curator: As digital shopping proliferates and becomes less of an experience and more impersonal, certain stores a filling the gaps to reignite the spark of human connection, an insightful eye, and a thoughtful touch.

Retailer as Brand: As fashion brands grow and command more ability to manage their own stock and points of sale, whether physical or digital, retailers need to develop strategies to remain a part of the conversation and command media value.

Integrating Physical and Digital: While algorithms and automated processes have a lot to say about a customer’s personal style, they can become even more powerful in the hands of a real human or on the sales floor.

Marketplace Model: E-Concessions and E-Consignment

Just as it greatly accelerated the embrace of e-commerce by luxury brands – which have been relatively slow to embrace online models – the pandemic also accelerated the transition toward e-concession models. As brands are understanding the value of having direct control over their product and how it is presented to customers, so are retailers appreciating the reduced risk of having to buy inventory that they then have to sell off. When done right, the approach is a win-win.

Selfridges has long made effective use of the concessions model in its physical stores. By selectively partnering with leading brands of the moment and making room for the brand to create a dedicated space according to its own identity and aesthetic, it leverages the desirability and exclusivity of a brand while benefiting from the lower risk of the concessions model. Translating this kind of direct brand contact into the digital sphere, however, can prove more difficult.

E-concession can be a particularly viable option for young or smaller brands. While bigger brands have the ability to take a multifaceted approach, ensuring their products are as widespread on marketplace platforms as possible while still flexing the power of their own online stores, emerging brands that might not have the initial capital to launch their own stores will find these platforms an excellent way to grow their sales at a relatively low initial cost. Meanwhile, the retailer benefits from the excitement of an emerging voice in fashion, particularly if they manage to get an exclusive deal with the brand. While luxury department stores such as Harrods have long benefitted from the symbiotic relationship of “shop-in-shop” models, taking this format digital represents more of a new frontier.

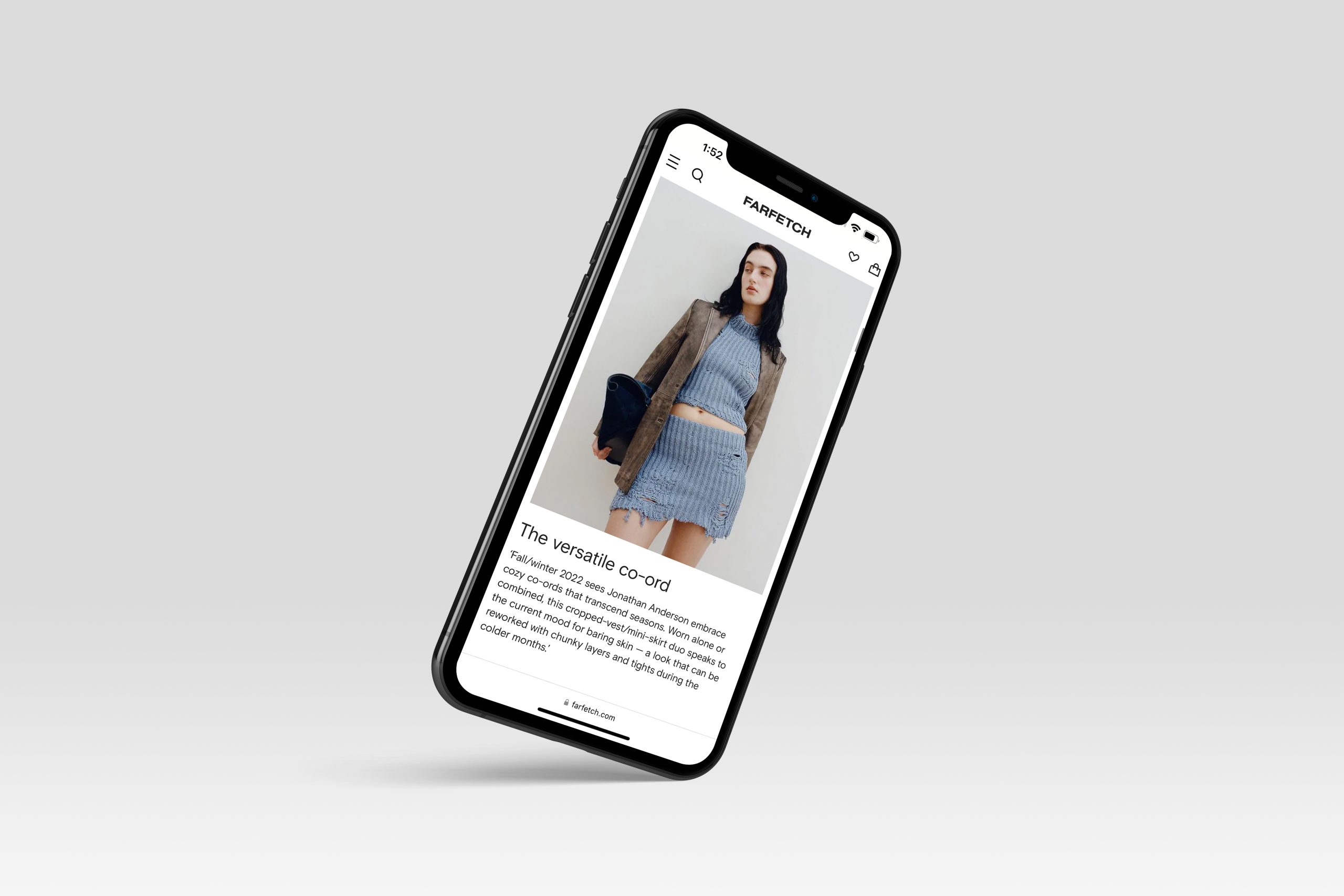

In the last two years, Saks, Yoox, Nordstrom, Net-a-Porter have switched to concessions or hybrid models online. Meanwhile, Farfetch has been operating on a concessions model since day one. Farfetch is also unique in that the brand is wholly responsible for managing their stock, including shipping fulfillment, which hypothetically serves to streamline the efficiency of a brand as its own e-commerce warehouse is one and the same as that of its “space” on Farfetch.

E-consignments have also been growing. In this model, rather than process the inventory themselves, brands engage with a third party like Amazon or Shopify that act as a broker for the transaction and handle shipping. This is a strong option for brands that don’t have or haven’t yet been able to invest in the kind of groundwork that will make their shipping competitive on today’s fast-paced, demanding timeline, or don’t have the capabilities to sell globally.

Retailer as Curator

In a model that feels in many ways opposite to the growing world of e-concessions, some brands have smartly positioned themselves as fashion curators. This approach feels more classic and historically minded; what brought people to a specific retailer in the first place is a distinct voice, a certain eye. Platforms such as these have been adopted by Mytheresa, which prides itself on a tight edit of designer brands personally selected each season by a team of expert buyers.

For the Fall 2021 season, Neiman Marcus partnered with Hypebeast for what they dubbed “the first virtual showroom.” Drawing on Hypebeast’s understanding of the current menswear market’s trend of exclusivity and hype – particularly when it comes to sneakers – and Neiman Marcus’ luxury retail connections, the digital shopping experience featured an exclusive, tightly curated edit of eleven styles from leading brands that were housed in a futuristic, CGI-rendered space that visitors could explore and interact with the products. Speaking to the partnership, Neiman Marcus President and Chief Merchandising Officer Lana Todovorich said, “Online luxury retail continues to grow and our customers are seeking retail theater outside of traditional retail interactions. As this space evolves, so does our larger strategy as a multi-channel luxury retailer to provide the most unique and engaging experience in our physical, digital, and remote selling environments.”

Retailer as Brand

Another way for brands to position themselves as desirable authorities on fashion is to create a brand identity that can coexist in the same sphere as those of the luxury houses they stock. In addition to creating campaigns with strong concepts and visuals, this also means maintaining an omnichannel presence and rolling out engaging branded content.

Printemps recently launched “Le Studio” at its Parisian flagship. This in-house content creation space will host the retail chain’s podcast, which was launched in November 2021, as well as bi-mothly live shopping featuring influencers and stylists. Under the direction of Printemps Group chief executive officer Jean-Marc Bellaiche, who joined in October 2020, the legacy department store has refocused efforts on expanding its omnichannel and digital presence, including e-commerce from its website and through third-party apps like WhatsApp. Creating its own content marks a further push in this direction, making the retailer more competitive in the attention economy as the media impact weight independent streamers, content creators, and TikTok stars continues to increase, offering both competition and opportunity for collaboration.

Online retailers like Net-A-Porter and Ssense have worked with leading creatives, stylists, and talents to create campaigns dedicated to a single brand. Releasing in tandem with the arrival of a brand’s new collection to the site, these campaigns almost position brand and retailer as collaborators, furthering the retailer’s wider reach and appeal while courting customers of the brand by leveraging its visual identity.

Integrating Physical and Digital Retail

While a human touch is always welcome, the improvements to algorithms and personalization processes on digital platforms in recent years means that, in many ways, the computer can have a better sense of your personal style – and what piece you’ll buy next – than a sales associate can. Can the computing power of digital retail platforms be introduced into the more human realm of physical department store shopping?

Companies like Neiman Marcus Group – which owns both Neiman Marcus and Bergdorf Goodman – are answering that question with an anticipatory yet exciting “yes.” In the last two years, the group has made a push to widely expand its digital capabilities – including acquiring Stylyze, a platform that provides retailers with product attribution data, digital outfit and room builders, content creation tools, and more to boost their e-commerce shopping experiences, in 2021 – and is finding ways to integrate this increased digital power into the physical shopping experience. Through the store’s website and mobile app, sales associates can connect with customers and understand their tastes before they set foot in the physical store.

Companies like Neiman Marcus Group – which owns both Neiman Marcus and Bergdorf Goodman – are answering that question with an anticipatory yet exciting “yes.” In the last two years, the group has made a push to widely expand its digital capabilities – including acquiring Stylyze, a platform that provides retailers with product attribution data, digital outfit and room builders, content creation tools, and more to boost their e-commerce shopping experiences, in 2021 – and is finding ways to integrate this increased digital power into the physical shopping experience. Through the store’s website and mobile app, sales associates can connect with customers and understand their tastes before they set foot in the physical store.