Revitalizing American Luxury: How Tapestry’s Acquisition of Capri Holdings Targets the Aspirational Consumer and Diversifies the Fashion Landscape

By Kenneth Richard

The announcement of Tapestry’s acquisition of Capri Holdings signifies a pivotal moment for the American luxury sector. The $8.5 billion deal, set to close in 2024, promises to create a powerful conglomerate that seeks to rival European giants LVMH and Kering. The merger seeks to reinvent the wheel in the accessible luxury fashion domain, aiming at a niche that’s distinct from traditional luxury players.

Index

- Strengthening the Portfolio

- Focusing on Accessible Luxury

- Challenges Ahead: The Michael Kors Turnaround

- Reviving American Luxury Fashion on the Global Stage

- Building Resilience through Diversification

- Key Takeaways

Strengthening the Portfolio

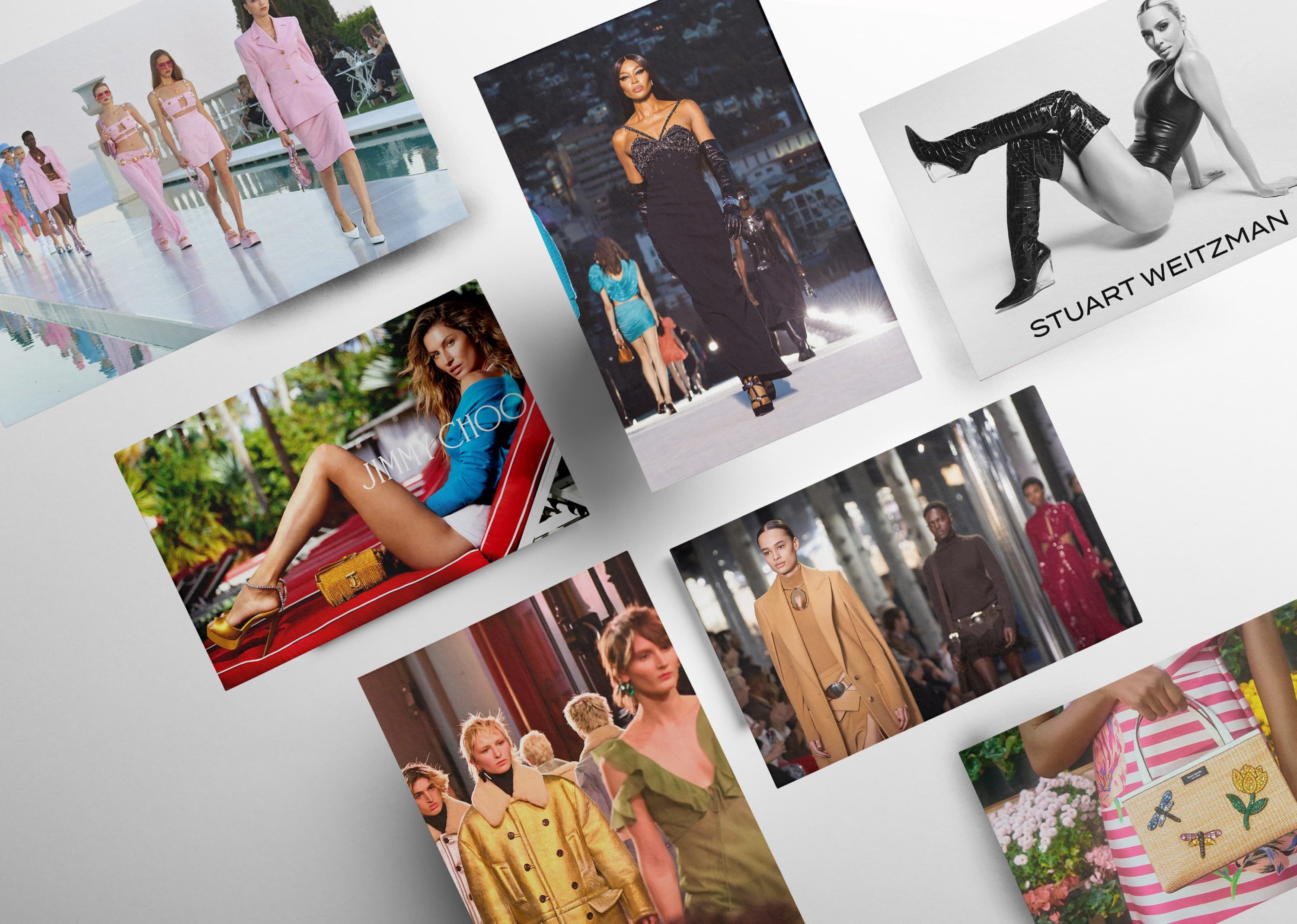

Under this groundbreaking agreement for US based fashion behemoths, Tapestry will add Capri Holdings’s popular brands Michael Kors, Versace, and Jimmy Choo to its existing roster, including Coach, Kate Spade, and Stuart Weitzman. This expanded portfolio will create a “new powerful global house”, in the words of Tapestry CEO Joanne Crevoiserat.

A broadened range brings more than just added variety; it signifies growth. “Together they drive over $12B in annual revenue and have a presence in over 75 countries, and the combined company will be able to cut corporate overhead by around $200 million,” says Robert Burke, Chairman and CEO of Robert Burke Associates.

Focusing on Accessible Luxury

While the European luxury powerhouses such as LVMH and Kering continue to assert their dominance in the traditional high-end market, the combination of Tapestry and Capri Holdings is carving out an entirely distinct trajectory. It’s targeting an area that has often been overlooked by the major European players: the accessible luxury segment, catering to aspirational consumers who yearn for luxury but are drawn to more attainable price points.

They aren’t directly competing with LVMH or Kering, it’s a completely different customer they are going after. This is an aspirational customer, usually from markets that aren’t NY or LA, etc.

Robert Burke, Chairman and CEO of Robert Burke Associates

Burke adds, “However, this is a big opportunity for American brands and American Fashion.”

This targeted approach is more than just a strategy; it’s an exploration of a significant niche within the U.S. market. It recognizes the existence of a vast consumer base that has unique demands and preferences that aren’t met by traditional luxury offerings. This also signals a revitalization of American luxury branding, focusing on cities and regions often overshadowed by the luxury hubs of New York and Los Angeles.

The idea of focusing on this particular segment isn’t merely a short-term play. According to Burke, it might also set the stage for future acquisitions to further service this lane. “It’s become increasingly challenging for independent brands to get to the next level and gain market share, especially American brands,” he elaborates. “This would allow them to focus on the aspirational customer and also potentially acquire other brands.”

In an industry where many American designers have struggled, and brands have become more fractured and less potent, the merger is also a symbolic gesture towards the reinvigoration of American luxury fashion. Burke recounts the fading influence of iconic brands like Donna Karan and Calvin Klein, contrasting them with the enduring relevance of Ralph Lauren. However, there are still “good smaller brands out there, but they need the support and infrastructure of a conglomerate,” he asserts.

The underlying wisdom of this merger, lies in understanding the dynamics that have propelled European conglomerates like LVMH and Kering. Their success in growing brands stems from a solid infrastructure and the ability to harness synergies between different labels within the group. Tapestry with Capri embraces a similar model but they can tailor it to the unique contours of the accessible luxury segment.

In sum, this union represents more than a business decision. It’s a strategic move that promises to reshape the landscape of American luxury fashion, focusing on an often-neglected segment of the market. By recognizing and targeting the aspirational customer and hinting at the possibility of future acquisitions, Tapestry and Capri are not only filling a void but also pioneering a path that could redefine the accessible luxury space in the coming years.

Challenges Ahead: The Michael Kors Turnaround

Despite the optimism, challenges lie ahead, particularly concerning the turnaround of Michael Kors, a brand that has seen a decrease of 10.9% in revenue in the fourth quarter of 2023. Overexposure and slowness to adapt to digital trends have put the brand in a vulnerable position.

However, Tapestry’s experience in moving Coach upmarket could be the key to revitalizing Michael Kors. “Tapestry can provide Michael Kors with much-needed infrastructure and resources, that Tapestry has been investing heavily in over the last few years,” says Burke.

Reviving American Luxury Fashion on the Global Stage

The recently announced merger between Tapestry and Capri Holdings does not merely signify a consolidation of assets; it represents an ambitious plan to revive the presence of American luxury brands on the global stage. By acquiring celebrated brands such as Versace and Jimmy Choo, the new conglomerate is poised to explore higher luxury positioning and take on markets previously dominated by European giants.

“With this merger, they’ll be able to take some of the best practices from Kering/LVMH and be able to combine their data, production, knowledge, etc,” shares Robert Burke, Chairman, and CEO of Robert Burke Associates. This alignment with global best practices highlights the strategic vision behind the merger, positioning the American conglomerate as a sophisticated player in the luxury sector.

While the ambition is clear, the path ahead is filled with challenges and opportunities. Carving out space in major European fashion cities may not be an immediate outcome, but the groundwork has already been laid. Burke emphasizes that they “already have major exposure in Eastern Europe and thrive with that customer.” This established presence could well be the springboard for deeper penetration into Europe’s coveted luxury markets.

“North America and China are their two biggest markets, and I’m sure they’ll focus on expanding in Europe moving forward,” adds Burke. This statement underscores the geographical focus of the new entity. North America and China provide a strong base, but Europe, with its rich tradition of luxury fashion, represents the frontier where the new conglomerate can test its mettle and solidify its standing in the global luxury sphere.

The merger, thus, symbolizes a strategic resurgence of American luxury fashion. With a well-thought-out integration of respected brands like Versace and Jimmy Choo, and a clear roadmap that draws inspiration from European luxury leaders, Tapestry and Capri Holdings are not just expanding their portfolio; they are reimagining American luxury fashion’s role on the international stage. By targeting unexplored markets and aligning with best practices, they are crafting a future where American luxury brands resonate with a global audience, combining elegance and innovation in a way that’s distinctly their own.

Building Resilience through Diversification

The accessible luxury sector, positioned between high-end luxury and mainstream fashion, caters to a broad yet discerning customer base. Its appeal lies in offering products that exude luxury but are attainable to a wider audience. However, this segment has been hit hard by factors like COVID-19, which disrupted supply chains, and economic downturns, which affected consumer spending. The new conglomerate’s diversified brand offering could build more resilience and elevate its stature in the evolving global market.

A diversified brand portfolio offers a buffer against market volatility. When one brand faces difficulties, others may flourish, providing stability and continuity. The amalgamation of brands under the new conglomerate creates a synergistic effect where the combined knowledge, resources, and market presence enhance overall resilience.

Diversification also provides an opportunity for the new conglomerate to explore various customer segments and markets. By leveraging the strengths and unique positioning of each brand, the conglomerate can cater to diverse preferences, from aspirational consumers seeking accessible luxury to high-net-worth individuals seeking exclusivity.

Moreover, the diversified approach aligns with global trends, allowing the entity to tap into emerging markets and shifting consumer behaviors. As Burke noted regarding the conglomerate’s potential in major European cities and thriving exposure in Eastern Europe, diversification is as much about geographical reach as it is about brand versatility.

Key Takeaways

The marriage between Tapestry and Capri Holdings is not just a merger of brands; it’s an alignment of visions, a move that fills a void in the accessible luxury fashion sector. By weaving together a well-curated portfolio and targeting aspirational consumers, this new American conglomerate sets itself apart from traditional luxury players. Only time will tell if it can successfully capture this niche, but with a strategic approach, strong leadership, and a keen understanding of its target market, the potential is enormous.