Kering’s first-half results show a 50% drop in net profit, with Gucci underperforming, and a cautious outlook for the rest of 2024

Kering, the French luxury conglomerate, reported a 50% drop in net profit for the first half of the year, attributing the decline to continued weak performance from its flagship brand, Gucci. The group anticipates further challenges, forecasting a 30% decrease in operating profit for the second half.

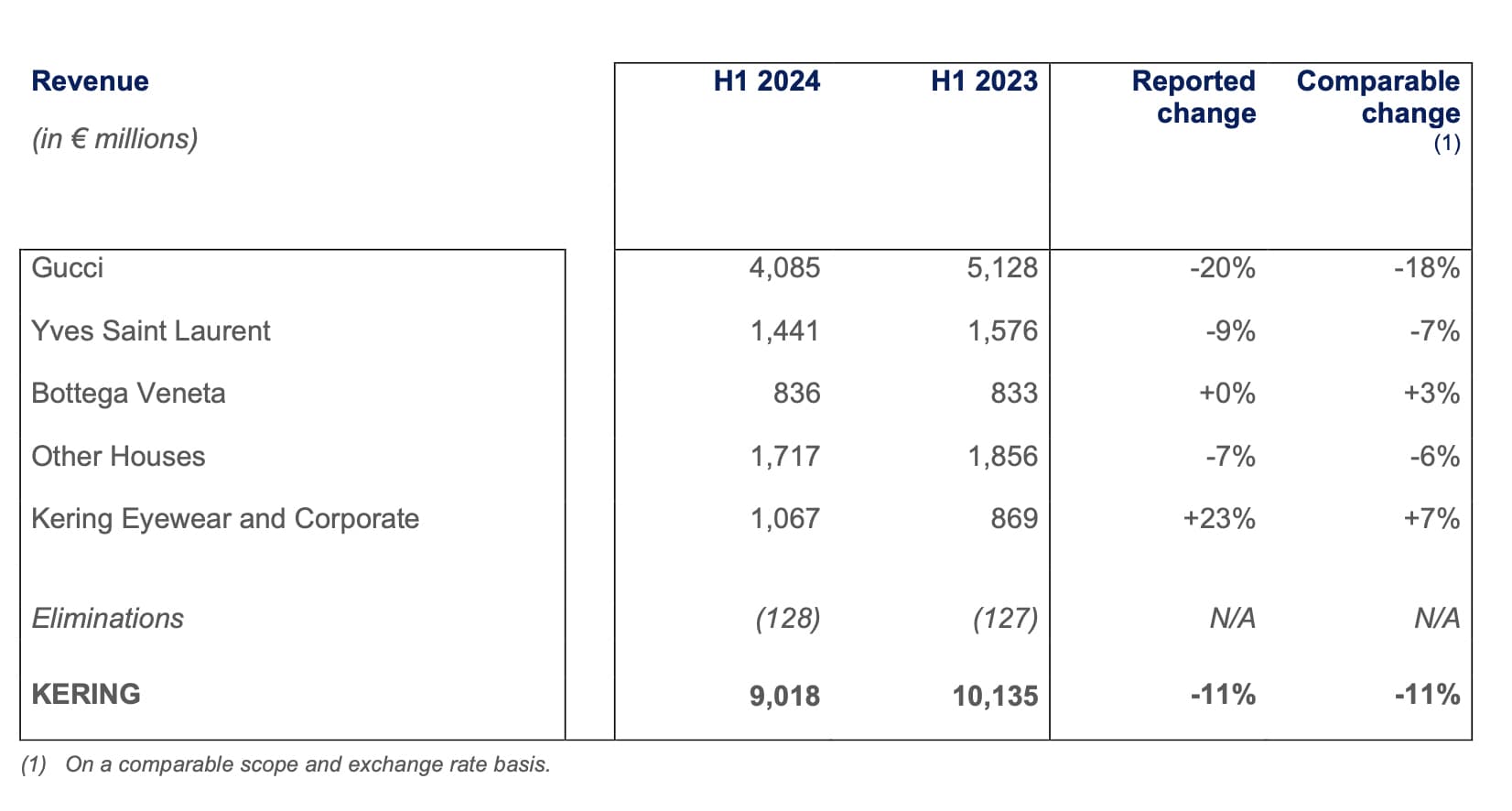

In the first six months of 2024, Kering’s net profit totaled €878 million, falling short of analyst expectations of €930 million. The company’s revenue for the period was €9.02 billion, an 11% decline both on a reported and comparable basis. This performance was consistent with the company’s April guidance, predicting a 40-45% drop in first-half operating profit.

In a challenging market environment, which adds pressure on our top line and profitability, we are working assiduously to create the conditions for a return to growth, While the current context might impact the pace of our execution, our determination and confidence are stronger than ever.

– François-Henri Pinault, Kering Chairman/CEO

Gucci, Kering’s star brand, recorded a 19% decline in organic sales in the second quarter, below market expectations. The brand’s revenue for the first half was €4.1 billion, a 20% drop from the previous year. Gucci’s recurring operating income fell to €1.0 billion, with a margin of 24.7%.

Yves Saint Laurent saw its revenue fall by 9% in the second quarter, with a 25% decline in wholesale revenue. Bottega Veneta, however, managed a flat year-over-year record of second-quarter sales, supported by strong performance in Western Europe, North America, and the Middle East. The “Other Houses” division, including brands like Balenciaga and Alexander McQueen, posted a 7% decline in sales.

Kering Eyewear and Corporate segment reported a 5% increase in organic sales, contributing €1.1 billion to the group’s revenue. Kering Eyewear’s sales rose by 3% in the second quarter, driven by the solid performance of its portfolio brands.

The luxury sector is currently facing a cyclical downturn, with analysts predicting that this slump could last for one to two years. Kering, like other companies in the sector, is feeling the pressure. The company’s operating income fell 42% in the first half, totaling €1.6 billion. The recurring operating margin was 17.5%, significantly lower than the same period last year.

The company highlighted challenges in key markets, including a 27% sales drop in the Asia-Pacific region. However, Kering noted some positive trends, such as a sequential improvement in Japan.

Kering’s strategic initiatives include ongoing investments in its brands to enhance their offerings and reinforce the exclusivity of their distribution. The company also highlighted its efforts to manage inventory effectively, resulting in free cash flow from operations totaling €1.1 billion, including the acquisition of a property on Fifth Avenue in New York City.

Despite the current challenges, Pinault remains optimistic. “Our houses pursue their investments to enrich their offer, intensify the impact of their communications and reinforce the exclusivity of their distribution. We make certain that every one of these investments creates value for the long term.”

Kering’s cautious outlook for the remainder of the year reflects ongoing uncertainties in the luxury market. As other major luxury brands prepare to report their results, the industry continues to navigate a complex economic landscape.