Operational discipline, cost controls, and creative reinvestment shape strategy ahead of Peter Copping’s first full season in stores

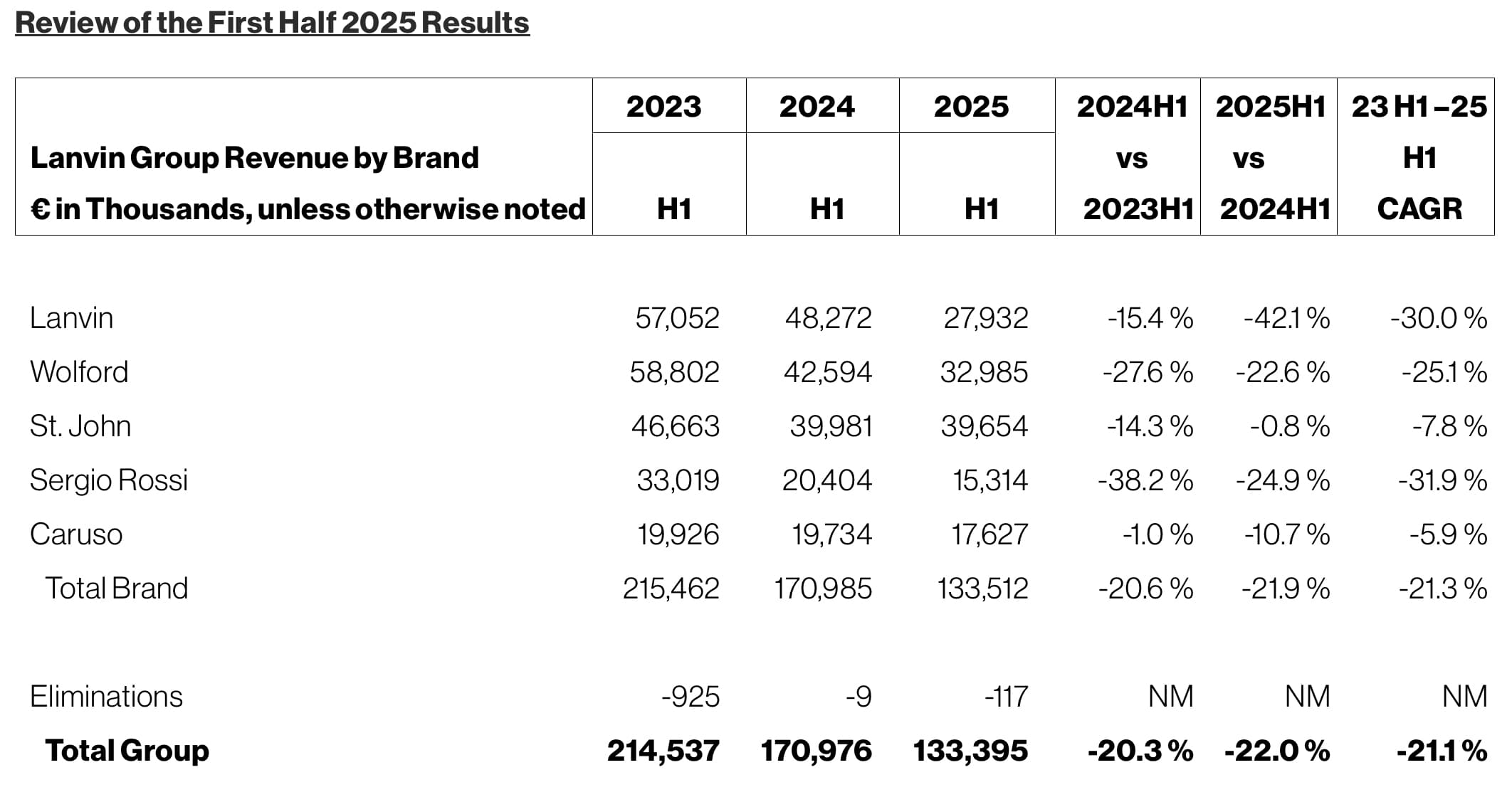

Lanvin Group released its unaudited H1 2025 financials this week, revealing a 22% decline in overall group revenue to €133 million and a steeper 42.1% drop at its namesake Lanvin brand. The results reflect a period of strategic realignment for the group and a transition year for the Lanvin house, which continues to evolve under new artistic and commercial leadership.

The group cited industry-wide luxury softness, a cautious wholesale environment, and uneven consumer sentiment in Greater China as key headwinds during the first half. For Lanvin specifically, wholesale clients in EMEA took a wait-and-see approach ahead of Peter Copping’s debut collection, first shown in January 2025 and set to hit stores in the second half of the year. Despite the drop, the group reported “highly resilient” retail sales in EMEA, with a strong Q2 e-commerce rebound in North America attributed to the rollout of its new marketplace model.

Gross profit for the group was €72 million, with a margin of 54%, supported by disciplined inventory management and cost containment. While Lanvin’s gross margin contracted by 366 basis points year-over-year, this was largely due to product mix and the ongoing optimization of the retail network. The brand maintained tight control of overhead and continued to invest in creative development.

“In the first half, our focus was on operational discipline and laying the foundation for future growth,” said Andy Lew, Executive President of Lanvin Group. “With fresh creative direction across our houses, supported by targeted marketing and refined channel strategies, we expect to build brand momentum and increase consumer engagement in the second half.”

Zhen Huang, Chairman of Lanvin Group, added: “Despite a challenging luxury market in the first half, we remained disciplined in cost management and strategic streamlining, responsive to market dynamics, and steadfast in our commitment to unlocking the long-term potential of our brands. With new creative leadership and continued investment in product innovation, we are well positioned to capture opportunities as the market environment improves.”

Contribution profit for the group came in at -€15 million, though proactive cost reductions and streamlined marketing spend helped partially mitigate the impact. Adjusted EBITDA was -€52 million, compared to -€42 million in H1 2024, reflecting lower revenue and margin compression. However, the group emphasized that continued investment in product and creative development—especially at Lanvin and Sergio Rossi—was essential for long-term brand equity.

The second half of the year is poised to be a turning point for Lanvin. With Peter Copping’s first collection slated to arrive in-store, the brand will launch a fully integrated marketing campaign to support the rollout. Visual merchandising will be refreshed across key locations, and a series of clienteling events is planned to reignite brand engagement and drive traffic.

Copping’s January debut at Paris Fashion Week leaned heavily into Lanvin’s archival codes, with Deco-inflected silhouettes, structured tailoring, metallics, and a reintroduction of menswear—signaling a return to the house’s foundational elegance and a more unified creative direction. The collection was received as both refined and historically grounded, offering a clear counterpoint to the churn seen elsewhere in the industry.

Alongside Lanvin’s reset, the Group continues to invest across its portfolio. Wolford will celebrate its 75th anniversary in H2, Sergio Rossi will debut new collections from Paul Andrew, and St. John—one of the group’s most stable performers—continues to post strong margins and full-price sell-throughs. Caruso, meanwhile, is doubling down on ready-to-wear and wholesale expansion.

Still, with Lanvin’s revenue accounting for a significant share of the Group’s topline, its return to growth is essential. The 42.1% drop in the first half places pressure on the brand to perform in the coming months, though leadership appears confident in the turnaround strategy already underway.

“Despite revenue decline, contribution profit demonstrated the benefits of disciplined cost control while the brand continued to invest in Peter’s upcoming debut,” the group noted in its H1 release.

While the road to recovery remains steep, the second half of 2025 will be a critical test of whether Lanvin’s recalibration—from store footprint to creative voice—can capture renewed consumer interest and reposition the house for durable growth in a shifting luxury landscape.