Wines And Spirits Dragged On Reported Revenues As The Group Closed A Challenging Year For Luxury Demand

LVMH Moët Hennessy Louis Vuitton reported a 1 percent increase in fourth-quarter sales at constant exchange rates, slightly ahead of expectations, as continued weakness in fashion and leather goods and wines and spirits weighed on the world’s largest luxury group.

Revenues for the three months to December 31 totalled €22.7 billion, down 5 percent on a reported basis due to currency effects and portfolio changes, following a 2 percent decline in the prior quarter. The performance capped a difficult year for the sector, with uneven demand across regions and categories amid a volatile macroeconomic and geopolitical backdrop.

The group’s crucial fashion and leather goods division posted a 3 percent decline in organic sales during the quarter, broadly in line with consensus forecasts. Analysts pointed to sluggish demand, high comparison bases and ongoing resistance to higher price points, even at the group’s most resilient brands, including Louis Vuitton and Dior.

Wines and spirits remained a significant drag on results, with revenues down 9 percent during the quarter, while perfumes and cosmetics slipped into negative territory over the holiday period, declining 1 percent. Watches and jewelry emerged as a bright spot, with organic sales rising 8 percent, supported by momentum at jewelry brands including Tiffany & Co. and Bulgari, while selective retailing, anchored by Sephora, maintained its growth trajectory with a 7 percent increase.

“Despite a geopolitical and macroeconomic environment that remains uncertain, the group remains confident and will pursue its brand development-focused strategy, underpinned by continued innovation and investment as well as an extremely exacting quest for desirability and quality in its products and their distribution,” LVMH said in a statement.

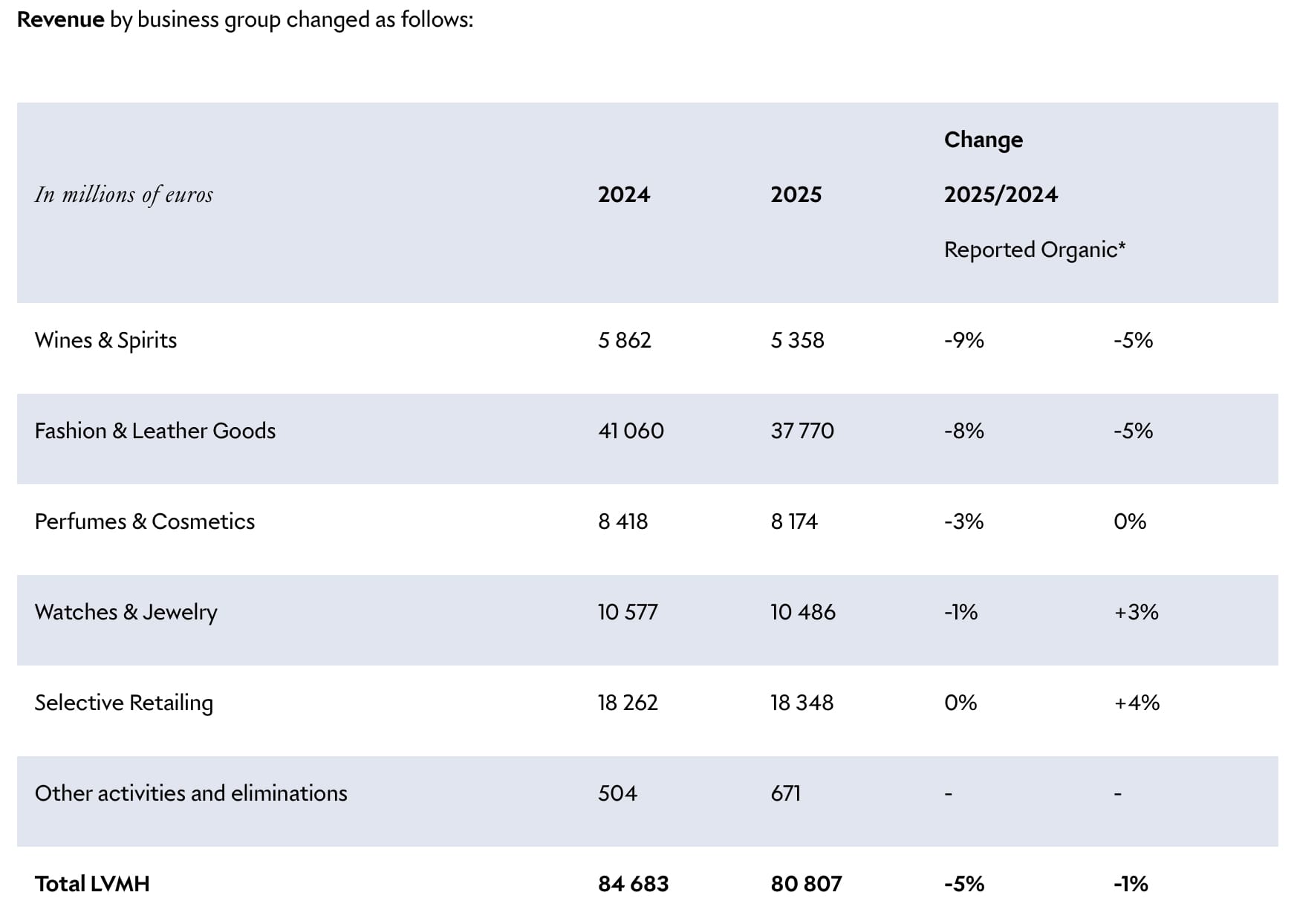

For the full year, LVMH reported revenues of €80.8 billion, down 4.5 percent year-on-year on a reported basis and 1 percent organically, as improving trends in the U.S. and Asia-Pacific failed to offset persistent weakness in Europe and Japan. Fashion and leather goods sales fell 5 percent for the year, while wines and spirits declined 5 percent and perfumes and beauty were flat.

VMHNet profit dropped 13 percent to €10.9 billion, while profit from recurring operations fell 9 percent to €17.8 billion, resulting in an operating margin of 22 percent, impacted in part by currency fluctuations.

“Once again in 2025, LVMH demonstrated its solidity and effective strategy upheld by its highly engaged teams. The group was buoyed by the loyalty and growing demand shown by our local customers,” said Bernard Arnault, chairman and chief executive officer of LVMH.

Arnault struck a cautious tone on the outlook, describing the current environment as “a fast-changing, agitated and at times unpredictable economic context,” adding, “2026 will not be easy either. We continue to look ahead calmly. I am optimistic mid-term, but short-term it’s very hard to make a serious forecast.”

He highlighted early signs of creative momentum at Dior following the appointment of Jonathan Anderson as creative director, noting that the brand is “benefitting from its creative renewal,” with products “in high demand since the start of the year.” Arnault also pointed to recent collections by Pharrell Williams at Louis Vuitton, describing the direction as “particularly wearable, and desirable.”

While Louis Vuitton remains the group’s largest and most profitable brand, Arnault confirmed that plans for a Vuitton hotel tied to its Champs-Élysées flagship have been shelved. “There won’t be a Vuitton hotel. Vuitton is focusing, not diversifying,” he said.

LVMH said it would continue to invest across its portfolio while restructuring underperforming businesses, including its wines and spirits division and parts of its duty-free retail operations, underscoring a strategy centred on long-term brand equity as the global luxury sector works through a prolonged slowdown.