Insights into the Luxury Market as Economic Signals Shift

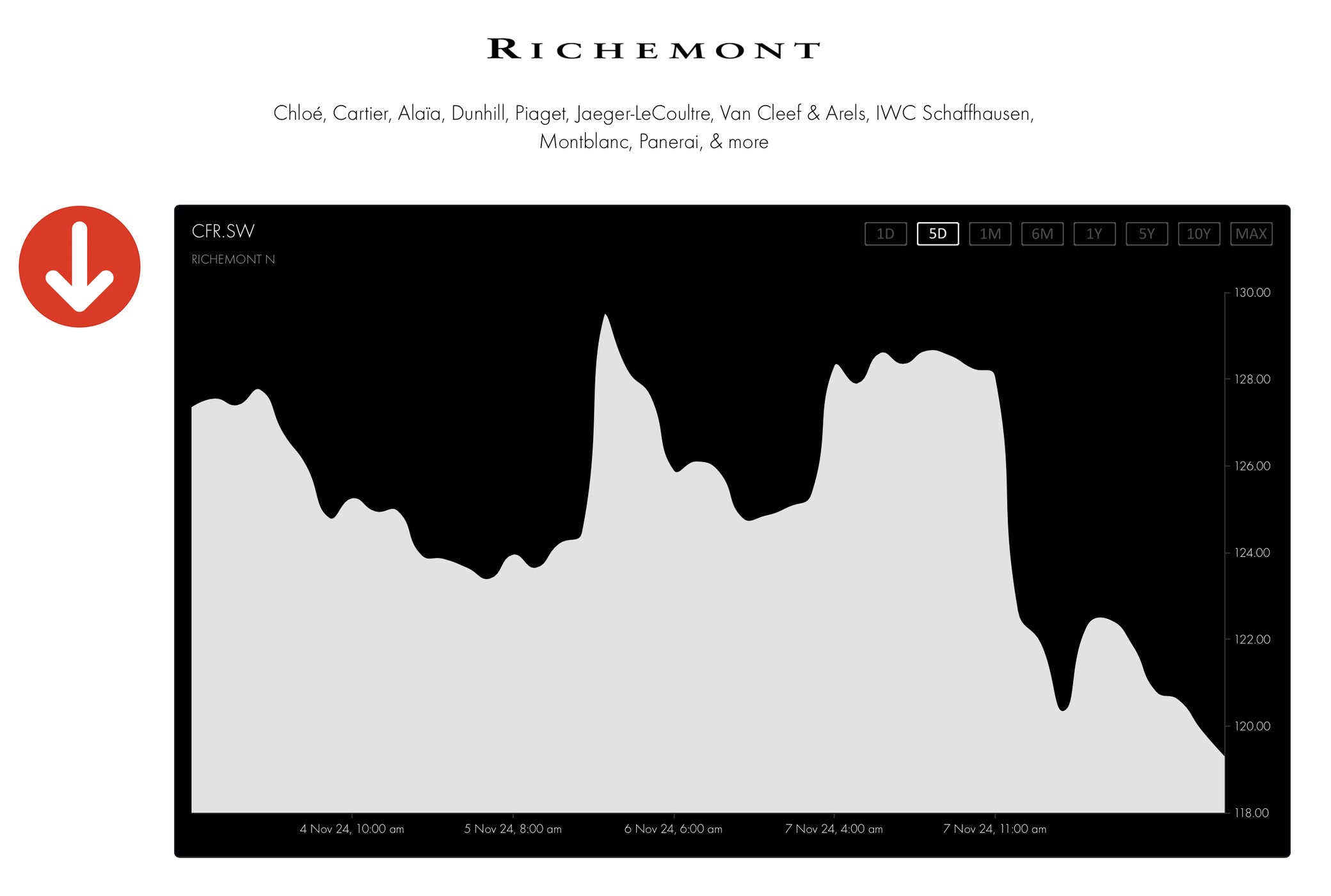

Despite facing turbulent waters in the luxury sector, Richemont, the parent company of iconic brands like Cartier, Chloé, and Alaïa, reported moderate stability in the first fiscal half of the year. However, sales dipped by 1%, totaling €10.1 billion, and profits fell to €457 million, primarily due to the sale of Yoox Net-a-porter to Mytheresa. The drop in sales was largely attributed to a significant 19% decline in the Asia-Pacific region, driven mainly by waning demand in China. On a brighter note, the Americas and Japan showed notable growth, with sales rising by 10% and 32%, respectively, during the six-month period.

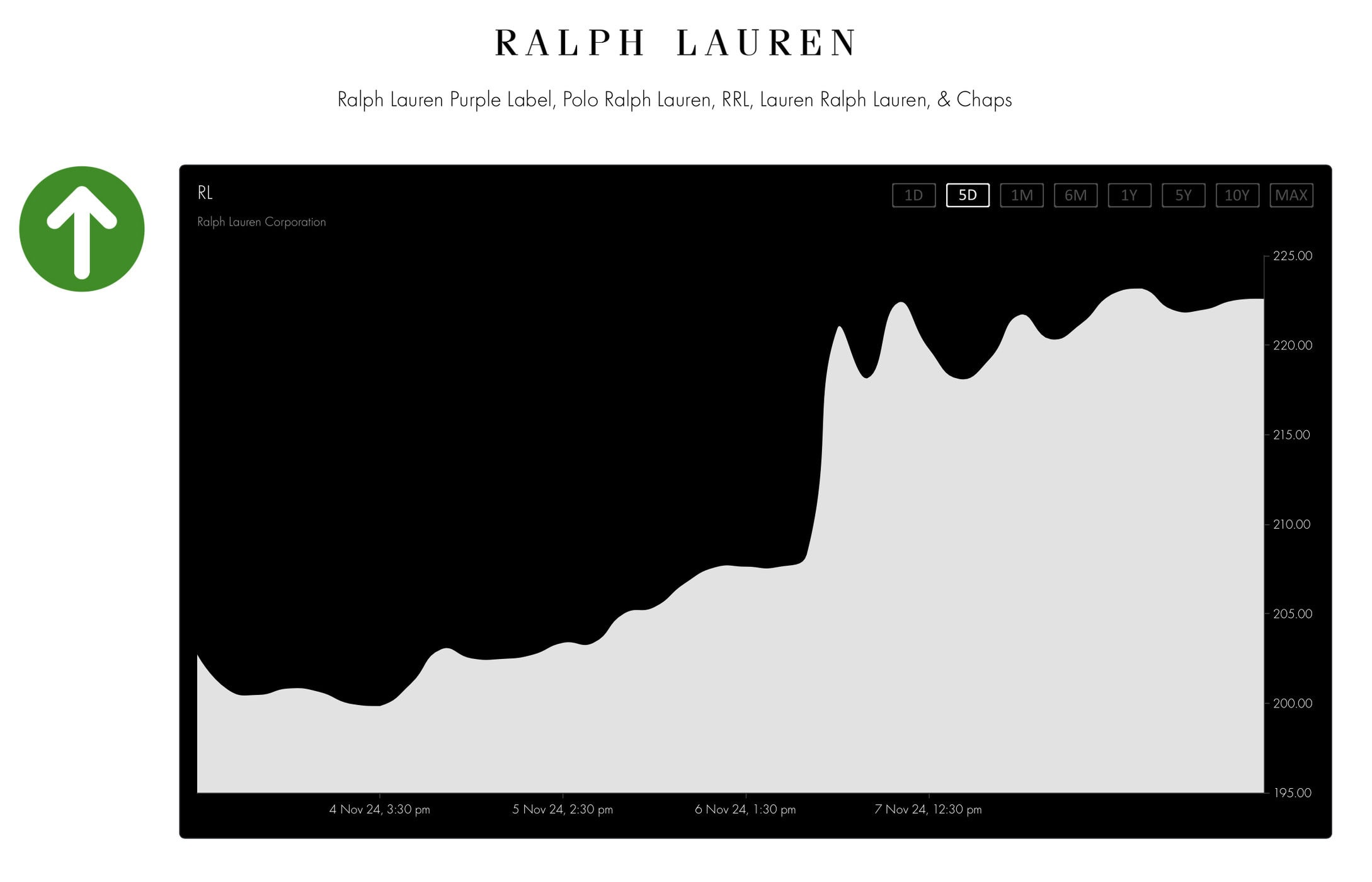

Ralph Lauren also posted positive results, with a 6% revenue growth for its second fiscal quarter. The company exceeded expectations, prompting an adjusted outlook for the year. Its direct-to-consumer business saw an impressive 10% increase in comparable sales, with all regions recording positive growth. North America grew 3%, Europe increased by 7%, and Asia marked a 9% rise, bucking the trend seen in many other luxury brands.

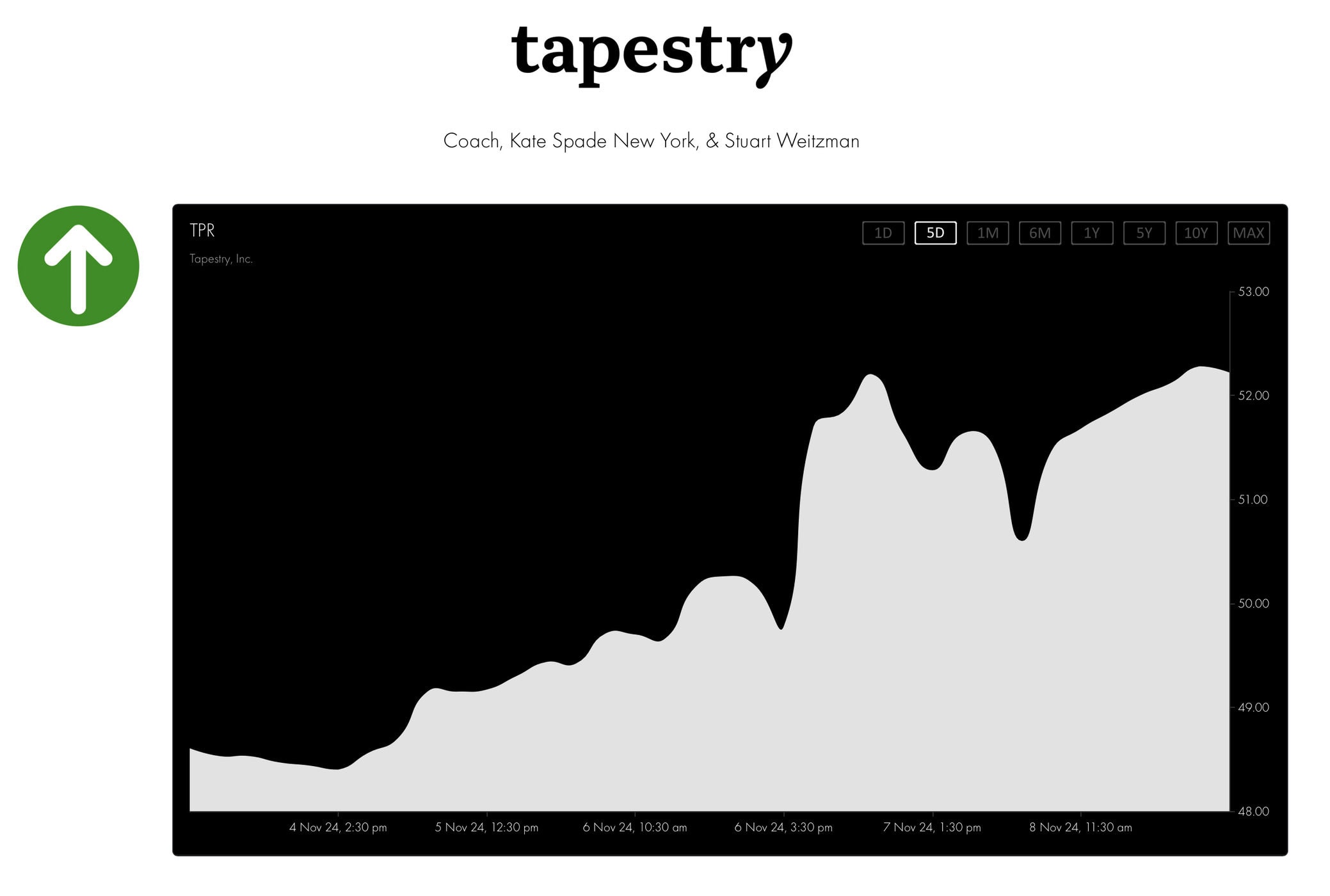

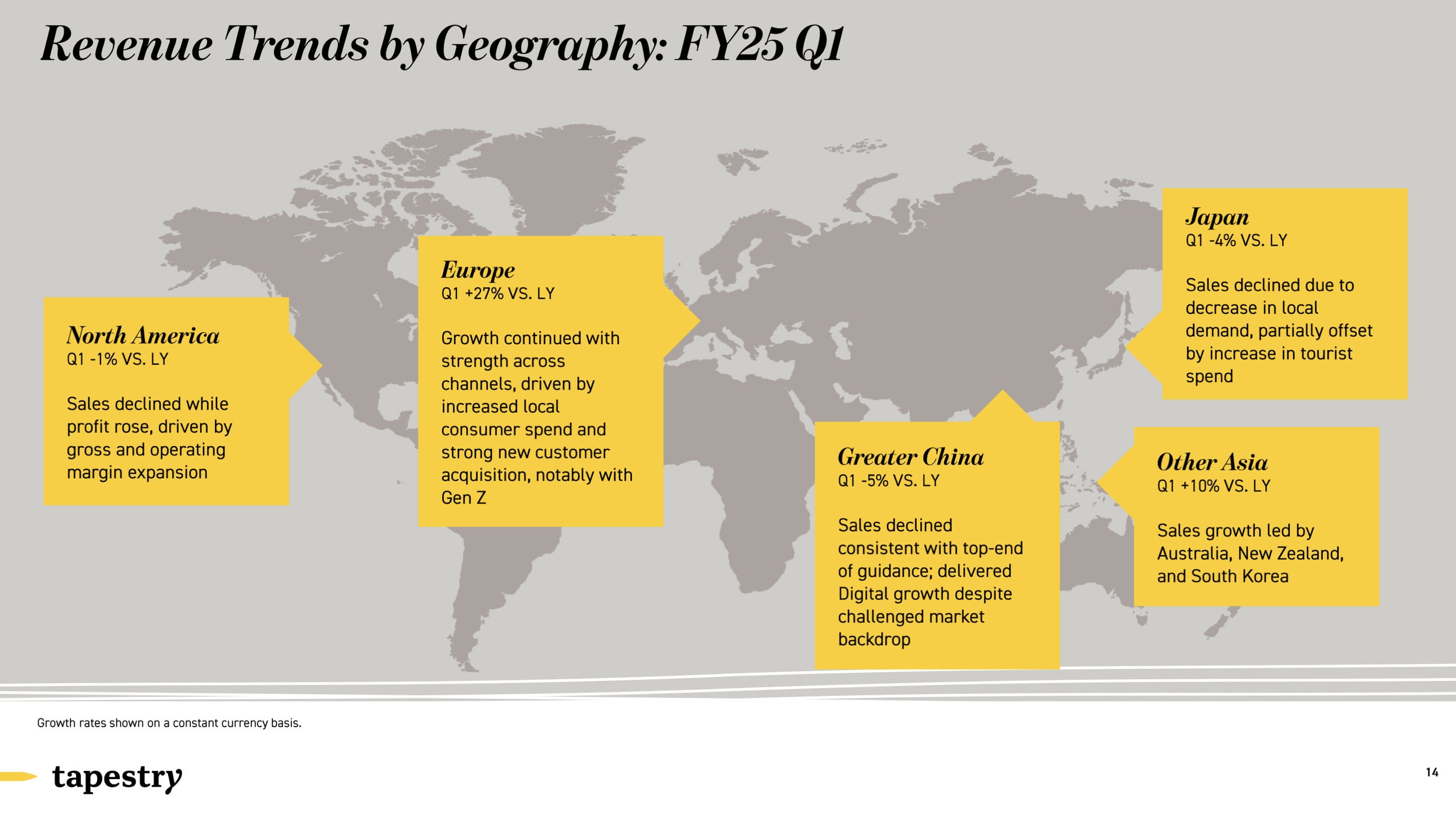

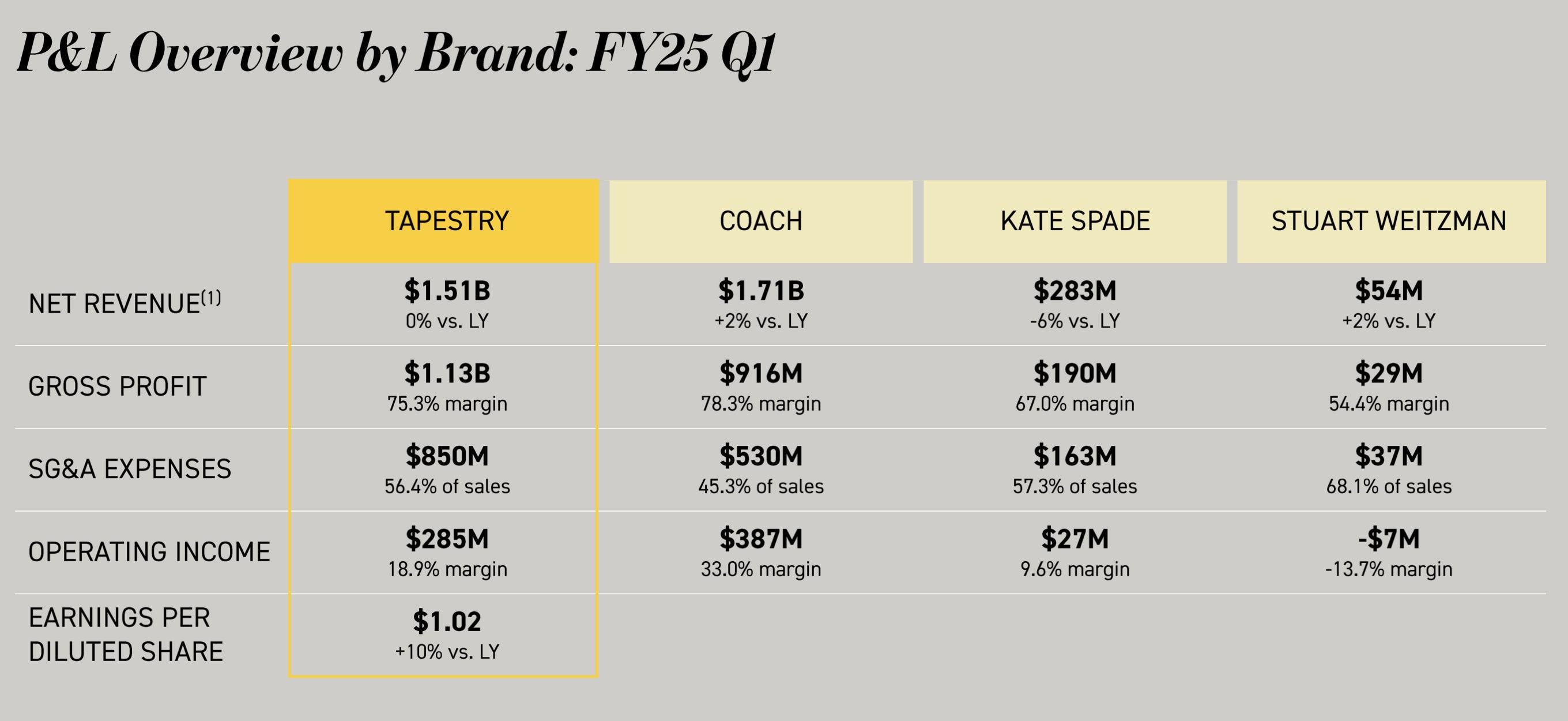

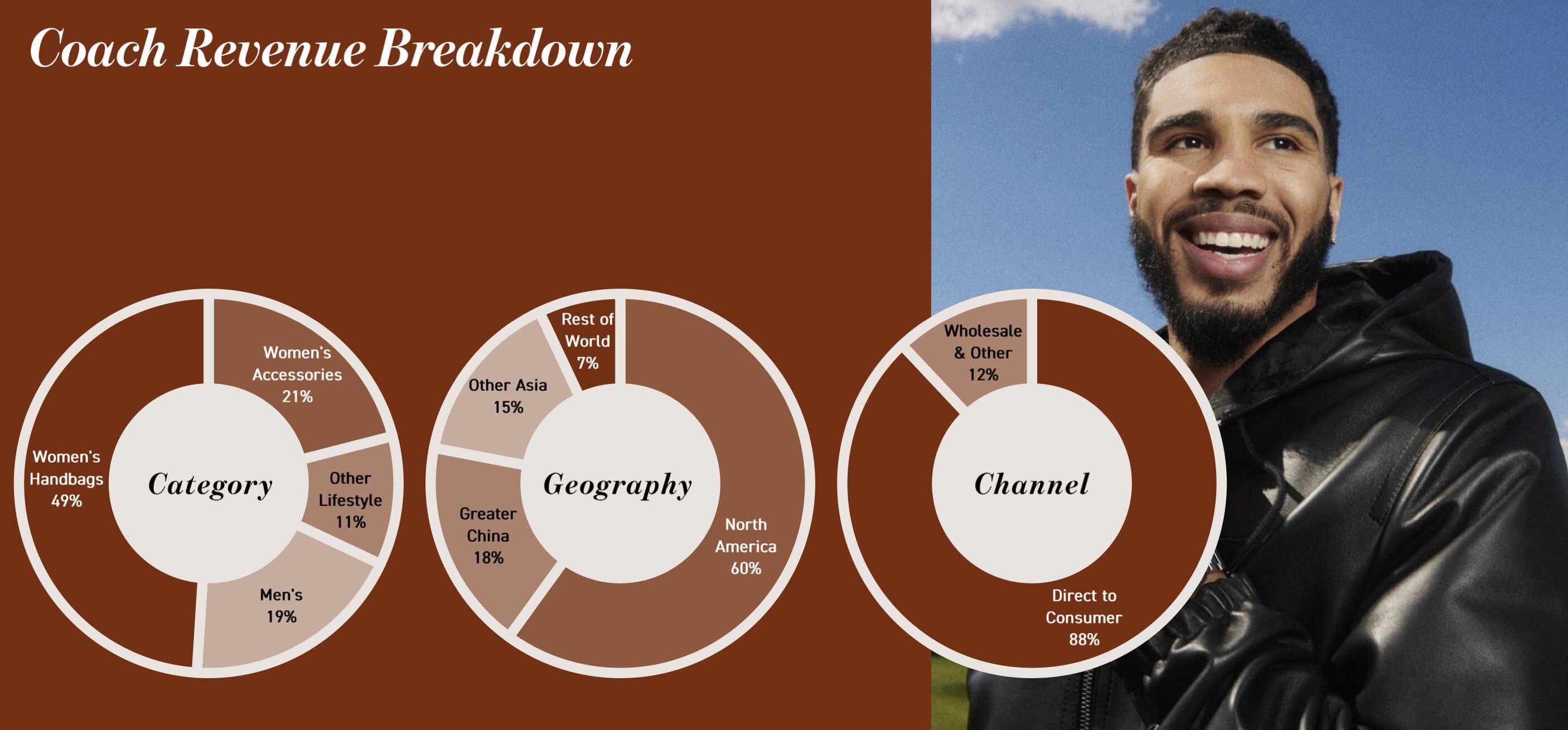

Tapestry Inc., the parent company of Coach, Kate Spade, and Stuart Weitzman, reported stronger-than-expected earnings for its fiscal first quarter, driven by solid performance from Coach. Coach’s sales rose 1% to $1.2 billion, while Kate Spade saw a 7% decline, and Stuart Weitzman grew by 2%. Despite a recent federal injunction blocking its $8.5 billion deal to acquire Capri Holdings, Tapestry raised its full-year sales forecast, projecting $6.75 billion in sales, up from a previous estimate of $6.7 billion. The company’s stock has gained 35.2% this year.

Earlier this week, speculation about a major industry acquisition stirred the luxury market. Rumors swirled that Moncler, the Italian winterwear giant, was eyeing a takeover of Burberry, sending Burberry’s shares up as much as 8% at one point. While both companies dismissed the rumors, Burberry’s stock closed the week fluctuating but ultimately down, ending with a slight dip.