Strategic Brand Initiatives Propel Moncler to Robust Growth Amid Market Volatility

The Moncler Group has reported a significant rise in sales for the first quarter of 2024, with total revenues reaching 818 million euros, a 13% increase from 726.4 million euros in the same period last year. The impressive growth is attributed primarily to the group’s direct-to-consumer channel and robust performance in the Asia Pacific region. With constant exchange rates, the sales were up by 16%.

Moncler’s Chairman and Chief Executive Officer, Remo Ruffini, praised the group’s performance during a time characterized by challenging market conditions. “The first quarter’s excellent performance is a testament to the distinctive brand experiences we’ve created, which have allowed us to build stronger connections within our communities,” Ruffini remarked.

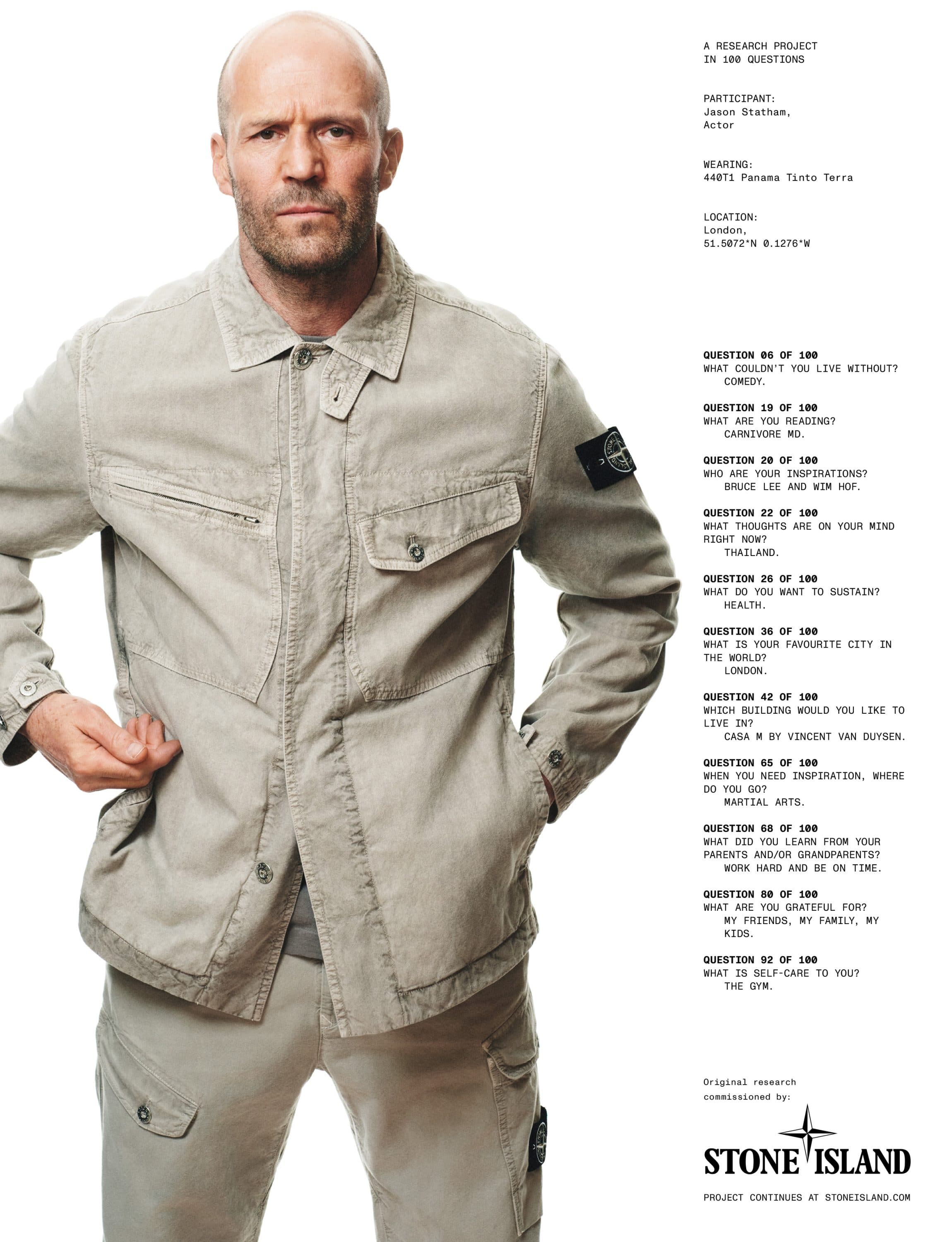

The quarter was marked by significant brand activities that bolstered Moncler’s market presence. Notable among these was the Moncler Grenoble fashion show held in St. Moritz in February, which Ruffini described as a fusion of high style and high performance that brought global attention to the Moncler Grenoble brand. Additionally, Stone Island, another brand under the Moncler Group umbrella, launched its new brand manifesto titled “The Compass Inside” at a major event in Milan. This launch was coupled with a global campaign that featured prominent figures from its cultural community, further enhancing the brand’s visibility and appeal.

Despite the optimism, Ruffini expressed caution due to the volatile macroeconomic environment and normalization trends in the luxury sector. “We are confident in the strong potential of both Moncler and Stone Island, yet we remain mindful of the still volatile economic conditions and the normalization trends in our sector, which require us to stay prudent and reactive,” he stated.

The company’s Chief Corporate and Supply Officer, Luciano Santel, echoed this sentiment during a call with analysts, emphasizing the strength of the quarter but advising against overly optimistic forecasts for the remaining year. “The first quarter was very strong, but it would be a mistake to extrapolate this for the next three quarters,” Santel cautioned. He highlighted that while January and March showed solid performance, February’s sales surged significantly, bolstered by the Chinese New Year celebrations which saw increased travel and spending by Chinese customers globally.

In terms of geographic performance, Asia Pacific led with a 19% growth, amounting to 362.6 million euros. This was driven by solid growth on the Chinese mainland and increased Chinese consumption abroad. Japan and South Korea also continued to perform strongly, benefiting from both local consumption and tourist spending.

The Europe, Middle East, and Africa region saw a 14% increase in revenues to 246 million euros, lifted by spending from both tourists and local customers. The Americas region reported a 14% increase to 96.4 million euros, with the direct-to-consumer channel offsetting declines in the wholesale segment.

Moncler’s direct-to-consumer sales in the first quarter soared by 21% at constant currency to 608.5 million euros, reflecting the strategic focus on enhancing customer relationships and brand loyalty. However, the wholesale channel experienced a 7% decline to 96.5 million euros, impacted by strategic conversions of major accounts like Nordstrom and Saks from wholesale to direct-to-consumer business models.

As of March 31, Moncler operated 275 directly owned stores, an increase from the previous quarter, and 56 wholesale shop-in-shops. The first quarter’s results set a positive tone for the year, although the group remains cautious about the evolving market dynamics and maintains a conservative outlook for the upcoming quarters.