Retail Sales Rise 9% At Constant Exchange Rates, With 19 Consecutive Quarters Of Growth; Prada Slows, Miu Miu Expands Across Categories And Geographies

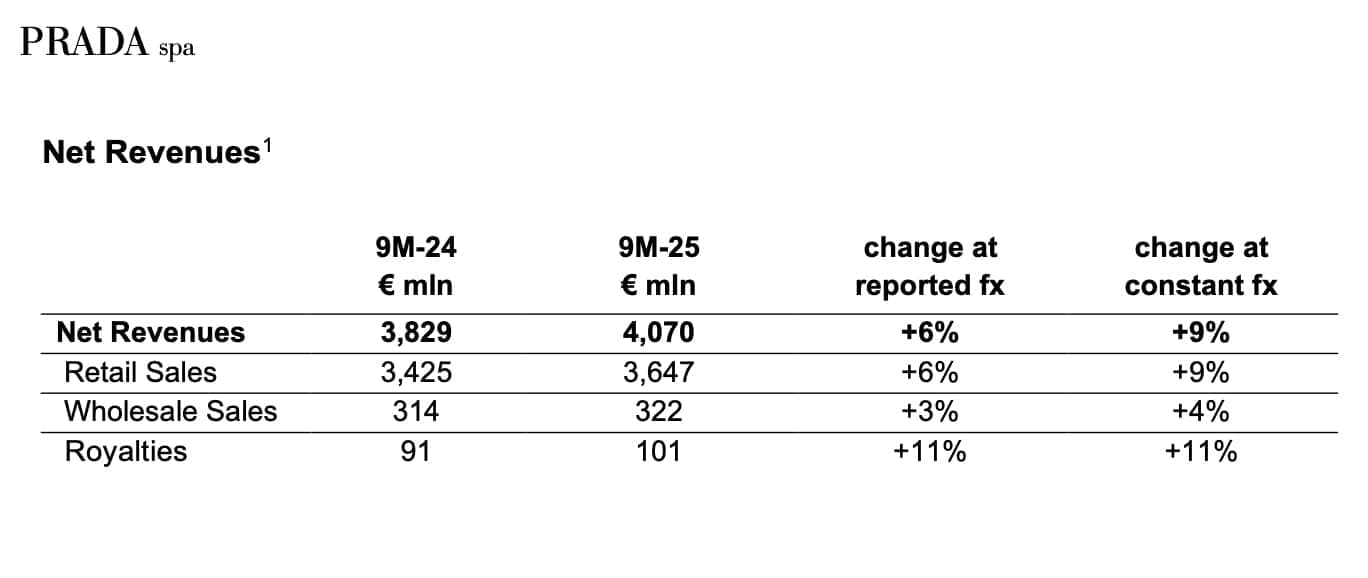

Prada Group reported consolidated revenues of €4.07 billion for the nine months ended September 30, 2025, marking a 9% increase at constant exchange rates and extending the company’s run to 19 consecutive quarters of growth. Retail sales rose 9.3% over the period, reaching €3.64 billion, supported by like-for-like and full-price performance across brands.

“The consistency of our results, in a complex macroeconomic environment, confirms the strength of our brands and the validity of our strategy,” said Patrizio Bertelli, Prada Group Chairman and Executive Director. “With the one just closed, the Group has delivered 19 quarters of uninterrupted growth. We continue to focus on creativity, product excellence and craftsmanship as foundations for enduring relevance and long-term development. These principles guide us as we navigate an evolving landscape with confidence, discipline and responsibility.”

By brand, Miu Miu remained the group’s strongest performer. Retail sales grew 41% over the nine months, with Q3 revenues up 29%, despite being measured against a triple-digit gain of 105% in the third quarter of 2024. Growth was broad-based across product categories and global markets.

Miu Miu’s momentum was attributed to a combination of creative output and cultural resonance. The brand’s Spring/Summer 2026 runway show emphasized the role of work in women’s lives, while the Fall/Winter 2025 campaign reinterpreted wardrobe archetypes with a mix of tailoring and feminine silhouettes. Key initiatives included the Atheneum pop-up, which embedded collegiate codes with Miu Miu’s irreverent aesthetic, and the launch of Miutine, the brand’s first fragrance developed in partnership with L’Oréal. Additional cultural platforms, such as Women’s Tales and 30 Blizzards at Art Basel Paris, reinforced the brand’s influence beyond fashion.

“Despite a still challenging environment, we remain confident in our trajectory, focusing on products and experiences that spark emotional engagement, while further improving our speed and flexibility,” said Andrea Guerra, group chief executive officer. “Prada accelerated versus the previous quarter; Miu Miu has maintained a sustained growth trajectory for 4 years, including in this quarter that was facing triple-digit comps.”

Prada, the group’s largest brand, posted a 1.6% decline in retail sales over the nine months and was down 0.8% in Q3. Though revenue softened, the brand maintained a full-price strategy and emphasized balance across product categories. The Spring 2026 womenswear show examined the role of clothing in an image-saturated culture, while campaigns such as Galleria, Couleur Vivante, and Fall/Winter 2025 merged the presentation of new products with a renewed focus on brand icons. The most recent edition of Prada Mode, held in London in conjunction with Frieze, extended the brand’s cultural programming.

“Our performance confirms the health of our brands and further solid, diligent execution by our teams,” Guerra said. “We remain focused on continuing to nurture the appeal of each brand within the group through a combination of creative leadership and strategic consistency.”

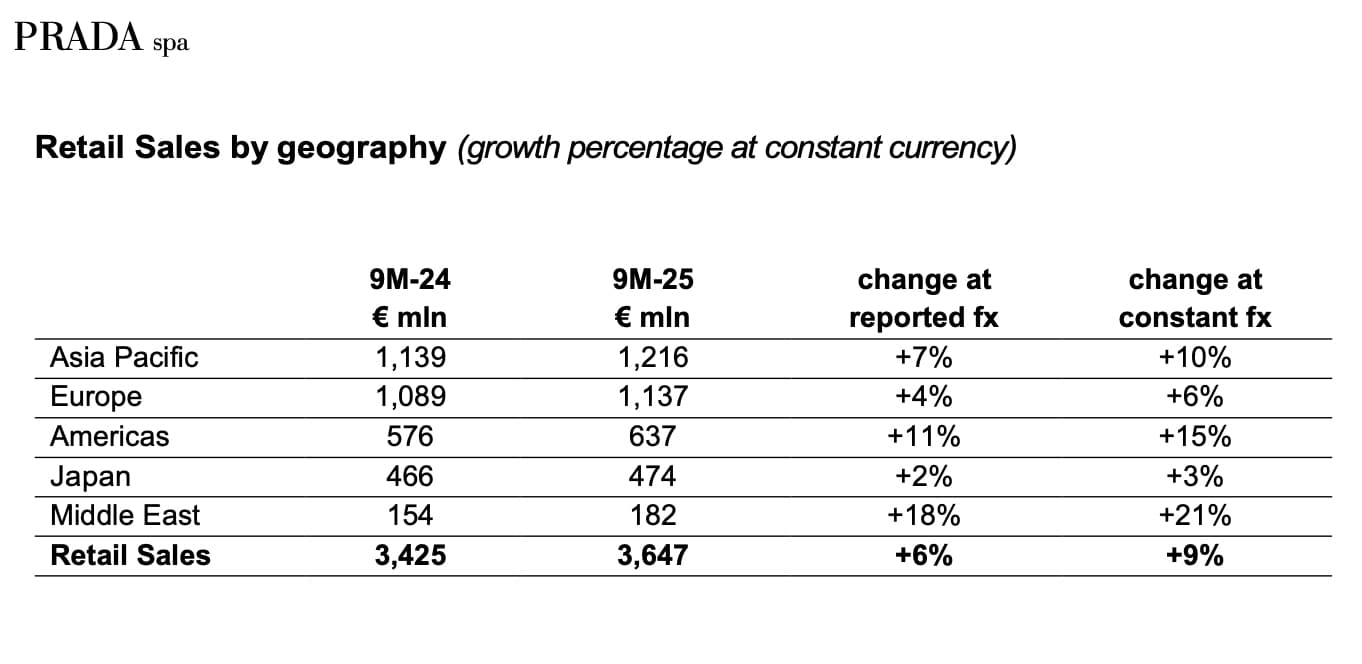

From a geographic perspective, Asia Pacific delivered double-digit retail growth of 10% at constant exchange rates, with sales reaching €1.21 billion. The group cited improved trends in Mainland China during the quarter, where performance had previously been weighed by softer local demand.

Europe posted a 6% increase in retail sales over the nine-month period at constant exchange, supported by both domestic shoppers and international tourism. Sales totaled €1.13 billion, with Q3 holding steady relative to Q2, despite softer tourist flows.

In the Americas, the group saw a sequential acceleration in Q3, with nine-month retail sales rising 15% at constant exchange rates to €637 million. The region continued to benefit from both high local engagement and a more stable macro backdrop relative to 2024.

Japan recorded modest growth of 3% at constant exchange, reaching €474 million, amid comparisons with last year’s tourism peak in the first half. Q3 showed improvement, fueled by both returning international visitors and stable local demand.

The Middle East grew 21% in the nine-month period at constant rates, though the pace of expansion moderated in Q3, reflecting higher prior-year comparables. Regional sales reached €182 million, driven by strong store performance across the Gulf.

Outside of retail, wholesale revenues rose 3% to €322 million, while royalty income increased 11% to €101 million, reflecting licensing activity and the early impact of beauty partnerships.

While the overall retail channel remained the primary growth contributor, the company continued to emphasize full-price discipline and long-term brand equity. The Q3 retail increase of 7.6% was broadly in line with the 8% growth seen in Q2, and occurred against a challenging base of 18% growth in the same quarter last year.

At the brand level, the divergent trajectories of Miu Miu and Prada signal a shift in audience momentum and market receptiveness. While Prada continues to anchor the group’s portfolio, Miu Miu’s multi-season expansion—backed by both product innovation and strategic marketing—positions it as one of the sector’s most closely watched stories in the accessible luxury segment.

Guerra emphasized the group’s operational evolution and adaptability amid shifting consumer and market dynamics. “We remain confident in our trajectory,” he said. “Our focus is on improving the speed and flexibility of execution, strengthening the emotional resonance of our products and experiences, and ensuring we meet the expectations of our global clients with precision and consistency.”

As Prada Group enters the final quarter of the year, it does so with continued investment in creativity, full-price positioning, and cultural programming. With 19 quarters of uninterrupted growth behind it, the company now faces the challenge of maintaining momentum in a landscape marked by shifting macroeconomic signals and intensifying global competition.