Makeup Leads Fourth-Quarter Momentum While The Group Posts Record Revenue And Margin Expansion Ahead Of Guidance

Puig closed 2025 with record sales exceeding €5 billion for the first time, as fourth-quarter revenue rose 6.2 percent on a reported basis to €1.45 billion, up 9.8 percent like-for-like, supported by continued strength in makeup.

For the full year, the Barcelona-based fragrance and fashion group generated net revenues of €5.04 billion, representing 5.3 percent reported growth and 7.8 percent like-for-like growth, at the top end of its 6 to 8 percent outlook range. Foreign exchange had a negative impact of 2.6 percent on annual results and 3.6 percent in the fourth quarter.

“In 2025, Puig delivered a strong, high-quality performance. For the full year, we achieved high single-digit, +7.8% like-for-like revenue growth, at the top end of our guided range, continuing to outperform the market. This reflects the strength of our portfolio, our agility and our ability to execute consistently in a more demanding environment. I am proud to confirm that we have delivered on all of our commitments made a year ago. In 2025, we completed our previous five-year strategic plan, communicated in early 2021, which set our ambition to double our 2020 revenue in three years and triple it in five. We exceeded those goals, more than doubling our revenue by 2022 and more than tripling it by 2025. Looking ahead, while we expect growth in the fragrance market to continue to normalize, we enter the new financial year with confidence. Given the strength of our brand portfolio and our steady pipeline of innovation, we are well placed to sustain healthy growth and continue to outperform the premium beauty market,” said Marc Puig, chairman and chief executive officer.

Adjusted EBITDA rose 7.8 percent year-on-year to €1.045 billion, with margin expanding to 20.7 percent from 20.2 percent in 2024, ahead of guidance. Reported net profit reached €594 million, up 11.9 percent, while adjusted net profit totaled €587 million, representing an 11.6 percent margin. Free cash flow came in at €664 million, with net debt to adjusted EBITDA at 0.7 times, well below the company’s 2.0 times threshold.

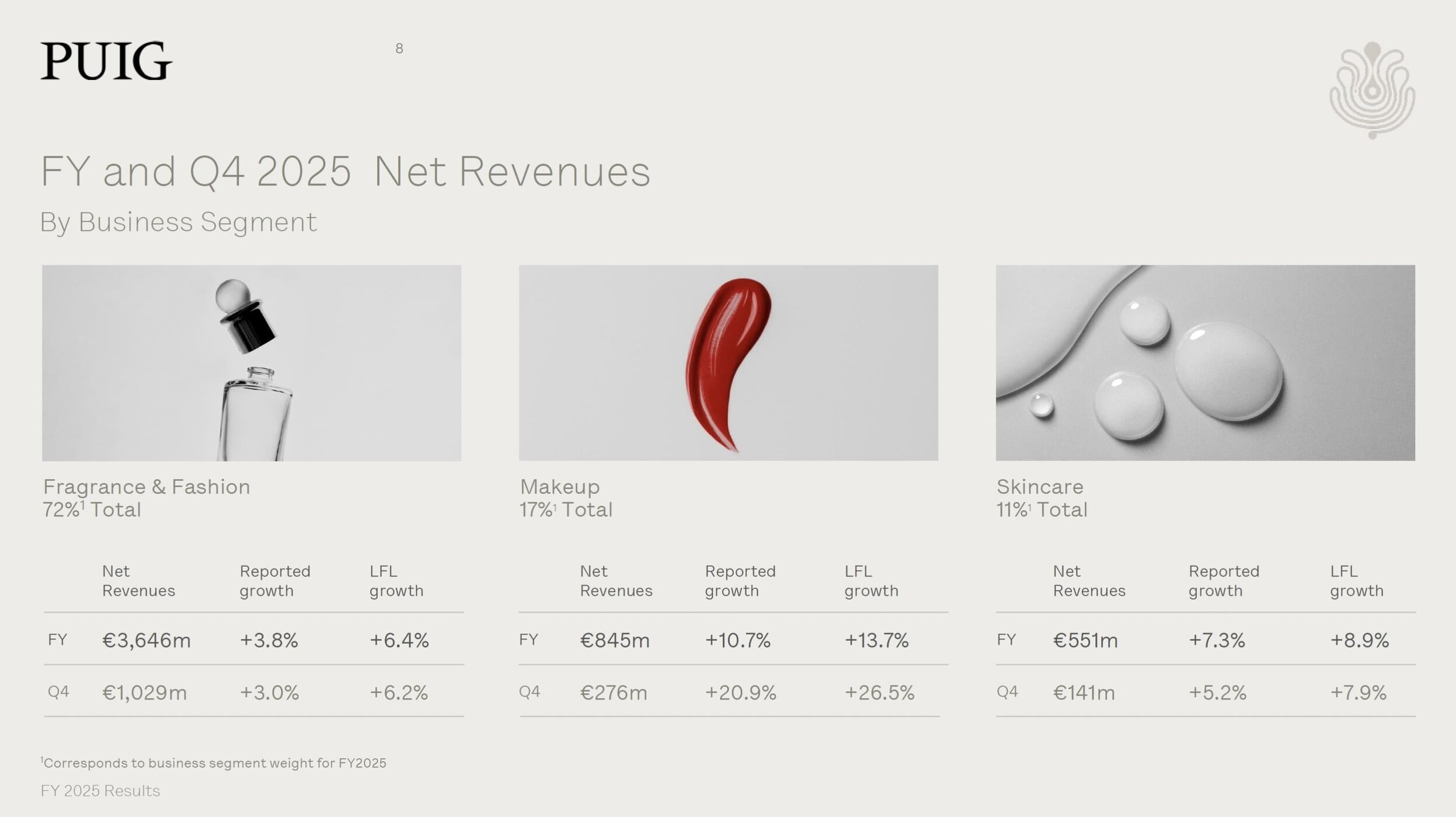

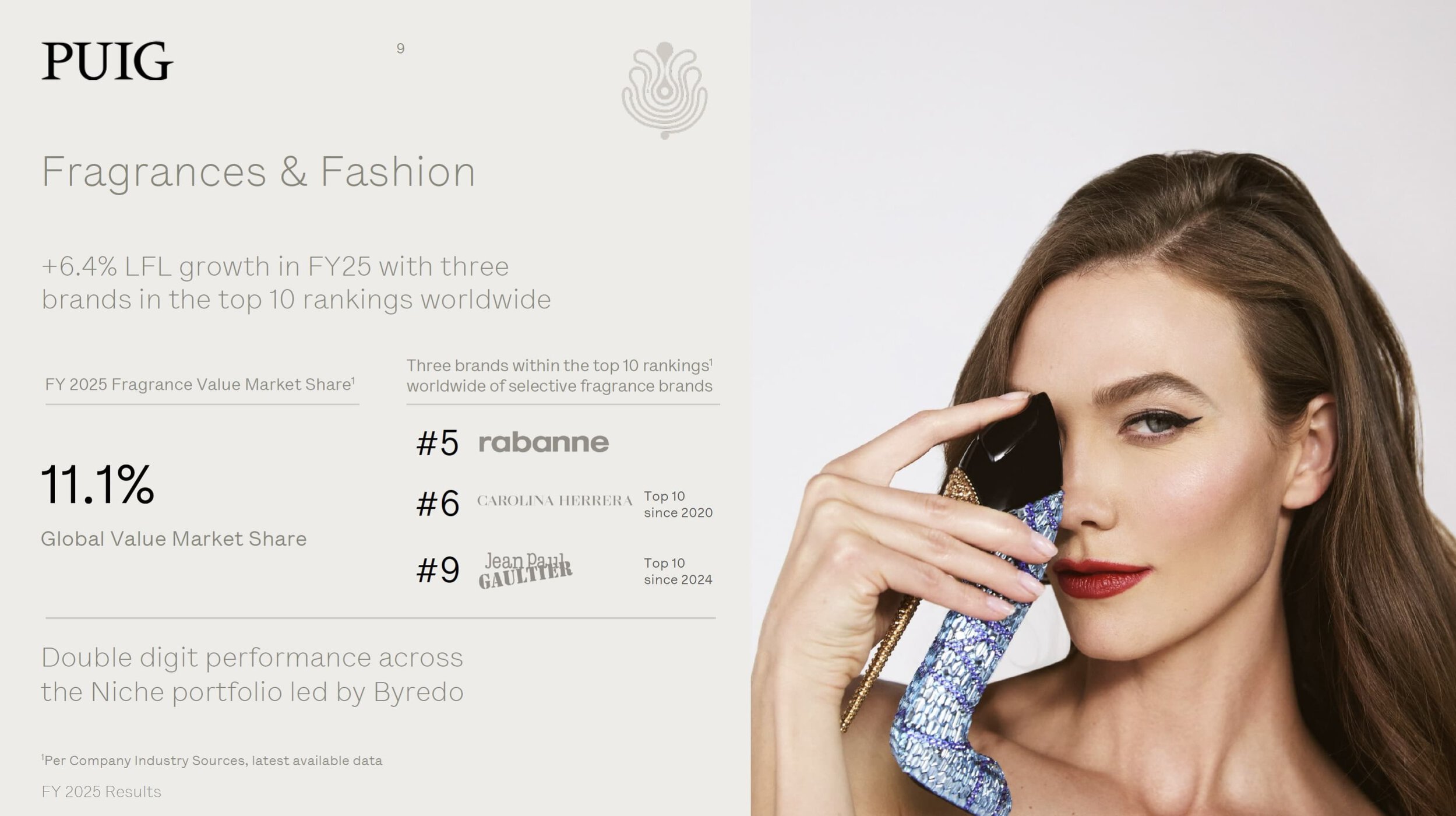

Fragrance and fashion, Puig’s largest division accounting for 72 percent of group sales, generated €3.65 billion in 2025, up 3.8 percent reported and 6.4 percent like-for-like. Growth was driven by continued momentum at Carolina Herrera, including the launch of La Bomba, and strong performance at Jean Paul Gaultier. Puig maintained three positions in the global top-10 prestige fragrance rankings with Rabanne, Carolina Herrera and Jean Paul Gaultier, and estimates its selective fragrance market share at 11.1 percent by value in 2025.

Makeup was the fastest-growing category, rising 10.7 percent reported and 13.7 percent like-for-like to €845 million, representing 17 percent of total sales. Charlotte Tilbury delivered what Puig described as “exceptional” performance, supported by innovation, geographic expansion and activation in APAC, as well as expanded distribution including Amazon in the U.S. The brand retained its number-one prestige makeup position in the U.K. and ranked third in the U.S., with further distribution expansion planned.

Skin care generated €551 million, up 7.3 percent reported and 8.9 percent like-for-like, accounting for 11 percent of group sales. Growth was led by Uriage, supported by franchise strength and new product launches, alongside continued gains in Charlotte Tilbury skin care.

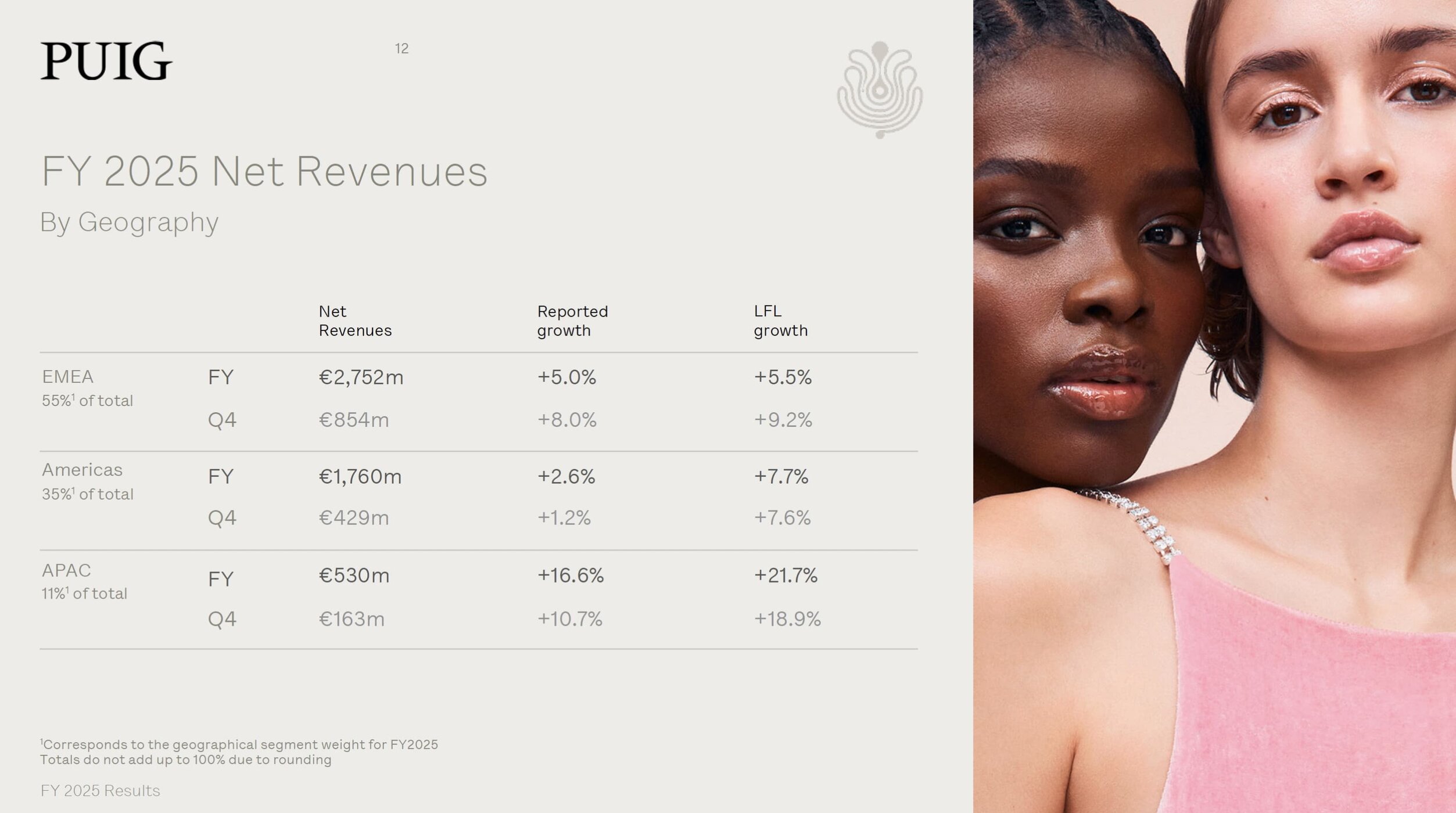

Regionally, EMEA remained Puig’s largest market at 55 percent of sales, totaling €2.75 billion, up 5 percent reported and 5.5 percent like-for-like. The Americas accounted for 35 percent of sales at €1.76 billion, rising 2.6 percent reported and 7.7 percent organically, despite foreign exchange headwinds and hyperinflation adjustments in Argentina. Asia-Pacific was the fastest-growing region, up 16.6 percent reported and 21.7 percent like-for-like to €530 million, representing 11 percent of sales.

Puig noted that the fragrance market is transitioning from the post-pandemic “super-cycle” toward normalization, particularly in the second half of the year, though underlying demand trends — including increased engagement from younger consumers — remain supportive.

For 2026, the company expects margins to remain stable while maintaining healthy investment levels in its brands. Foreign exchange and tariffs are anticipated to weigh particularly in the first quarter, but Puig reiterated confidence in sustaining like-for-like revenue outperformance versus the premium beauty market, supported by its brand portfolio, innovation pipeline and disciplined capital structure.