Karla Otto and Lefty Highlight Fashion Weeks Shifting Perspective

By Angela Baidoo

The Fall 2023 runway season felt like a litmus test for designers, buyers, consumers and the influencers who occupy the expanded multi-verse of the spectacle which is fashion month. There were a number of discernible shifts nodding to where we are set to see the industry head as it learns to re-strategise for constant change. Namely, designing into a new version of everyday luxury which can be worn with ease, reframing the idea of the media moment to go beyond the viral spectacle, and engaging with the growing power of the APAC influencer who has the ability to skew a brands earning potential or engagement rate based off a simple reduction in posts from one season to the next.

Following on from their in-depth analysis of the Men’s fashion season in January, The Impression have once again worked with Karla Otto and Lefty to review the key findings from their ‘Women’s Fashion Month Roundup: AW23’ report, and bring you our top Insights that will help you build out winning strategies for the upcoming July and September seasons.

Index

1.) Breaking Down the Top 10

2.) Outside Influence

3.) The Kult of Kylie

4.) Media Moments that Mattered

5.) The Return of China

Key Takeaways

1. Marketing moments should resonate with your brand in order to connect with your consumer and not be seen as gimmicky.

2. Continue to seek out and engage KOLs from the APAC region as ambassadors as the impact and power of their posts can increase EMV season-on-season

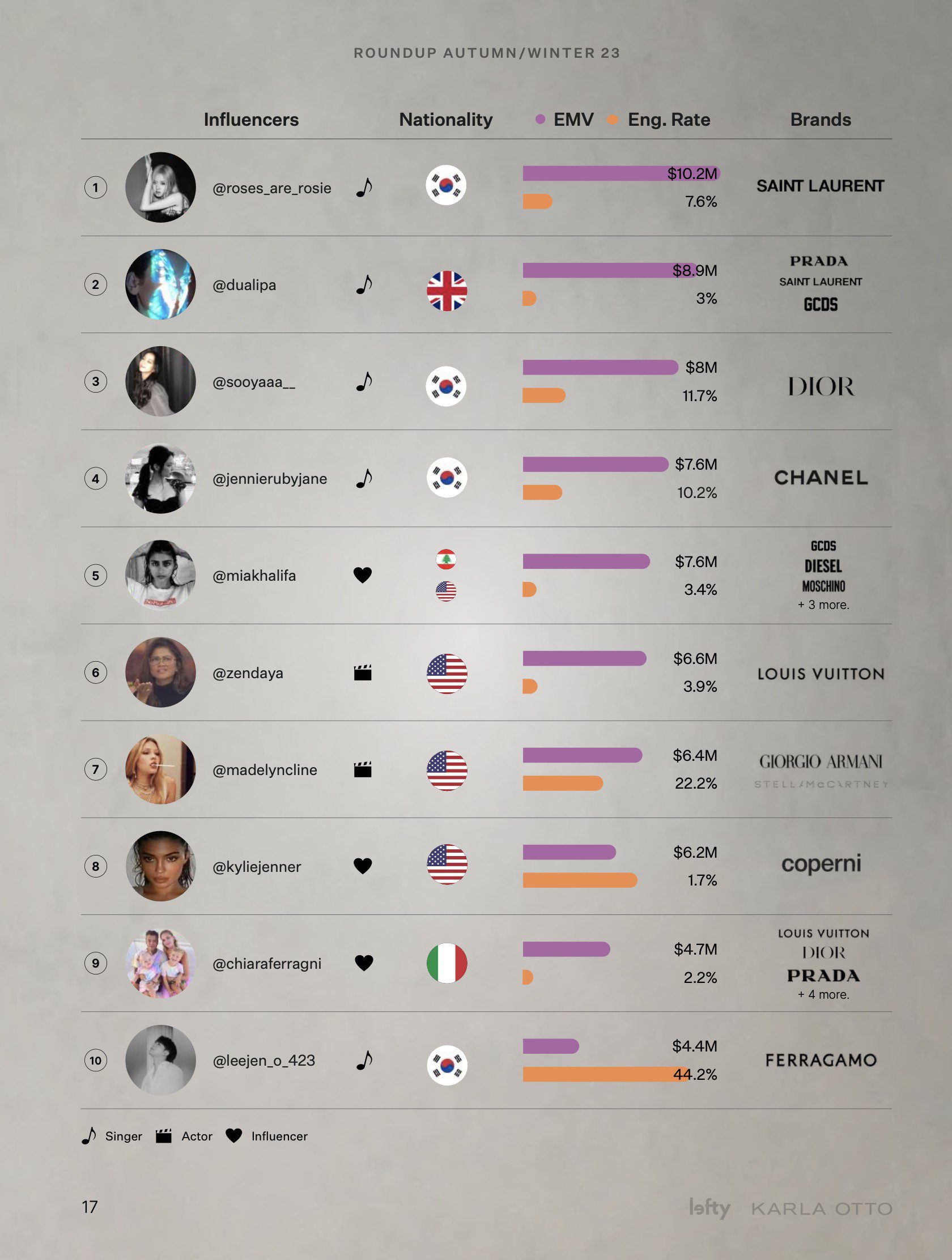

3. Look to influencers across all creative disciplines as their following inside and outside of fashion can be a valuable asset to grow your customer base, as musicians made up 40% of the influencer mix, with actors following with 33%, and true influencers with 23% of the mix.

Asian influencers, primarily hailing from South Korea, dominated AW23 fashion weeks, securing top EMV rankings at $62M and leaving American, European, and South American influencers in their wake.

– Karla Otto x Lefty: Women’s Fashion Month Roundup: AW23

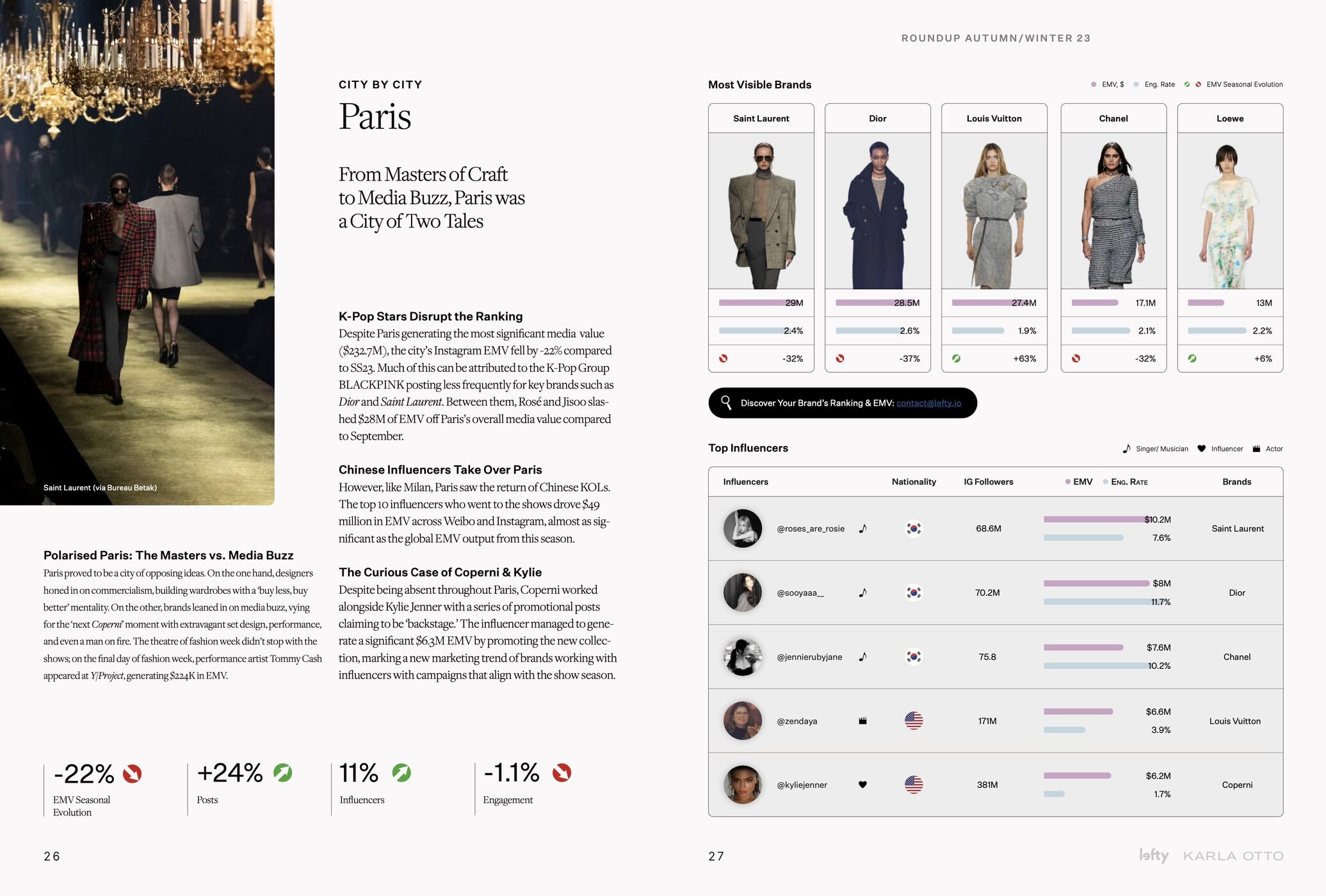

Breaking Down the Top 10

Overall, the Fall 2023 season managed to bring in $419M, of which $343M was generated by Mega influencers. What is interesting to note is that despite encompassing the smallest number of influencers within their tier at 16%, Mega influencers brought in $343M, while on the Micro end – making up a much larger share of the influencer co-hort at 40% – their EMV came in at $25M, demonstrating that a few well-placed partnerships with top tier influencers, especially those within the K-Pop world, can be all that is required to meet both engagement and monetary targets.

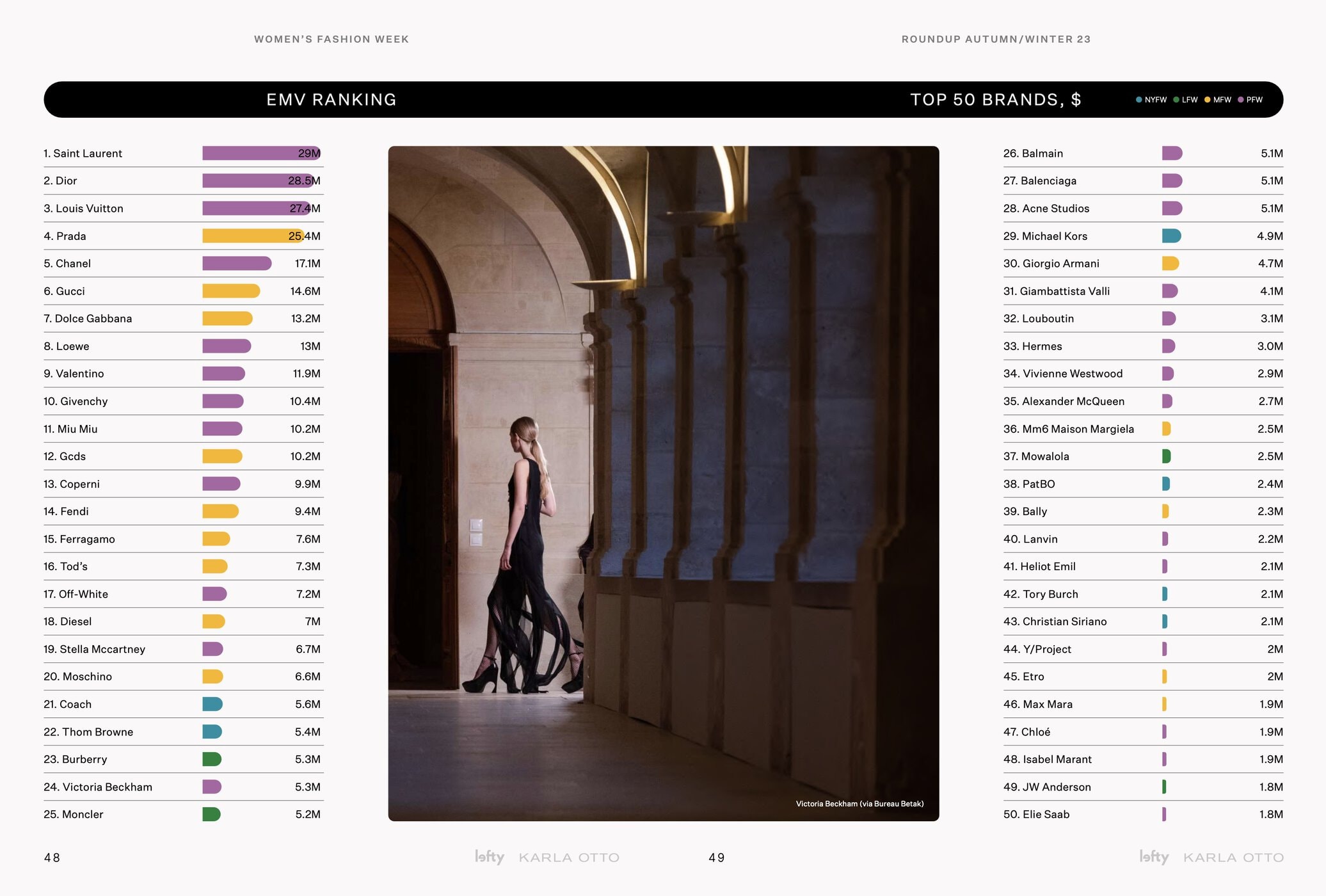

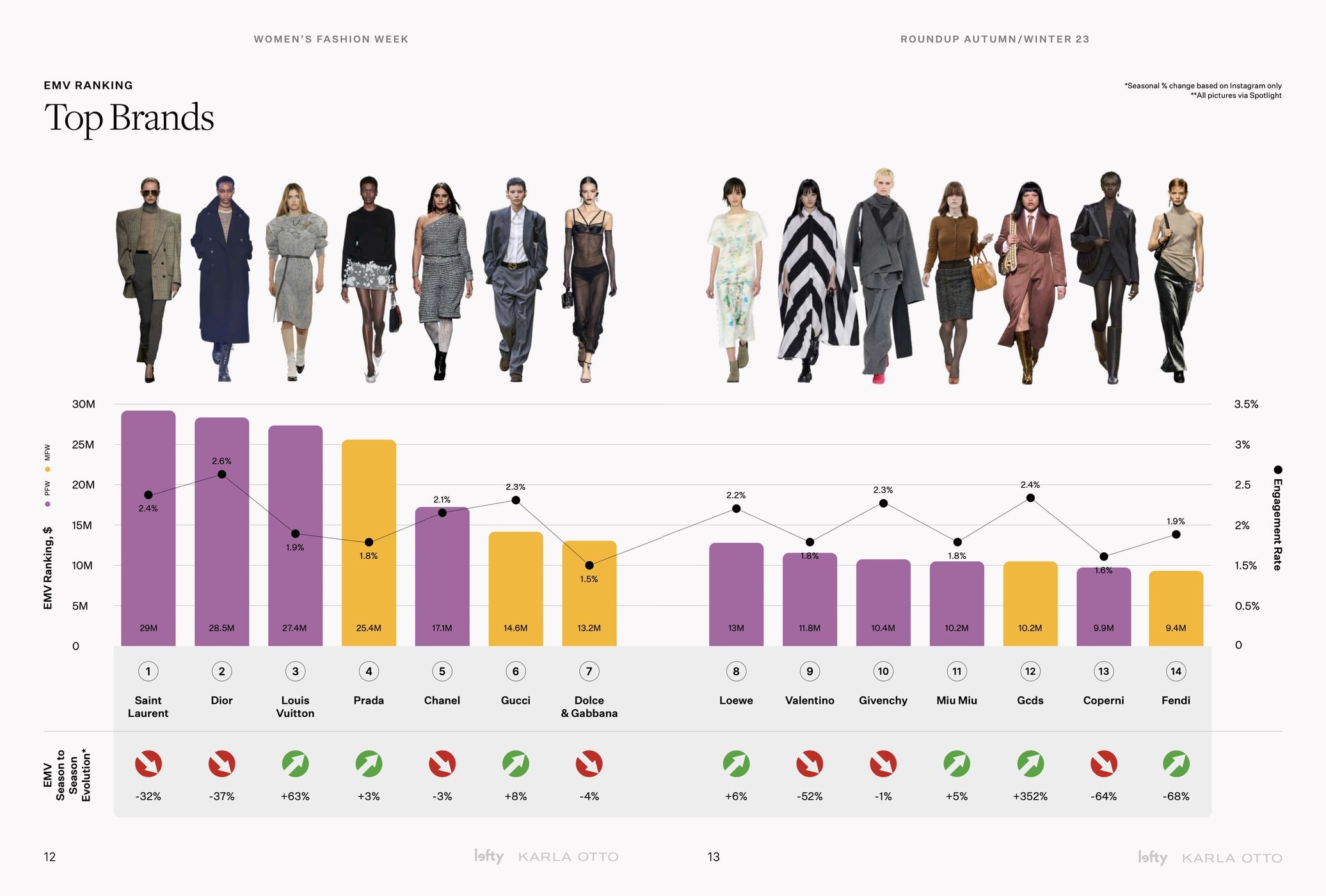

Rounding out the top 3 brands, based on their EMV were:

Saint Laurent – coming in at number one, the luxury brands total EMV was $29M, but their Earned Media Value was down 32% when compared to last season. For Fall 2023 the House called on Blackpink’s Rosé (Karla Otto x Lefty stats – South Korean, Singer, EMV $10.2M) and Dua Lipa (Karla Otto x Lefty stats – British, Singer, EMV $8.9M) as their influencers of choice for the season.

Dior – came in second, with a total EMV of $28.5M, but their Earned Media Value was down 37% when compared to last season. Tapping into influencers from both South Korea and China, Dior worked with their ambassador Jisoo of Blackpink (Karla Otto x Lefty stats – South Korean, Singer, EMV $8M), who not only attended as a front row guest, but starred in a behind-the-scenes video for the brand which saw her visit the brands archives and learn more about the collection the day before the show. In addition to Jisoo, Chiara Ferragni (Karla Otto x Lefty stats – Italian, Influencer, EMV $4.7M) who has in many ways transcended the moniker of ‘Influencer’, to become a fully-fledged digital entrepreneur, was also in attendance. As part of Dior’s Influencer activation, Gen Z actor Antonia Gentry (who stars in Netflix romcom Ginny and Georgia and has over 3M followers on Instagram) features as a highlight on the luxury brands Instagram account. The actor took her fans with her, for her first Dior show, which involved going through the shows inspirations, getting ready with Dior Beauty products, and meeting Creative Director Maria Grazia Chiuri. In the case of Gentry it should be noted that her attendance at the show does not appear as a post on her feed, and while it would be assumed that this would have been a minimum requirement of their partnership, it also indicates that the way in which brands are working with influencers is continually evolving, rather than applying a one-size-fits-all approach to each of their VIP guests.

Louis Vuitton – was the third top brand with a total EMV of $27.4M, less than both Saint Laurent and Dior, but their Earned Media Value was up a significant 63% when compared to last season. A contributing factor could have been their mix of Gen Z and Millennial influencers in the form of Zendaya (Karla Otto x Lefty stats – American, Actor, EMV $6.6m) and Chiara Ferragni (Karla Otto x Lefty stats – Italian, Influencer, EMV $4.7M), who both also qualify as Mega influencers.

The top 3 were all derived from Paris fashion week, with only Prada coming close to competing with the figures from Saint Laurent, Dior, and Louis Vuitton with $25.4M, a modest 3% increase on last season.

Breaking into the Top 10 for Fall, GCDS was a social media success story, generating nearly as much EMV – $10.2M – as Gucci’s interim show (while it awaits the arrival of its new Creative Director Sabato De Sarno) at $14.6M, also boasting near identical engagement rates of 2.4% and 2.3% respectively. Managing to secure the top influencers from Milan – singer Dua Lipa and influencer Mia Khalifa – for their front row. Posts featuring the two, which have appeared on the brands Instagram feed, have seen Mia Khalifa generate nearly 10,000 likes, while Dua Lipa in a sheer black dress from the brand has generated over 61,000 likes.

Outside Influence

Social media platforms and the data which can be gleaned from them, have been a welcome tool in many a luxury marketing departments arsenal. As fashion shows can be amplified in ways which could only have been dreamed of before the advent of Instagram, Weibo, and TikTok. But as a brand who chose to exit from all social platforms in 2021, Bottega Veneta, even without a social presence, still managed to make their ‘presence’ felt this season, leaving no doubt that they would have made the top 10 list, especially considering the numbers achieved by posts from the shows attendees and the brands Creative Director.

BTS Member and South Korean Rapper RM (Kim Nam-joon) – 7M likes

Creative Director Matthieu Blazy – 13,000 likes

Singer Kelela – 30,000 likes

Bottega Veneta’s absence from Instagram – and as a result its omission from this report – begs the question as to whether luxury brands can learn to live without social networks. In a world where whole teams have been built around them, it would seem that brands are taking a less-is-more approach. Seeking out new methods of marketing, Bottega Veneta has worked out a way to resonate with their customers through craft and innovation, from OOH (Out Of Home activations – The Great Wall of China and Bottega for Bottegas), to working with pioneering designers (Gaetano Pesce’s chairs for the summer 2023 set design formed part of a Design Miami installation, and are also available to buy online).

The Kult of Kylie

A strong fixture during January’s Couture week, with her appearance at Schiaparelli in a black column dress complete with faux lion’s head making headlines around the world, the uber-influencer proved her star power could transcend the physical. A Coperni collaboration during Paris fashion week provided a clever marketing moment, as the brand left many guessing as to whether she was actually in the city, with many were expecting her to appear front row.

Posting an image with the cryptic caption “King Kylie was here?”, Arnaud Vaillant and Sebastien Meyer styled Jenner in looks from the show in a ‘Backstage’ setting. These posts not only generated over 6M (Jenner’s personal account) and 147,000 (the combined total of three Coperni feed posts) likes, but according to the Karla Otto x Lefty report:

The influencer managed to generate a significant $6.3M EMV by promoting the new collection, marking a new marketing trend of brands working with influencers with campaigns that align with the show season

– Karla Otto x Lefty: Women’s Fashion Month Roundup: AW23

But while it stands out as a playful take on the marketing moment which throws up new ways of engaging with influencers to create promotional posts (even if they are not in the same country), caution should be taken as it could also have the adverse effect with fans of both the brand and influencer, who will be expecting to see them front row, left disappointed.

Media Moments that Mattered

In a season which saw a lot less spectacle, the report highlighted the ways in which brands created noise during a season building on the trend for quiet luxury, and fatigued by empty gimmicks which take the focus away from the clothes themselves.

New York – making up a 9.8% share of voice across all four cities, New York saw a significant dip when compared to the heightened fanfare of last season, which saw major names such as Fendi pairing up with Marc Jacobs to celebrate the anniversary of the Baguette bag, as well as Marni debuting their first show outside of Milan, resulting in an 89% EMV drop from summer 2023 to fall 2023. Yet, despite the absence of tentpole names such as Tom Ford it was the smaller designers whose shows managed to cut through the noise and drive engagement. According to the report Collina Strada’s show which featured models in lifelike animal prosthetics saw a 94% seasonal growth ($1.1M EMV), and through a collaboration with Patbo and actor Elizabeth Gilles (her tagged post has garnered over 800,000 likes), the Brazilian designer generated $1.46M in EMV.

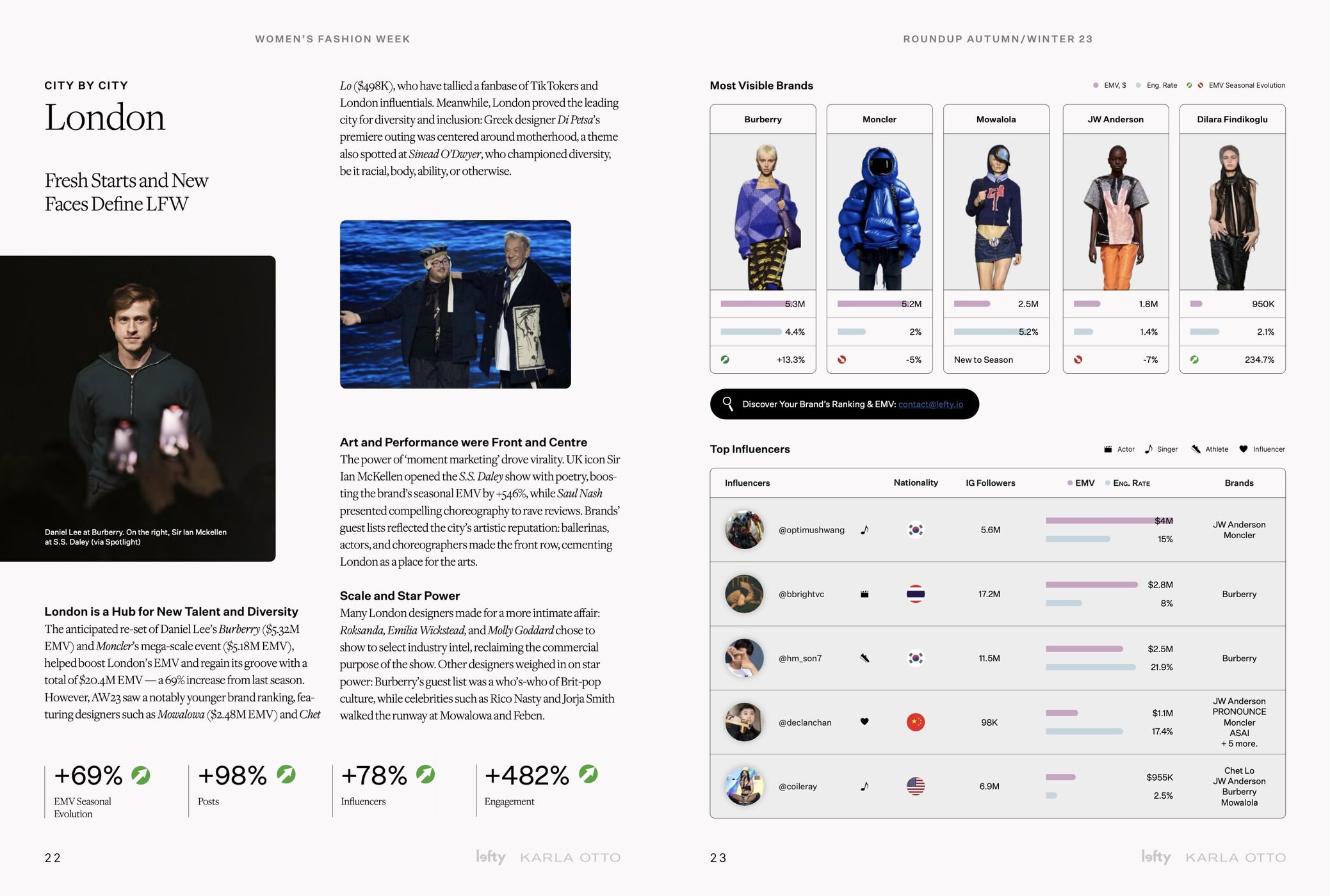

London – saw an increase across all of the key media value indicators, seeing an impressive 482% rise in engagement, a 78% rise in influencers, and a 69% rise in EMV to $20.4M when compared to last season. These statistics are likely a result of the buzz of the debut of Daniel Lee’s first collection for British heritage brand Burberry, with editors and influencers alike drawn to the city, as well as Moncler’s stadium-style activation for its Art of Genius initiative. In a season which saw a worrying return to ‘Size Zero’ the city’s emerging designers doubled down on their commitment to diversity with Di Petsa and Sinead O’Dwyer featuring a size-inclusive range of models in their shows. While young brands made a strong showing with Mowalola and Chet Lo garnering $2.48M and $498K EMV respectively, as their decisions to court content creators from TikTok and stars from London’s music and creative scenes paid off.

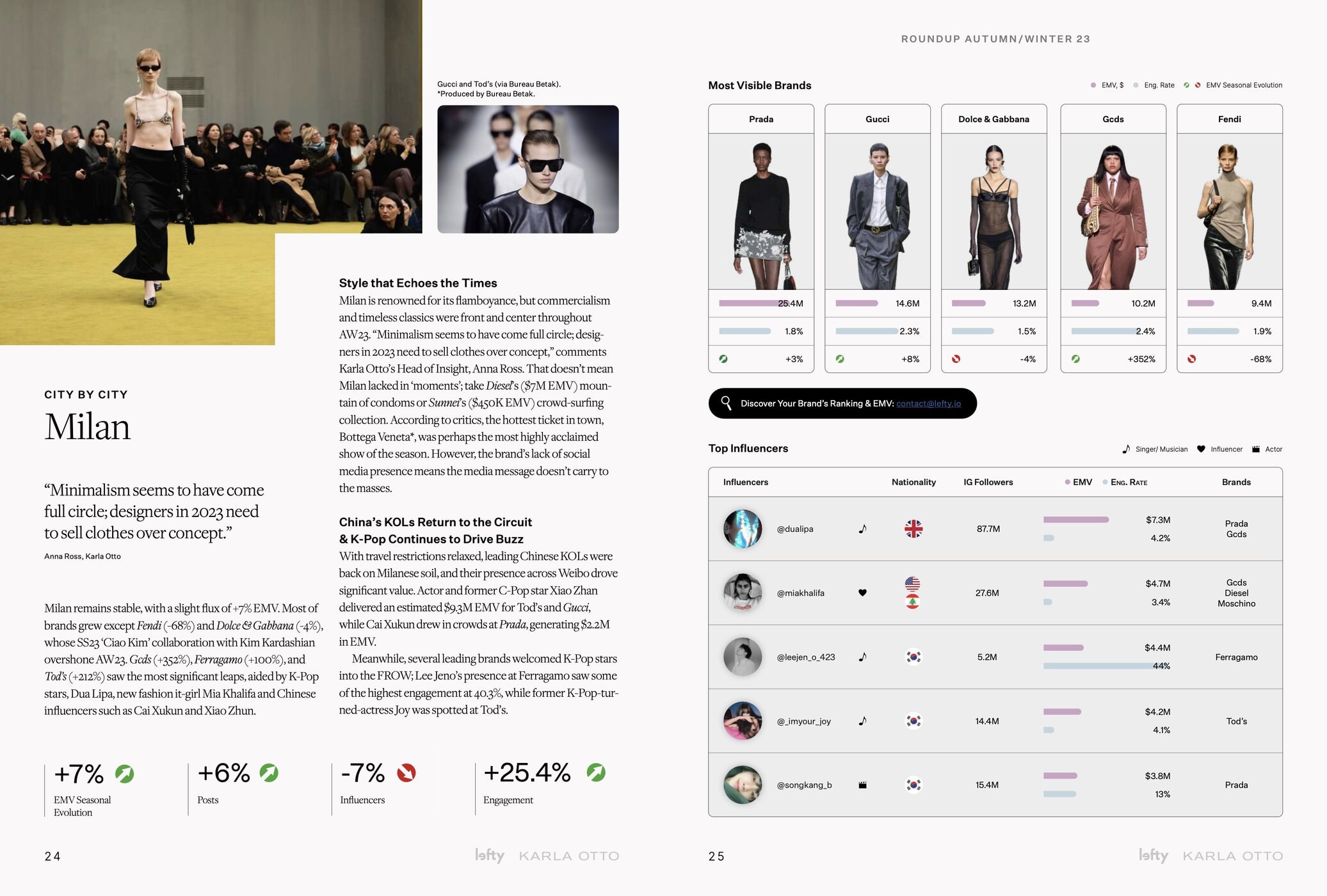

Milan – kicking off the wave of Chinese KOLs return to fashion month, coupled with the continued dominance of K-Pop influencers and their dedicated fans which created a genuine scene of enthusiastic fandom outside each of the shows they attended, Milan set the scene for the shift which was growing during Men’s fashion week in January. As according to the report

Actor and former C-Pop star Xiao Zhan delivered an estimated $9.3M EMV for Tod’s and Gucci, while Cai Xukun drew in crowds at Prada, generating $2.2M in EMV

– Karla Otto x Lefty: Women’s Fashion Month Roundup: AW23

Engagement was also at its highest when originating from K-Pop stars, such as Lee Je-no who generated numbers as high as 40% for Ferragamo. While younger brands created their own moments through performance art – Sunnei’s models walked the runway before crowd -surfing – or artisanal craft – as GCDS’s set design featured a giant animated papier mache cat created by Italian craftsmakers, which saw the brand achieve an impressive +352% season-on-season impact.

Paris – as brands looked to dressing their consumers with a quiet luxury aesthetic in mind, many designers chose to forgo the theatrics and honed-in on sets which would re-focus the eye on the clothes. But for those who wanted to shake-up the status quo we saw designers such as Stella McCartney’s employing of Wild Horses, Anrealage’s colour-changing collection, and Heliot Emil’s ‘Man on Fire’ all serving to provide a commentary on today’s world, whether in the form of preserving nature’s most graceful creatures or how the harnessing, rather than the fear, of technology can provide a sustainable solution. Despite posts and influencers being up 24% and 11% respectively, small changes in the social media activity of the top K-Pop KOLs caused a skew of the seasonal numbers:

Despite Paris generating the most significant media value ($232.7M), the city’s Instagram EMV fell by 22% compared to Summer 2023. Much of this can be attributed to the K-Pop Group Blackpink posting less frequently for key brands such as Dior and Saint Laurent. Between them, Rosé and Jisoo slashed $28M of EMV off Paris’s overall media value compared to September.

– Karla Otto x Lefty: Women’s Fashion Month Roundup: AW23

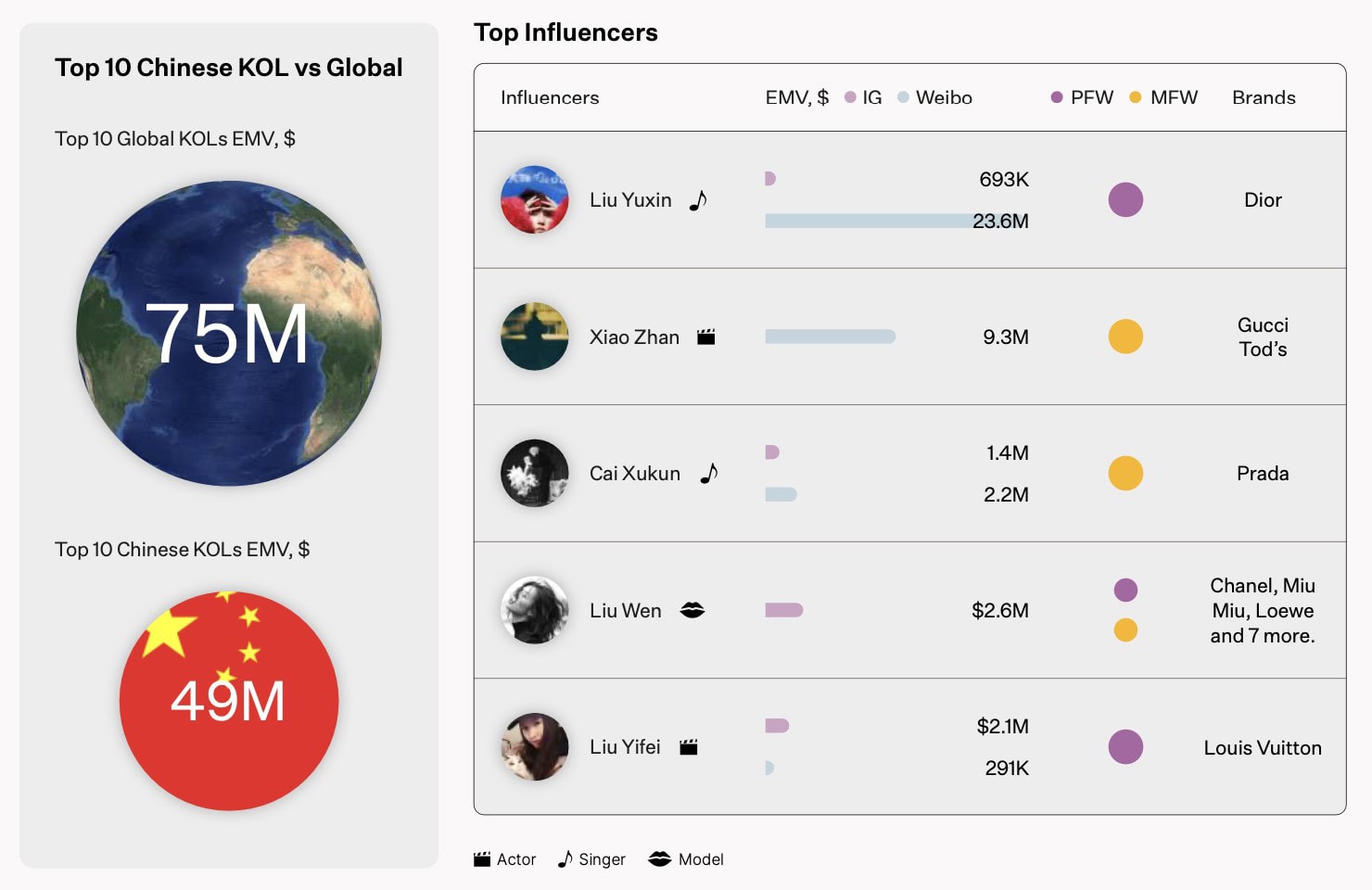

The Return of China

The long-awaited reopening of China following its strict clamp down on international travel to stop the spread of Covid-19 on its shores, saw the welcome return of top influencers from the region which came with the expected boost to numbers from Milan and Paris.

With the Chinese consumer heavily relied upon by the luxury market for growth pre-2020, the decline of this trajectory was a heavy blow to many brands bottom line, but with travel bans being lifted luxury is once again setting its sights and marketing dollars on China. Who’s regional EMV share (taking into account Instagram data only) stands at $62M, in comparison to North Americas $46M, and Europe’s $17M.

According to Bernstein, the overall luxury market in China is set to grow by 13% in 2023, presenting an opportunity for brands to work alongside KOLs in the space, especially across native platforms such as Weibo.

– Karla Otto x Lefty: Women’s Fashion Month Roundup: AW23

The growing influence of K-pop – through the global popularity of bands such as BTS, Blackpink, and Ones to Watch NewJeans – has been recognised by brands over the past few seasons, with the diversification of front rows at all the fashion weeks, from Mens, to Couture, and Ready-to-wear. During China’s absence KOLs (Key Opinion Leaders) from South Korea (Rose, Jisoo, Jennie Kim of Blackpink, and singer, dancer, and model Jeno) Thailand, Japan, and Vietnam have dominated. But with its opening up, the fall 2023 circuit saw influencers, editors, and celebrities from the region once again take centre-stage and drive engagement and sales for the top luxury houses. Most prominent were Chinese singer and dancer Liu Yuxin (whose show post garnered nearly 700,000 likes) at Dior, and singer, actor, and brand ambassador Chris Lee and actor Xiao Zhan who both attended Gucci, as well as BingBing Fan who was at both Schiaparelli and Giambattista Valli.

As Chinese influencers return to the runway scene, it will be key for brands to engage them on their native social media platforms. And with Weibo remaining the most popular option for Chinese influencers, the luxury market should continue to tap into the significant output which is being generated via the site. As highlighted in the report, the fact that the ‘Top 10 Chinese KOLs’ who attended shows during the fall 2023 season generated an EMV of $49M, which is almost comparable to the ‘Top 10 Global KOLs’ whose figure stood at 75M, should be a motivating factor in growing influencer marketing spend in the region. As well as creating moments that will resonate with the Chinese consumer, as has been seen of late, with Bottega Veneta announcing the re-staging of their fall show in Beijing, which follows on from Prada’s runway re-staging in 2022 which featured a total of nine Chinese actors who walked the show, with the event live-streamed on Weibo to an audience of over 92M.