From Tailors to Tickers: The Luxury Houses That Outpaced the Market

It’s been a turbulent year for luxury. Recession whispers, tempered demand in China, tariff tremors, and creative musical chairs sent ripples through the sector – but not everyone stumbled. While headlines obsessed over the softness in high fashion, three brands quietly delivered one thing Wall Street loves most: returns. Serious ones.

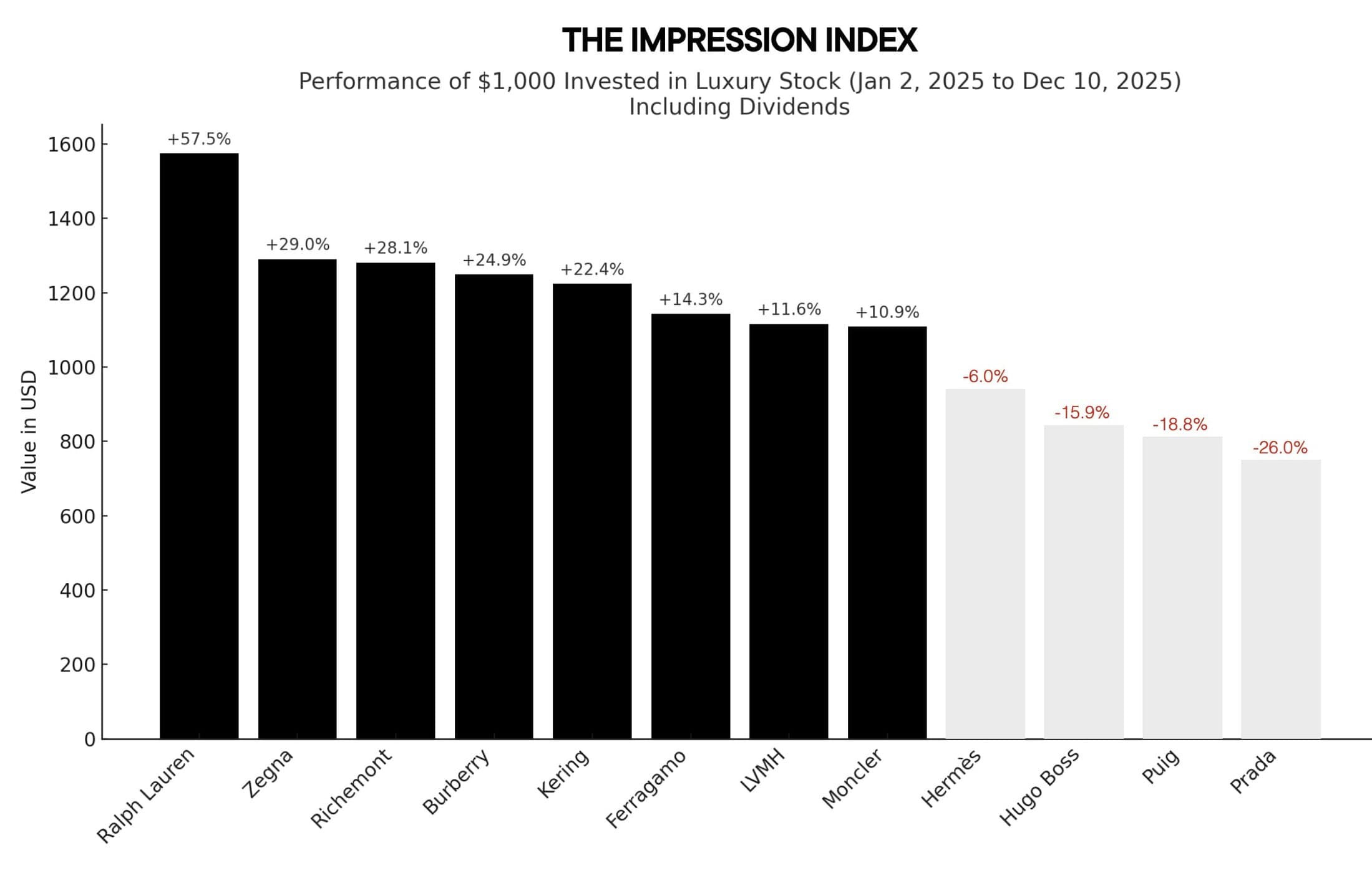

Ralph Lauren, Zegna, and Richemont posted the strongest year-to-date gains in stock price among the public fashion companies we track, rewarding investors who understand that in fashion, timing and storytelling matter as much as tailoring.

Let’s start with Ralph Lauren, a name that evokes American aspiration as much as it does a well-cut blazer. The stock began the year trading at $231.56 and closed in mid-December at $358.99—an eye-watering 55% gain. While much of the market was fretting over luxury fatigue, Ralph Lauren stayed disciplined: product elevation, tight distribution, and a polished narrative around heritage and modernity. Investors noticed. So did consumers.

Second on the podium is Zegna Group, which has transformed from a suiting brand into a luxury lifestyle house with growing cultural relevance. With Tom Ford Fashion now under its umbrella and Thom Browne undergoing a strategic reset, Zegna posted a 29% gain from January to December. It’s a story not just of tailoring, but of transformation—how an Italian house became a quiet power player by leaning into storytelling, DTC growth, and a distinctly modern tone.

Rounding out the top three is Richemont. Long known for its strength in jewelry, the group—led by Cartier, Van Cleef & Arpels, and Buccellati—also showed it knows how to manage value in tough times. Richemont’s stock climbed 26%, supported by strong margins, reliable top-line growth, and a steady hand on strategy. While it doesn’t always make the loudest headlines, it consistently makes the smartest moves.

Here’s what it would have looked like if you had put $1,000 into each of these stocks on January 2, 2025:

It’s worth noting that all three of these companies offer dividends, too—meaning that beyond capital appreciation, investors received a touch more polish on their portfolios. Ralph Lauren pays a consistent dividend, Zegna initiated one in 2025, and Richemont, ever the Swiss timekeeper, delivers on schedule.

In a year where headlines swayed wildly and volatility returned to the luxury market, these three players kept their eyes on the long game. They weren’t immune to macro pressures, but they communicated well, delivered consistently, and stayed true to their identities.

Sometimes, in luxury and in markets, quiet confidence outpaces loud ambition. The stocks that performed best in 2025 weren’t the flashiest stories—they were the best-executed ones.