Strategic Store Expansion and Brand Focus Keep the Group On Track for 2027 Targets

The Ermenegildo Zegna Group has reported a 53% increase in net profit for the first half of 2025, signaling strong results despite ongoing headwinds in certain segments and geographies. For the six months ending June 30, the group saw net profit climb to 47.9 million euros, up from 31.3 million euros in the first half of last year.

“Our first-half 2025 results reflect the group’s strategic decision to invest in the DTC store network and capabilities across our three brands, while continuing to support projects that fuel our long-term growth ambitions,” said chairman and CEO Gildo Zegna.

The Zegna brand itself led the charge. Adjusted operating profit for the segment—including its textile business and third-party licensing—hit 94.4 million euros, with an adjusted EBIT margin of 14.3%, up from 12.8% last year. Zegna credited this to better operating leverage, a more efficient direct-to-consumer setup, and tight cost controls.

“In this context, we are pleased with the operating results reported by the Zegna segment where stronger operating leverage and disciplined execution led to an improvement of the adjusted EBIT margin by 150 basis points. This strong performance helped balance the impact of the strategic transformation underway at Thom Browne and Tom Ford Fashion,” said Zegna.

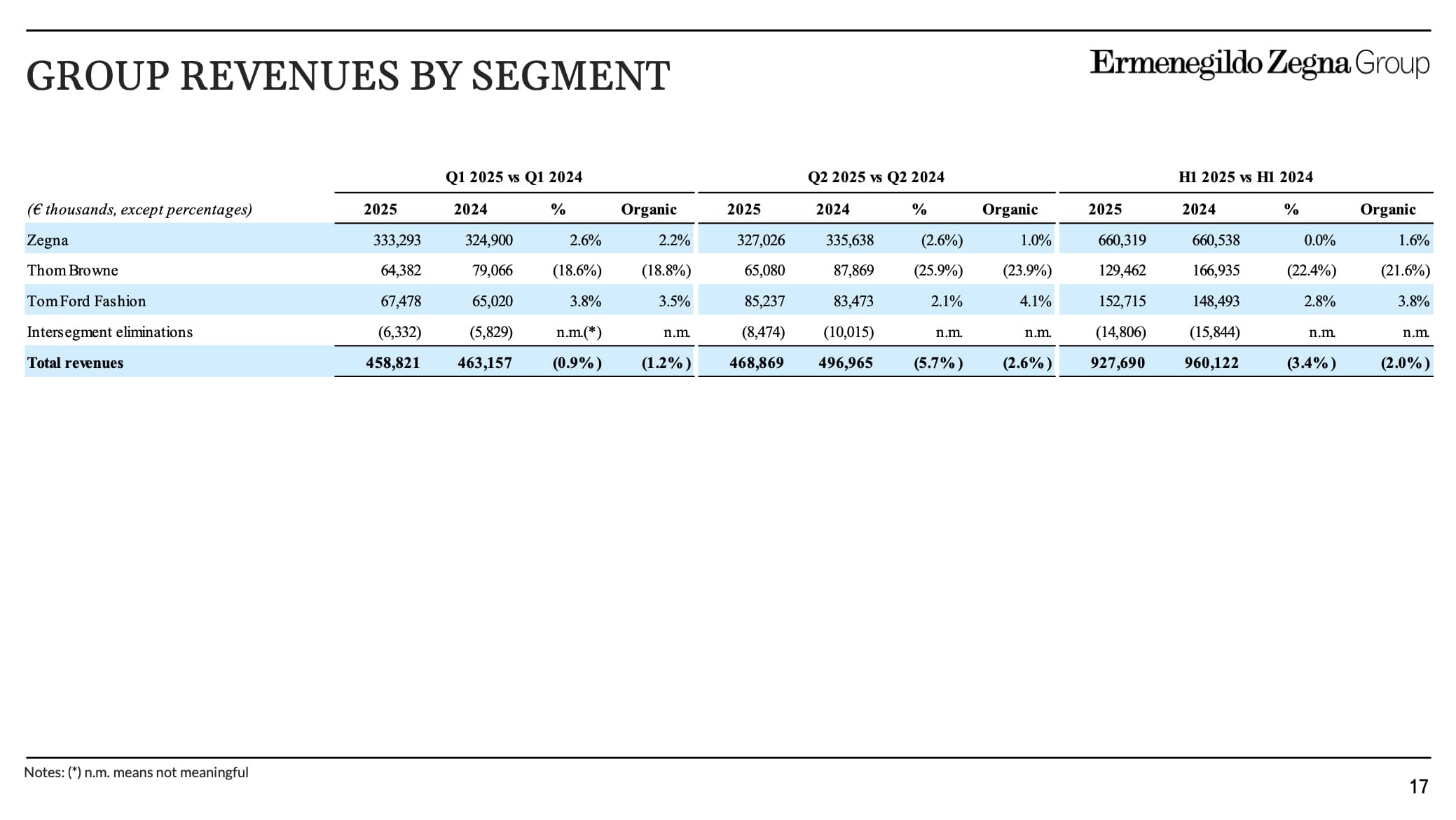

Despite the upbeat bottom line, group revenues dipped 3.4% year-over-year to 927.7 million euros. In organic terms, that decline was narrowed to 2%.

Brand-by-brand, the Zegna label remained steady, rising 0.8% to 570.4 million euros in sales. Meanwhile, Thom Browne saw a sharp 22.5% drop to 129.2 million euros. Tom Ford Fashion managed a modest 2.8% increase, totaling 152.7 million euros.

That Tom Ford lift coincided with the brand’s first collection under creative director Haider Ackermann, presented in Paris in early March. “And it has been very well-received,” noted CFO and COO Gianluca Tagliabue, referencing the new campaign under Ackermann. Though he cautioned, “it was early to comment on the trends, but the first, very initial reactions in the stores have been really positive.”

Zegna, too, is getting visual. A new campaign for Fall 2025 fronted by Mads Mikkelsen centers on the Torino suit—crafted from Vellus Aureum wool and billed as “the finest wool in the world.” That campaign dropped in tandem with the second installment of Zegna’s fall collection. “An initial positive feedback,” said Tagliabue, characterizing store performance.

He also pointed to Zegna’s growing footprint in the U.S., citing a recent opening in Miami’s Design District and plans for an Art Basel event in December. In Asia, the brand opened a new Salotto in Shanghai at Plaza 66—its third worldwide—offering custom suiting and by-appointment services for VIP clients.

“We want to keep on fueling the brand that is with positive tailwind but we don’t want to squeeze the numbers of the second half of the year in order to deliver in the short term,” Tagliabue added. “We see big potential in the long-term and we want to keep on having the right events, the right investments, just cutting discretionary costs, not anything else.”

Textile revenues, meanwhile, declined 6.6% to 67.1 million euros.

On the Thom Browne front, adjusted operating profit was 4.5 million euros, with the margin sliding to 3.5% from 12.1%. The dip was blamed on lower wholesale sales and startup costs tied to new DTC stores still finding their footing.

Leadership is also evolving. Rodrigo Bazan stepped down as CEO of Thom Browne on August 31, with Sam Lobban taking over the role. Lobban was previously EVP and general merchandising manager for apparel and designer at Nordstrom.

Tagliabue was upbeat about the shift. “Of course, having on board Sam Lobban as the new business leader, bringing and injecting a consumer-centric approach, starting from merchandising, training in retail and all the different levers that then bring to life the stores, bringing it back to double-digit EBIT where it belongs.”

At Tom Ford Fashion, the group posted an adjusted operating loss of 19.4 million euros, widening from last year’s 11.9 million euro loss. The brand is still ramping up, with major investments in retail buildout, talent, and infrastructure.

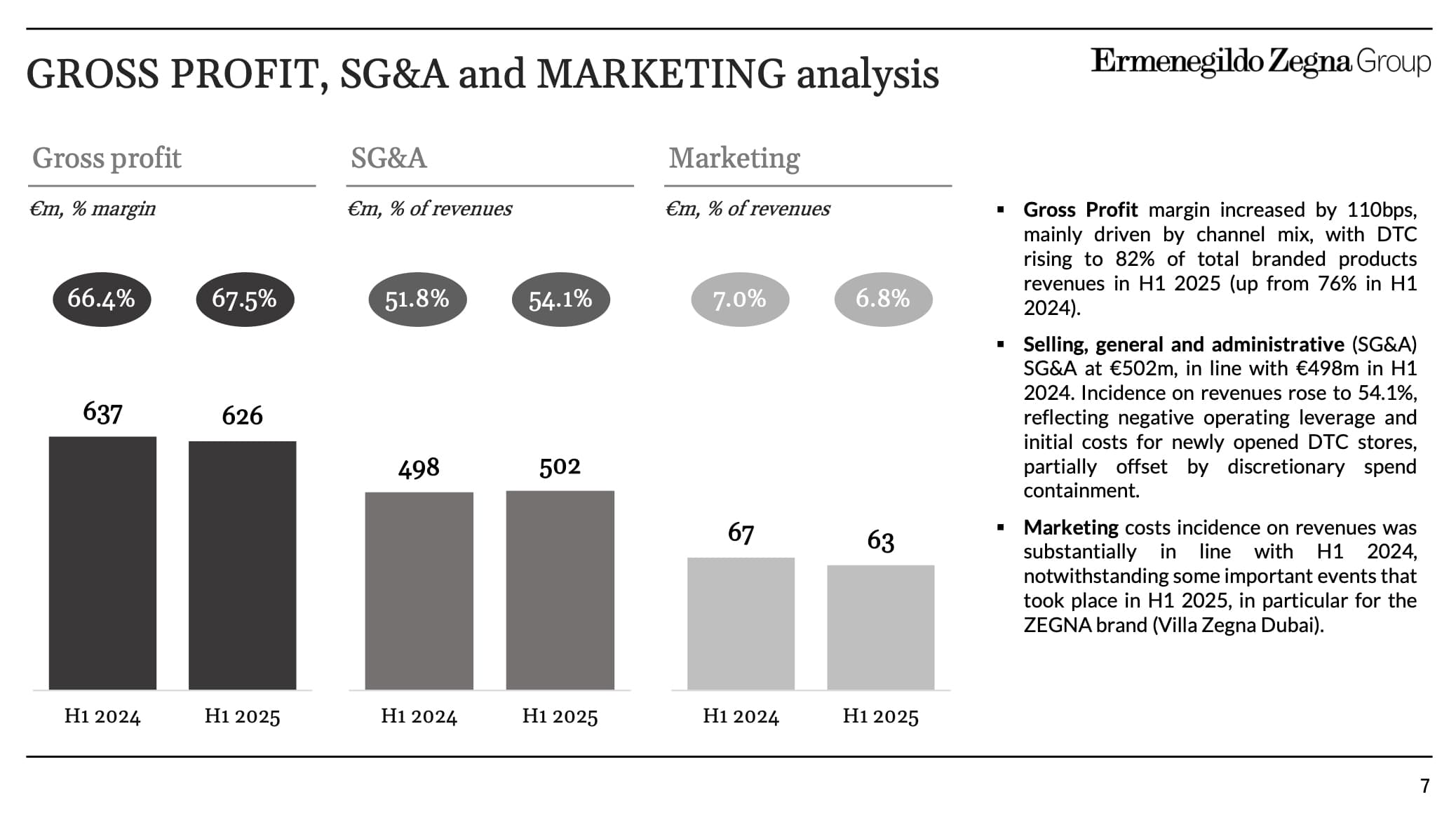

Overall group adjusted operating profit came in at 68.7 million euros, down from 80.9 million in the same period last year. The margin shrank 100 basis points to 7.4%, which investor relations lead Paola Durante attributed to cost structures and forex.

“It was also slightly negatively impacted by the currencies movement as the euro since April appreciated, particularly compared to the U.S. dollar and the renminbi, which are the two most important currencies for our group,” she said. “We are aware that the sector remains challenging and volatile. However, we know that we have implemented actions to protect our profitability.”

Despite these challenges, Tagliabue remained confident: “All in all, I can say we have entered September with good energy across all three brands, but it’s essential to remain cautious and vigilant, as initial signs should not be considered yet as consolidated.”

On regional momentum, the group continues to see solid growth in Europe, the Middle East, and the Americas. Greater China, on the other hand, remains fragile. “So it is yet early to draw a solid conclusion about this latest trend,” Tagliabue noted.

Still, he reaffirmed the group’s 2025 financial goals: projected revenues of 1.92 billion euros and adjusted EBIT of 173 million euros. Price increases in the U.S. were also well-received, helping to mitigate tariffs and FX headwinds. “We have acted in order to reflect this into our U.S. prices for winter 2025 live since August and we are not seeing a substantial boomerang from consumers. As I said before, we keep on seeing good momentum in the U.S.,” he said.

Operating expenses came in at 501.8 million euros, or 54.1% of revenue—up slightly from last year but in line with broader DTC expansion efforts.

Capital expenditure reached 54 million euros, down from 60.1 million euros last year, mostly attributed to continued store expansion and investments in a new footwear production facility in Parma.

Net debt was largely flat at 92.1 million euros as of June 30, compared to 94.2 million euros at year-end 2024.