Sales Challenges at Gucci and Weak Demand in China Impact Kering’s Financial Outlook

Kering, known for luxury brands like Gucci and Saint Laurent, has projected a significant profit decline of 40 to 45 percent for the first half of the year. This forecast was released alongside the company’s first-quarter sales data, which demonstrated a slowdown in line with earlier predictions. The group’s revenues decreased by 10 percent on a comparable basis from the previous year.

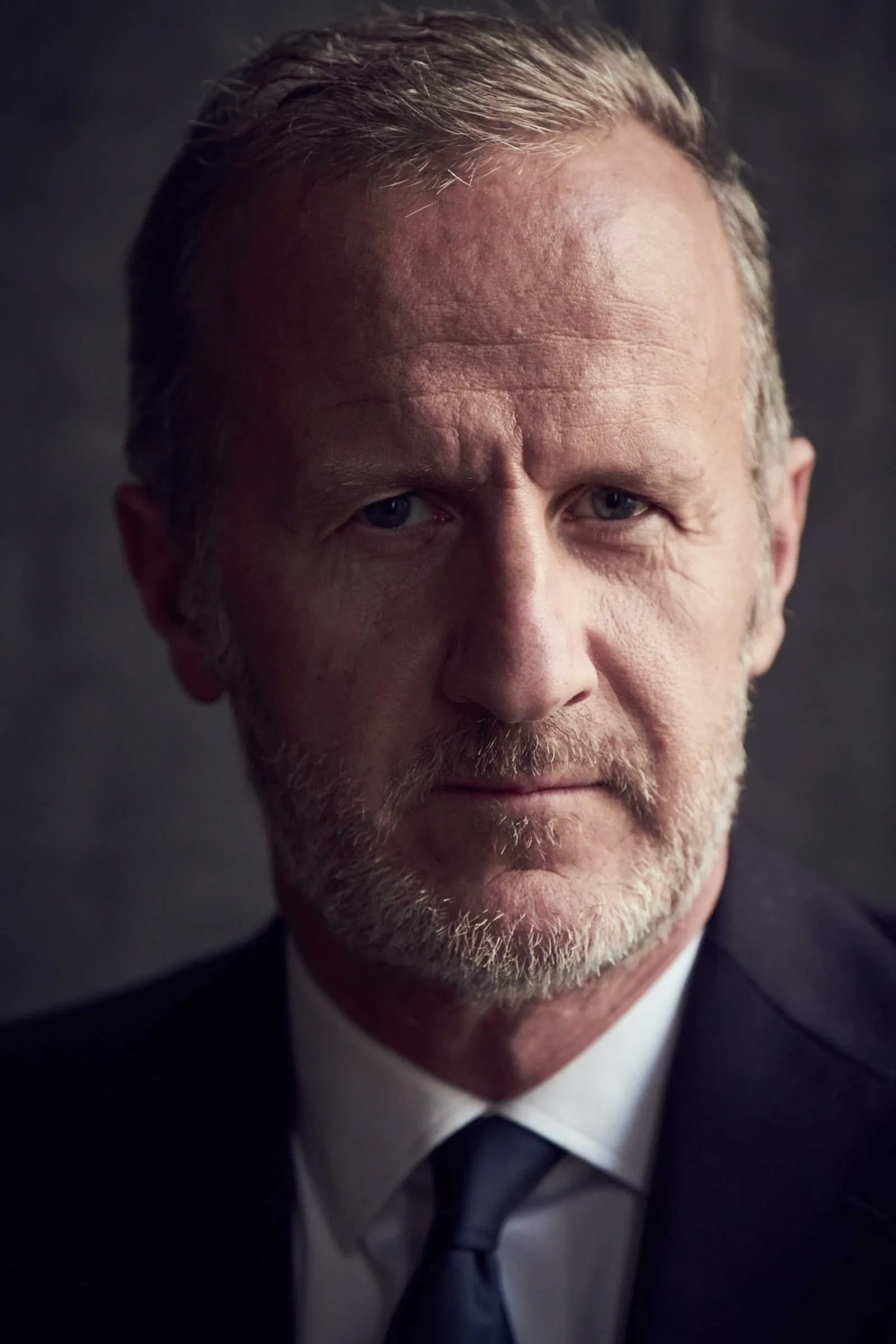

During a recent call with analysts, Kering’s CFO, Armelle Poulou, addressed the financial challenges: “The first half of the year is proving even tougher than we had expected. Regardless of the environment, we are investing in our brands, even if we are even more selective, more demanding in terms of return.” This statement reflects the strategic adjustments Kering is making amid a difficult market environment, particularly in China and within its flagship brand Gucci.

Gucci, which typically drives a significant portion of Kering’s profit, reported an 18 percent drop in comparable sales and a 21 percent decline in reported figures. The brand has been under pressure, especially in the Asia-Pacific region, despite undergoing a strategic overhaul with new leadership and creative direction aimed at revamping its brand image.

“The sales numbers were in line with a forecast the group released in late March. But the need for continued heavy investments, notably in marketing its brands, is likely to conspire with the significant loss of operating leverage at Gucci to weigh on profits more heavily than markets anticipated,” Poulou explained.

In contrast, other parts of the group like Yves Saint Laurent and the Other Houses division, which includes Balenciaga and Alexander McQueen, each saw a 6 percent drop in sales, indicating a broader slowdown across the luxury sector. Wholesale channels experienced a sharp decline of 25 percent, reflecting Kering’s strategy to reduce dependency on third-party retailers.

However, there were modest gains in certain areas. Leather house Bottega Veneta reported a 2 percent rise in comparable sales, aligning with trends seen in LVMH’s fashion and leather goods sales. Additionally, Balenciaga showed signs of recovery, particularly in Western Europe and North America, following a public relations issue in late 2022.

Despite these challenges, Kering remains focused on long-term strategies to enhance brand perception and profitability. This includes the ambitious turnaround efforts at Gucci under new deputy CEO Stefano Cantino, formerly of Louis Vuitton, who is expected to drive significant changes.

The macroeconomic environment continues to pose challenges, especially in China, where Gucci’s brand perception struggles between high-end allure and affordability. Poulou noted, “All the weaknesses of the brand are exacerbated in China, both in terms of perception of the brand and the necessity of raising the exclusivity of distribution. The macroeconomic environment is making attractive either higher-end products where they consider it an investment, or at the lower end with more affordable products … Gucci is not in the sweet spot for positioning — it’s seen as not enough high-end, nor enough affordable. But this context can change rapidly.”

As Kering navigates these complex market dynamics, the company is committed to refining its inventory management and closing some underperforming outlets by the end of the year, aligning with its vision to enhance the exclusivity and appeal of its brands.