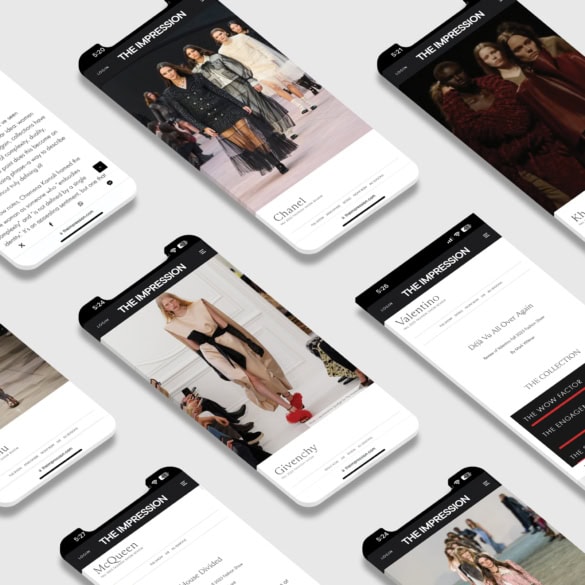

Unlocking An Edge For Fashion Forward Leaders

The Impression provides premium insights and creative intelligence for industry leaders and their teams to stay ahead of the trends transforming the fashion industry.

Campaigns

LVMHF

LVMH-Moet Hennessy Louis Vuitto

OTC Markets OTCPK

$0.86

0.16%KER.PA

KERING

Paris

2,44 €

1,37%CFR.SW

RICHEMONT N

Swiss

$2.85

1.75%1913.HK

PRADA

HKSE

$0.2

0.40%HESAF

Hermes International SA

OTC Markets OTCPK

$0.0000

0.00%BRBY.L

BURBERRY GROUP PLC ORD 0.05P

LSE

$28.20

2.81%SFER.MI

SALVATORE FERRAGAMO

Milan

0,17 €

2,90%ZGN

Ermenegildo Zegna N.V.

NYSE

$0.02

0.24%BOSSY

Hugo Boss AG

OTC Markets OTCPK

$0.0000

0.00%MONRF

Moncler S.P.A.

OTC Markets OTCPK

$0.0000

0.00%RL

Ralph Lauren Corporation

NYSE

$3.54

1.29%PVH

PVH Corp.

NYSE

$0.15

0.18%TPR

Tapestry, Inc.

NYSE

$0.73

0.92%CPRI

Capri Holdings Limited

NYSE

$0.09

0.52%Backstage

Insights