Retail Sales Down 2 Percent in Q1 as Brand Sees Signs of Turnaround Momentum

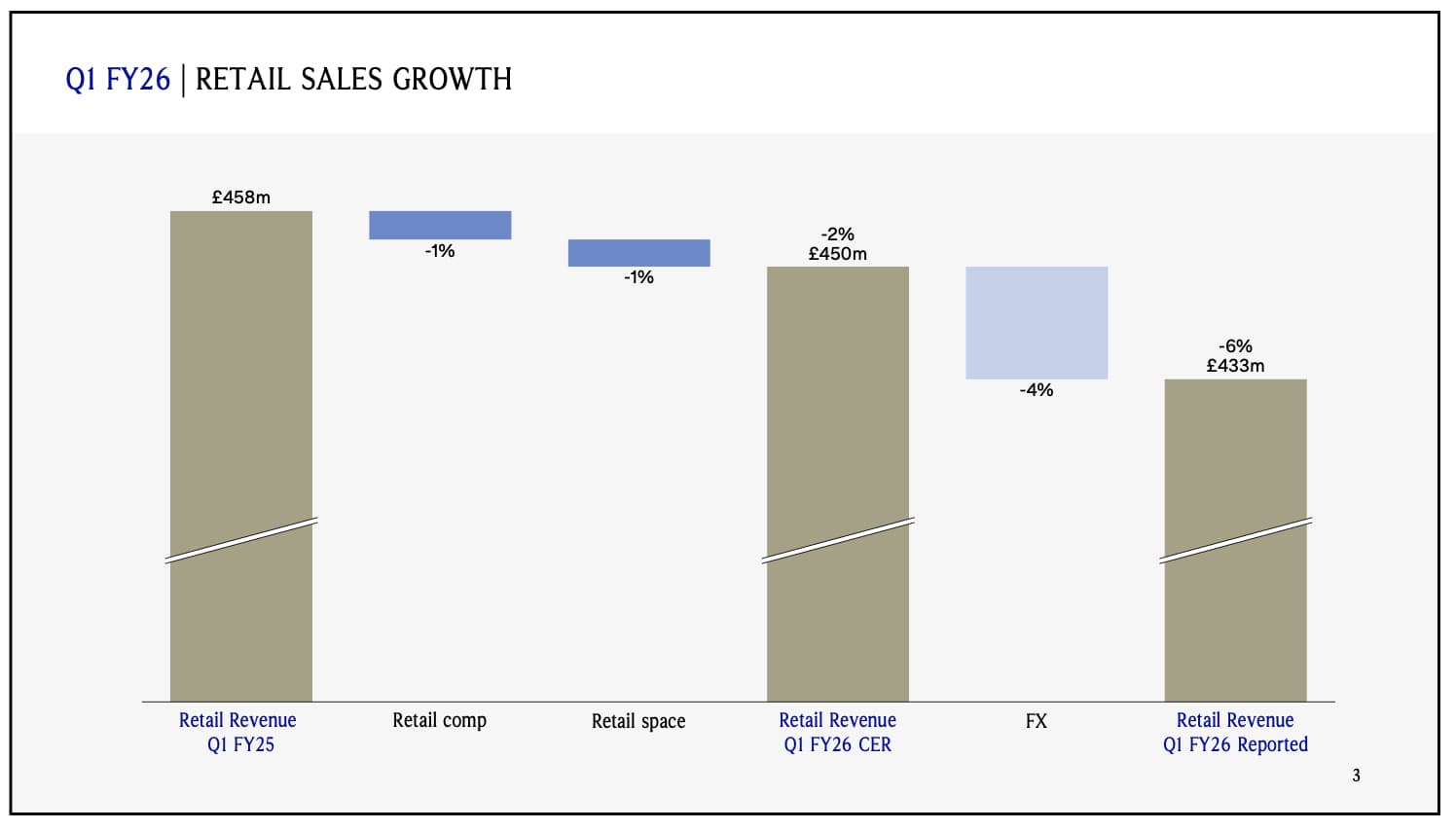

Burberry reported a narrower-than-anticipated drop in revenue for the first fiscal quarter, signaling early signs of stabilization under new leadership. Retail revenue reached 433 million pounds, marking a 6 percent decrease at reported exchange rates and a 2 percent dip at constant currency.

The numbers reflect a shift from the steeper declines Burberry experienced last summer, which prompted the board to appoint Josh Schulman as chief executive officer. Schulman, known for previous leadership roles at Coach and Michael Kors, was tasked with returning the brand to growth by simplifying operations, reestablishing brand identity, and improving profitability.

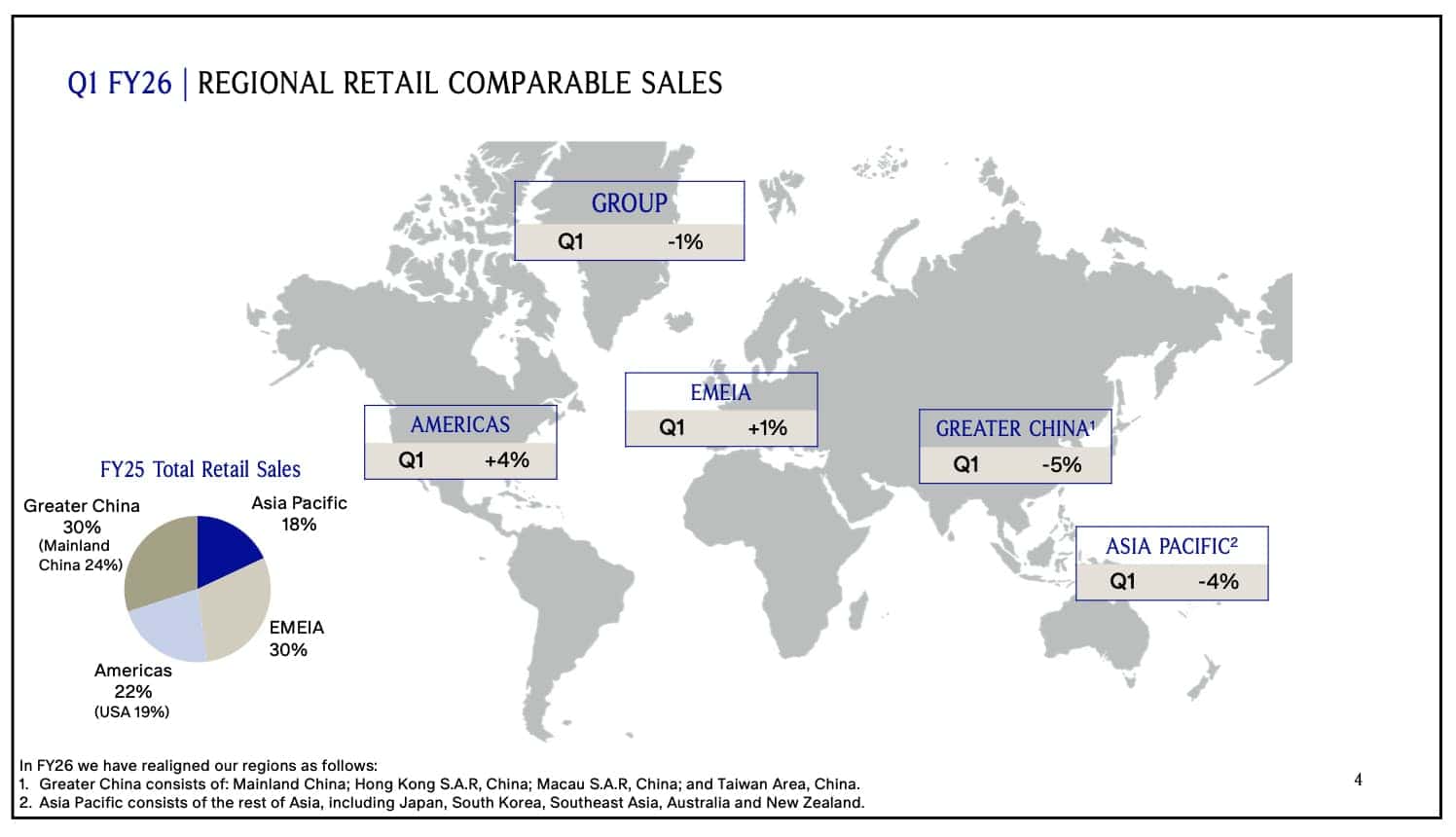

Comparable store sales declined 1 percent for the quarter ending June 30, compared to a 21 percent fall during the same period last year. Performance varied by region. The Americas saw a 4 percent increase, while the EMEIA region—Europe, the Middle East, India, and Africa—rose 1 percent. Greater China dropped 5 percent, and Asia-Pacific fell 4 percent.

The results exceeded analyst expectations, which had forecast a 3 percent drop in comparable sales. Investors responded positively, sending the share price up more than 6 percent to close at 13.27 pounds on July 18.

Schulman described the past 12 months as a transition from business stabilization to the implementation of Burberry Forward, the company’s official growth strategy. “The improvement in our first-quarter comparable sales, strength in our core categories, and uptick in brand desirability gives us conviction in the path ahead. Our autumn 2025 collection is being well received by a broad range of luxury customers as it arrives in stores,” he said.

He acknowledged that macroeconomic conditions remain volatile and that the transformation is still in early stages. “Although the external environment remains challenging and we are still in the early stages of our transformation, we are encouraged by the initial progress we are starting to see,” he added.

The company said its focus for the remainder of the year will be on deepening brand relevance and growing the top line. In the first half, it will continue to prioritize investment, particularly in product, marketing, and store experience.

At the same time, Burberry intends to improve margins through tighter operational controls and emphasis on productivity and cash flow. “We remain confident that we are positioning the business for a return to sustainable, profitable growth,” the company said.

The next fiscal quarter will test whether Burberry’s efforts to reinvigorate demand—particularly in key markets like China—can build on this momentum.