With Sales Sliding and Losses Mounting, CEO Joshua Schulman Leans on Cost Cuts and Core Icons to Steer Turnaround

Burberry closed out its fiscal year 2025 with a mix of tough realities and cautious optimism, unveiling plans to cut 1,700 global jobs—roughly 18 percent of its workforce—in a bold move to reset its cost base and reposition the brand amid a challenging luxury climate. While revenues slid 17 percent to £2.46 billion, the company posted an operating loss of £3 million, and an adjusted operating profit of £26 million came in above analyst expectations, offering a glimmer of stabilization as the turnaround under CEO Joshua Schulman takes hold.

Schulman, who stepped into the role in July 2024, has moved quickly to reshape the brand’s direction. After years of underwhelming product strategies and erratic pricing shifts, Burberry’s identity had grown muddled, particularly during a time when global luxury demand softened and competition intensified. Under Schulman’s leadership, the company has doubled down on its heritage, re-centering its narrative around iconic pieces like trench coats and scarves. It’s a calculated return to brand fundamentals designed to rebuild desirability and reengage loyalists and new customers alike.

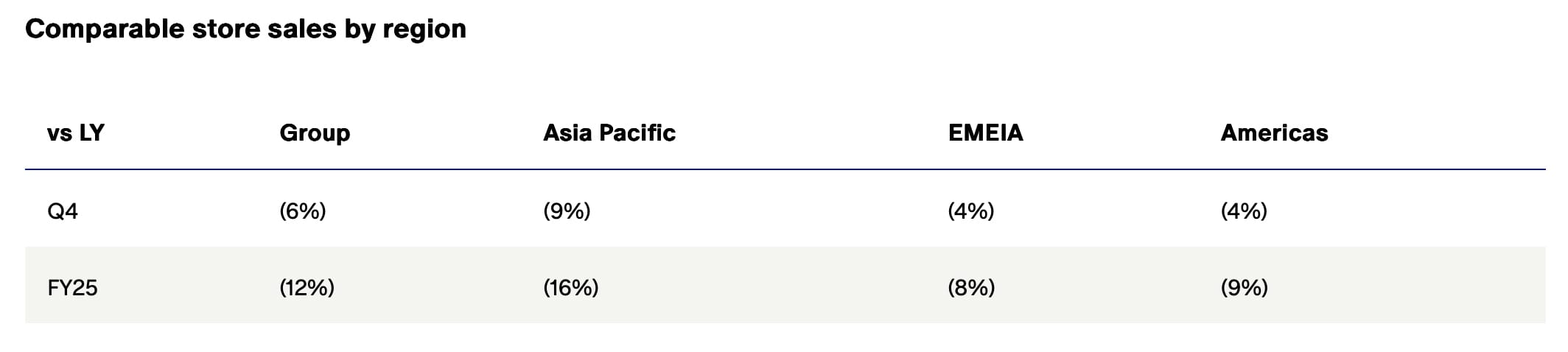

The numbers tell a story of a house in early recovery mode. Retail sales fell 12 percent for the year, with the steepest declines—a 20 percent drop—occurring in the first half. The second half showed signs of stabilization, with sales down only 5 percent. Fourth-quarter comparable store sales were down 6 percent, beating forecasts of a 7 percent drop. Still, the gap from prior performance remains stark: a year ago, Burberry had reported a healthy £418 million operating profit. That context helps explain the urgency behind the brand’s sweeping transformation plan.

Schulman’s strategy, known internally as “Burberry Forward,” is more than a marketing slogan—it’s a clear pivot away from recent attempts to chase high-fashion headlines and back toward timeless British luxury. Burberry has ramped up advertising efforts with campaigns featuring homegrown icons like Kate Winslet and Jerry Hall, signaling a desire to lean into Britishness while broadening its global appeal. And while handbags, once a growing revenue driver, have taken a backseat, outerwear and scarves have been repositioned as cornerstones of the house’s creative and commercial ambitions.

In parallel, Burberry announced an expanded cost-saving initiative, aiming for £100 million in total savings by fiscal 2027—£60 million of which will come from the new wave of layoffs. The workforce reduction follows a 500-position cutback in 2020 and will impact both corporate and retail staff, including shifts at the brand’s Castleford, Yorkshire manufacturing facility. While cost-cutting typically raises eyebrows in the luxury world, Burberry has framed this as necessary belt-tightening to enable longer-term investment, with reinvestment planned at Castleford later this year.

The luxury sector at large hasn’t done Burberry any favors. Macro headwinds—from inflation and geopolitical uncertainty to new tariffs and cooling demand in China—have dented sentiment across the board. Burberry specifically cited these developments as contributing to a more uncertain economic environment, though it stopped short of offering 2026 financial guidance. The brand’s sales in Asia Pacific were down 9 percent, while the Americas, Europe, the Middle East, India, and Africa regions both fell 4 percent. A weaker outlook for U.S. consumer spending poses additional risk, especially as Schulman has identified the American market as a key lever for growth.

Yet despite the sobering backdrop, Schulman remains upbeat. He believes the worst is behind them and that the focus on core products, supported by brand-appropriate storytelling and thoughtful distribution, is beginning to yield results. In his own words, “I am more optimistic than ever that Burberry’s best days are ahead.”

Investors offered a tentative vote of confidence. Following the earnings release and cost-cutting announcement, Burberry shares rose as much as 10 percent in early trading, their strongest intraday gain in over a month. While the company’s stock is still down significantly year-to-date—and it no longer holds a position in the UK’s FTSE 100 index—there’s growing belief that the reset under Schulman may put the brand on a more stable footing.

Still, the challenges ahead are real. Burberry must now walk a fine line between preserving its heritage and evolving to meet the expectations of today’s luxury consumer. The trench coat may be iconic, but it’s also a one-time purchase for most, which presents a unique merchandising dilemma compared to trend-driven brands that thrive on constant replenishment. Reigniting frequency and customer passion without undermining prestige will be the task at hand.

As Burberry trims its costs and tightens its focus, its path forward hinges on more than just product. It’s about reclaiming relevance—not through shock tactics or fashion gimmicks—but by reminding the world why it ever loved Burberry in the first place.