LVMH’s Q3 results miss market expectations, signaling challenges for the luxury sector ahead of key earnings reports

Key Takeaways

• LVMH’s Q3 revenues fell by 4.4%, with Japan’s economic cooling cited as a significant factor.

• Fashion and leather goods sales saw a 5% decline, missing market expectations.

• Watches, jewelry, wines, and spirits experienced declines, while perfumes and cosmetics showed modest growth of 3%.

• LVMH reiterated confidence in its long-term strategy, emphasizing brand desirability and operational agility.

• Luxury stocks, including LVMH, remain closely linked to China’s economic outlook and global inflation, impacting discretionary spending.

LVMH Reports 4.4% Drop in Q3 Revenue, Misses Market Expectations

LVMH Moët Hennessy Louis Vuitton, the world’s largest luxury conglomerate, reported a 4.4% revenue decline in the third quarter of 2024, falling short of market expectations. The group cited weakened demand in Japan and currency fluctuations as key contributors to the slowdown.

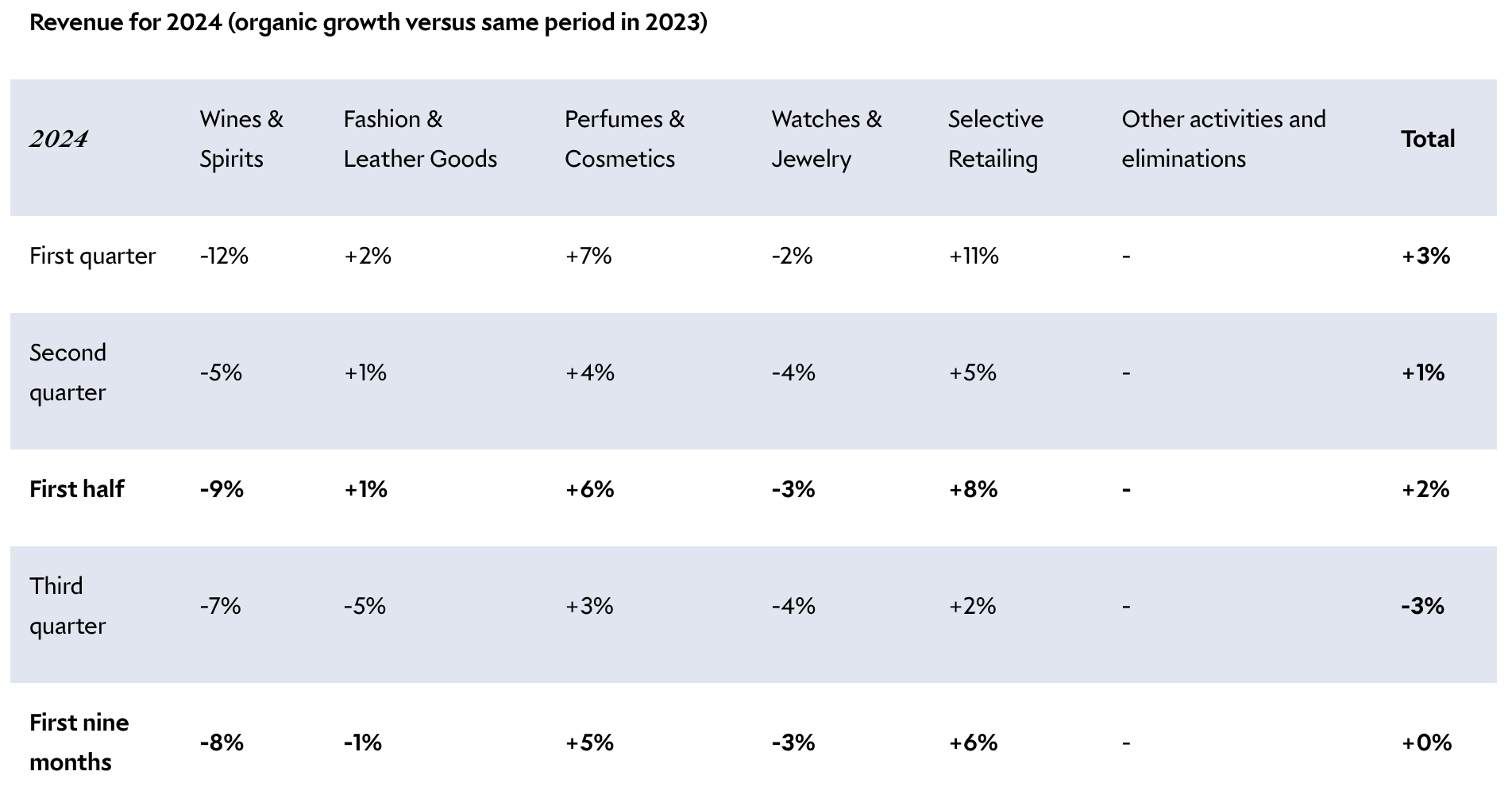

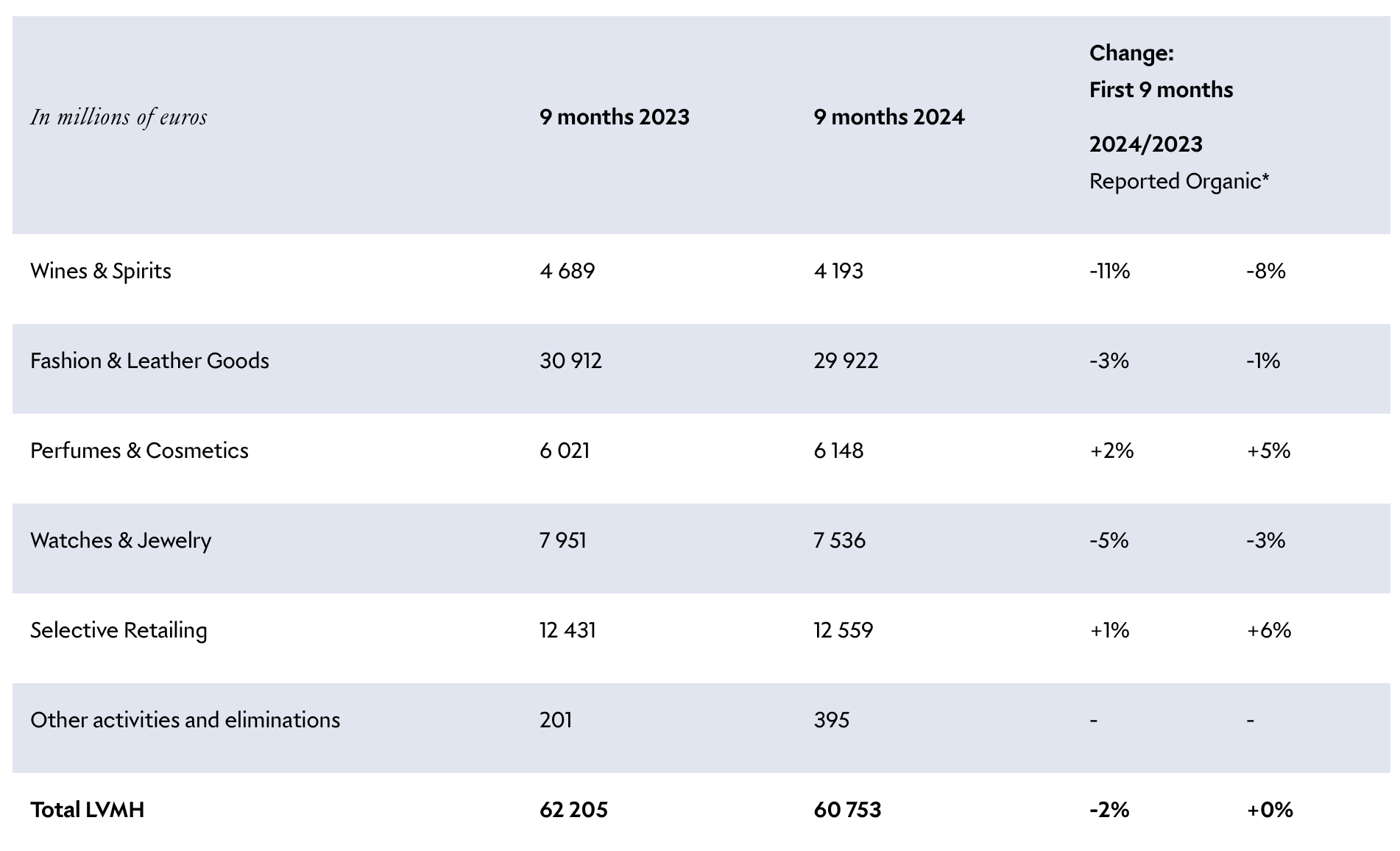

Revenue for the quarter amounted to 19.07 billion euros, falling short of the 20.01 billion euros projected by analysts, according to Visible Alpha. Stripping out currency effects, organic sales declined 3% year-over-year, underscoring a weaker performance compared to Q2, which saw a 1% increase in organic revenues.

The fashion and leather goods (FLG) division, a critical revenue driver, recorded 9.15 billion euros in sales, representing a 5% drop. This figure fell well below the anticipated 1% growth, signaling a challenging environment for some of LVMH’s core brands, including Louis Vuitton and Dior.

Sector Performance: Mixed Results

• Watches and jewelry: Down 4%

• Wines and spirits: Down 7%

• Perfumes and cosmetics: Up 3%

• Selective retailing: Up 2%

The absence of a statement from Bernard Arnault, chairman and CEO of LVMH, was notable, as the group instead reiterated its commitment to brand desirability and operational agility. The company emphasized its intention to maintain its leadership position in the luxury sector despite economic challenges, aiming for a strong performance in 2024.

“In an uncertain economic and geopolitical environment, the group remains confident and will maintain a strategy focused on enhancing the desirability of its brands,” LVMH said in a statement.

Challenges in Key Markets

The luxury sector’s performance continues to be closely linked to China’s economic stability, with the country’s slowing growth impacting global luxury consumption. With inflation curbing consumer spending and Japan’s cooling demand influencing Q3 results, analysts warn that discretionary spending remains under pressure.

LVMH’s stock has declined by 27% since reaching a peak of 872.80 euros in March 2024, as macroeconomic factors weigh on consumer sentiment. The group’s performance will likely influence the tone for the luxury sector, as Kering and Hermès International prepare to release their Q3 results later this month.