Led by Cartier, Van Cleef & Arpels, Buccellati and recently acquired Vhernier, the conglomerate posted the third consecutive year of double digit growth

Despite the ongoing luxury slowdown, Richemont’s jewelry brands have maintained their climb, posting a growth of 11 percent at constant exchange and 7 percent at actual rates to €3.91 billion in the three months to June 30, driven by the performance of Cartier, Van Cleef & Arpels, Buccellati, and Vhernier, which accounted for more than 70 percent of revenue in the first fiscal quarter of 2025-26. Overall, the group’s sales rose 6 percent at constant exchange, and 3 percent at actual rates to €5.4 billion.

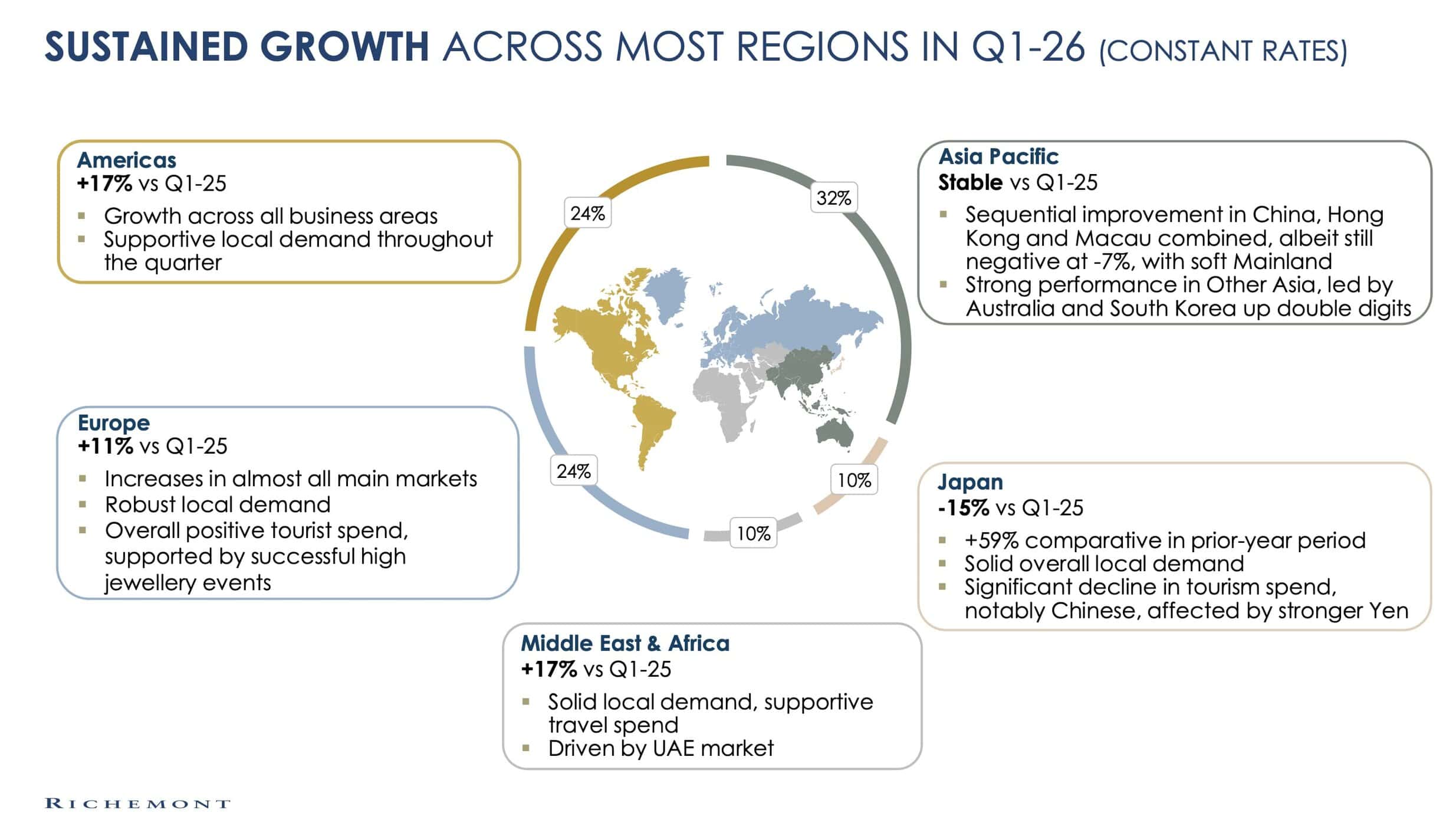

Richemont’s success comes amid rising gold prices and fluctuating exchange rates, but demand seems to have in part compensated for the volatile times. The company attributed sales increases to higher tourist spending and robust demand from both local and visiting clients, as well as successful high jewelry events like Cartier’s “En Équilibre” showcase in Stockholm. Regions leading the pack in sales included the Americas, which Richemont said was driven by local demand across all markets and business areas, as well as the Middle East and Africa, where sales rose by 17 percent, led by the United Arab Emirates.

Strategy in pricing has helped retain consumer loyalty and create a strong value proposition. Richemont remains mindful of consumer trust, and is wary about raising prices for fear of damaging their relationships with local customers. Their relatively stable pricing (Cartier, for example, raised prices by a maximum of just 5 percent in May) has helped reaffirm the intrinsic value of their goods. So have their attempts at fair pricing, maintaining equal pricing across regions to avoid clients traveling in attempts to purchase in cheaper markets.

European analysts were pleased with this news, with Deutsche Bank acknowledging it as the quarter’s standout luxury performance. As of June 30, Richemont’s net cash position stood at €7.4 billion. With caution and consistency, the group has positioned its jewelry maisons as resilient forces in luxury’s shifting landscape.